Rising sales, margins and net profits make Castrol analysts’ top pick

Rising sales, margins and net profits, a dominant market position and prospects of an even better performance as the economy picks up, makes Castrol analysts’ top pick

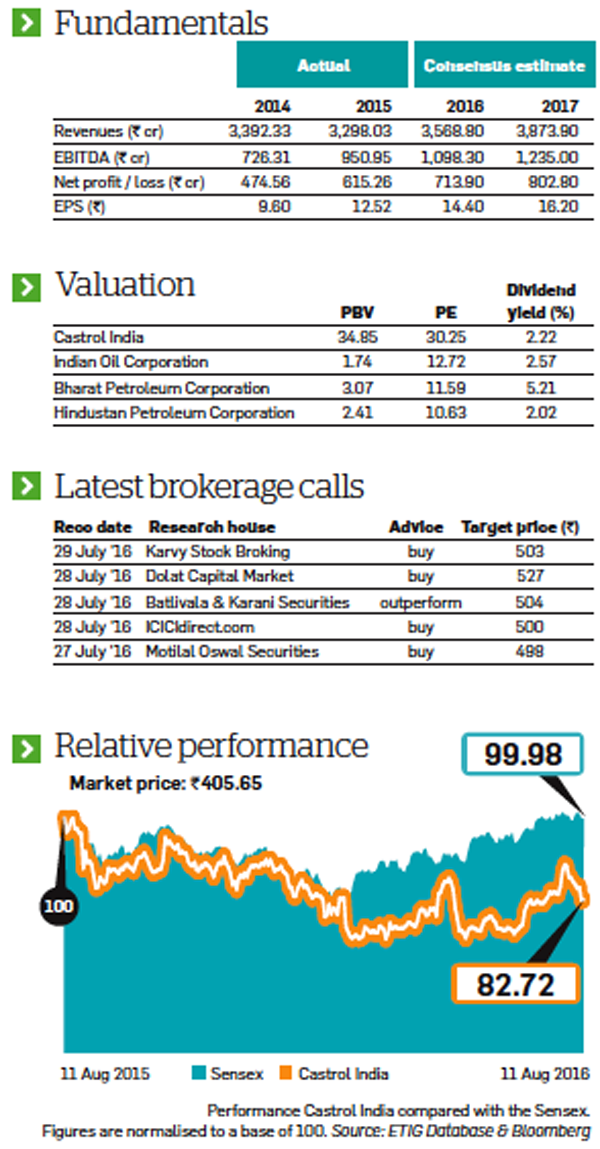

With a 5% increase in sales and 12% increase in net profit, Castrol’s second quarter numbers for calendar year 2016 were on expected lines. Castrol is a beneficiary of the fall in crude oil—its main raw material—and this has helped it see a major expansion in margin in past few quarters.

With a 5% increase in sales and 12% increase in net profit, Castrol’s second quarter numbers for calendar year 2016 were on expected lines. Castrol is a beneficiary of the fall in crude oil—its main raw material—and this has helped it see a major expansion in margin in past few quarters.However, crude oil prices have started stabilising and, therefore, gross margins may not expand further in the near future. However, Castrol is taking steps to increase its proportion of semi-synthetic lubricants, which will increase its revenue realisation and margin in the long term. Since most of Castrol’s revenue comes from the premium segment, its margin has always been better than the industry average. Castrol is the leading private sector automotive lubricant player with around 20% and 30% market share in the personal and commercial vehicle segments respectively.

The domestic automobile recovery—due to a good monsoon, Seventh Pay Commission— should help the company expand its sales in the coming quarters. Despite sluggish industrial growth, Castrol has seen a decent growth in volumes in its industrial lubricant segment. Performance from this segment should improve further once there is a turnaround in the economy. Usually, Castrol sets the price trends in the domestic lubricants market because of its superior brand positioning—Castrol Edge, Castrol Magnatec, Castrol GTX, Castrol Power1, Castrol Activ and Castrol CRB—and wide distribution network. In addition to spending a large sum to increase and maintain its brand pull, the company is also adding to its product portfolio to further expand its market share.

Castrol has all the markings of a true bluechip company. It is one of the few companies whose return on capital employed (ROCE) is above 100%. Since Castrol has limited capital expenditure requirements, it regularly generates free cash flow. This zero-debt company already holds sufficient cash reserves—around Rs 700 crore—to fund expansion plans. Since it doesn’t need additional cash for operations, Castrol rewards investors through high dividend payouts— around 70% of its net profit—every year, another positive aspect of this counter. It’s a good bet for long-term investors and there is no need for them to get worried about a slightly higher valuation compared to other FMCG companies.

Selection Methodology

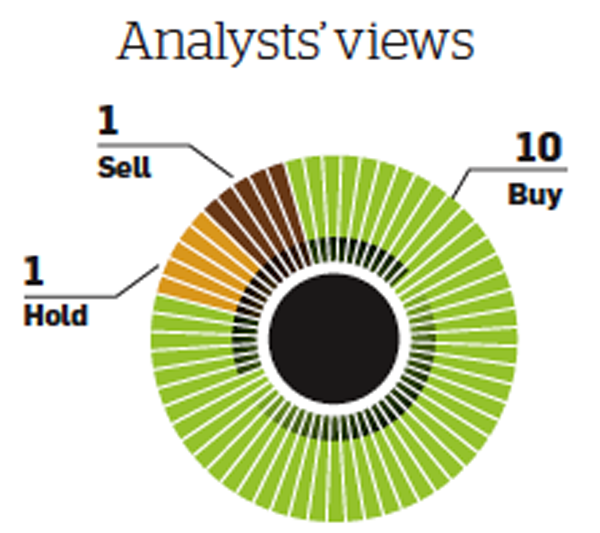

We pick the stock that has shown the maximum increase in ‘consensus analyst rating’ in the past one month. Consensus rating is arrived at by averaging all analyst recommendations after attributing weights to each of them (5 for strong buy, 4 for buy, 3 for hold, 2 for sell and 1 for strong sell) and any improvement in consensus analyst rating indicates that the analysts are getting more bullish on the stock. To make sure that we pick only companies with decent analyst coverage, this search is restricted to stocks that are covered by at least 10 analysts. You can see similar consensus analyst rating changes during the past week in the ETW 50 table.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions