Adani Power’s results disappointed with generation at Tiroda down to 16% PLF in June 2016 owing to water scarcity in Maharashtra. APL’s earnings continue to be supported by accrual of compensatory tariffs, Rs 4.7 bn in Q1FY17 that restricted consolidated losses before tax to Rs 929 mn. Outcome of prolonged regulatory process on payment of compensatory tariff is critical for Adani Power. Maintain SELL rating with TP of Rs 26/share.

Lower generation drags financial performance back in red Adani Power sold 14 BU in Q1 FY17, a 12% y-o-y decline primarily on account of near-shutdown of the Tiroda plant (3.3 GW) as well as lower PLFs at its Mundra facility. Realisations at Rs 3.7/kwh and fuel cost at Rs 2.1/kwh saw little sequential change, despite the increase in clean energy cess during the quarter. Reported losses of Rs 312m include (i) compensatory tariffs of Rs 4.7 bn, and (ii) deferred tax credit of Rs 617m. Cash profit of Rs 14.4 bn would only about service interest cost of Rs 14.5 bn.

Issuing fresh warrants to promoters, to help reduce gross debt position of Rs 530 bn

During the quarter, APL has issued 523m warrants to the promoters to be converted at a price of Rs 32.54 per share, for which APL has received 25% of the consideration (Rs 4.2 bn) as upfront payment. We note that APL currently has a gross debt of Rs 520 bn. Of the Rs 387 bn of long-term debt, Rs 96 bn is denominated in foreign currencies.

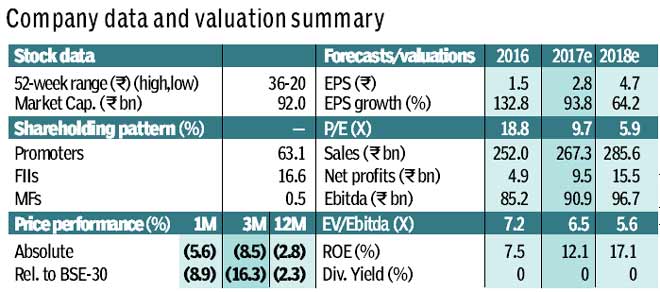

Maintain SELL with revised TP APL’s consolidated profit of Rs 4.9 bn for financial year 2016 was aided by accruing compensatory tariff of Rs 29.7 bn. A turnaround of fortunes is contingent on cash receipt of tariff though management is more confident post the APTEL ruling in April 2016. Maintain SELL with a TP of Rs 26 per share. Our revised earnings factor compensatory tariffs across most plants as accounted for by the management as well as lower generation at Tiroda for the quarter. We now factor earnings of R2.8 per share (Rs 3.1/share previously) for FY2017 estimate and Rs 4.7 per share (R4.4 previously) for FY 2018e.

Like musical chairs, this time it was Tiroda

* Revenues down 6% y-o-y led by sharply lower generation. Adani Power reported net generation of 14 BU of power on consolidated basis in Q1FY17, down 12% y-o-y led by a sharp decline in generation from Tiroda plant and lower PLFs at Mundra. Tiroda plant was impacted by water scarcity in Maharashtra and generated 3 BU of power during the quarter at just 42% PLF while Kawai (86% PLF) and Udupi (79% PLF) achieved better operational performance.

Consequently, the company reported Q1FY17 revenues of R56 bn, down 6% y-o-y and down 15% q-o-q.

Ebitda up 21% y-o-y on lower coal cost: The company reported Ebitda of R19 bn, in Q1FY17, up 21% y-o-y led by a decline in both the fuel cost and O&M costs. Average fuel cost stood at R2.1/kwh, down 2.5% y-o-y. On a consolidated, blended basis, the company uses 73% imported coal and 27% domestic coal. Weak global prices would have helped control the costs.

Large losses of R5.7 bn without compensatory tariff: As seen in the past few quarters, the company continued the practice of booking large compensatory income as they remain confident of a favourable outcome in the ongoing regulatory proceedings. The company booked compensatory tariff of R4.7 bn during the quarter that helped contain the loss before tax to R929m. Reported loss after booking a tax credit stood at R312m.

Promoters commit fresh equity infusion: After an equity infusion of R1 bn in FY 2016, the

promoters made additional commitment of R17 bn through convertible warrants. The company has received an upfront payment of 25% of the total consideration of the issue.

Respite likely in September: The company expects a final order on the issue of compensatory tariff by Sep-2016. If it is not delayed further, the order could provide relief to cash strained operations of APL.