State considers 'menu' of taxes if they want to scrap USC by 2020

Minister for Finance Michael Noonan Photo: Tony Gavin

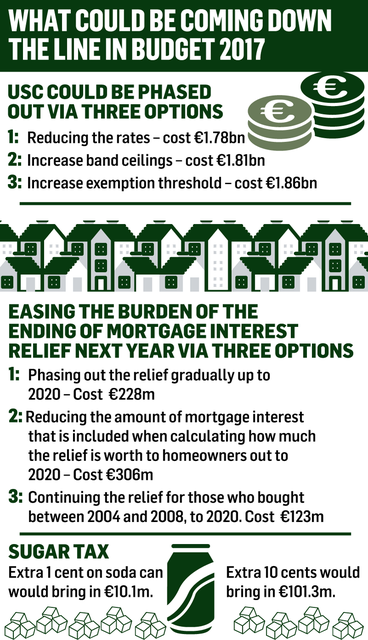

Phasing out the Universal Social Charge by 2020 could cost the Exchequer an estimated €1.8bn, the Department of Finance has said.

That's almost all of the spending leeway estimated for tax measures over the coming years.

Scrapping the controversial charge would mean the tax base may have to be broadened in other areas to offset the cost - including hiking the excise duty on cigarettes, introducing a sugar tax or scrapping the PAYE tax credit for higher earners, the department has said, referring to the Programme for Government.

The Irish Tax Institute has already criticised the latter move, saying it would see 270,000 workers being hit with a marginal tax rate of 70pc - one of the highest in the western world.

The Programme for a Partnership Government includes a commitment to get rid of the USC over the coming years as part of an income tax reform plan.

The Department of Finance has come up with three options to do this, the cheapest of which puts the cost at around €1.78bn.

The department yesterday, for the first time, published a menu of tax options and costings that the Government could choose from over the coming months as it puts together Budget 2017.

The three options for the USC include reducing rates, increasing band ceilings and increasing the exemption threshold.

The costs range from €1.78bn to cut the rates, to €1.86bn for hiking the exemption threshold.

The department said that the three options should not be construed as an indication of the fiscal space available for USC measures in the relevant budgets.

But the total fiscal space out to 2020 is estimated at €8.3bn, according to the Summer Economic Statement, with €1.93bn of that earmarked for tax measures.

The so-called tax strategy papers have been put together by the Tax Strategy Group, an interdepartmental grouping of senior civil servants whose task is to provide a 'helicopter' view of the potential options available to the Government, along with costings.

The department stressed they were not recommendations, but merely a menu of options.

Health

The Programme for a Partnership Government also contains commitments to increase the Earned Income Credit to €1,650 by 2018, boost the Home Carer Credit and withdraw the PAYE tax credit.

Boosting the Earned Income Credit by €550 to €1,100 next year would cost the Excheqeur €45m, the papers state, while increasing the Home Carer Credit by €100 to €1,100 in 2017 would cost €6.5m.

The papers also contain a detailed look at introducing a sugar tax. It estimates that a 1 cent increase to the price of a can of soft drink would bring in €10.1m, while a 10 cent increase would raise €101.3m.

But the department has said that over time the tax may not be a revenue-raising measure, as it is designed to be a health measure and to dissuade people from overindulging in sugary products.

The papers also referred to a commitment in the Programme for Government which states that the Capital Acquisitions Tax threshold on gifts and inheritances from parents to their children should be increased to €500,000. This, the department said, would cost around €75m in a full year.

The department said there was some anecdotal evidence that the Dwelling House Exemption is being abused.

This allows for an exemption in Capital Acquisitions Tax in the case where a person inherits or is gifted a house that he or she lives in. The department said it is looking at the issue with Revenue.

Join the Irish Independent WhatsApp channel

Stay up to date with all the latest news