Since the company did not disseminate any information to the stock exchange, the massive surge was based on speculation, rumours over unconfirmed reports of investment plans as trading volumes went higher.

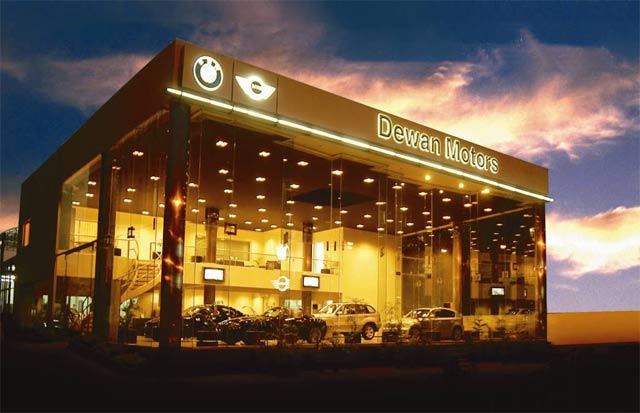

Dewan motors: 10 years of partnership with BMW

The automotive policy, which was announced by the government in March, came with incentives for new entrants as well as those players that had gone out of business. That provided the first boost. But the company did not react. After the Securities and Exchange Commission of Pakistan noticed the gains and high volumes, it sent a letter to the company on May 24 - the day when the DFML share ended at Rs17.32, up almost 100% Rs8.8 from a few months ago - asking it to explain the cause behind the surge.

The company’s management has now reacted - it has no clue why. On Wednesday, the company’s share price closed at Rs14.55, lower by Rs0.15, even though the benchmark-100 index gained around 2%.

“You are aware that many stakeholders/traders, for their personal benefits, circulate rumours and speculation in the market over which we have no control,” wrote the company to the SECP on Wednesday.

“Furthermore, we hereby confirm that we have nothing to do with the trading volume in Dewan Farooque Motors Limited (DFML) shares,” it added.

DFML is closed and out of production, but analysts say the increase in its share price is primarily driven by expectations that it would soon resume assembling cars.

The company was reported to have been in talks with Nissan and Renault for a joint venture. The impression got credence when the new auto policy gave incentives to brown field projects - to encourage companies that had stopped production in the past to resume operations.

The rise and fall of Dewans

Apart from giving incentives to new car makers to enter into Pakistan, the new auto policy was also aimed at the revival of sick automobile units - and that is where DFML was expected to benefit.

“The speculations that the DFML was about to resume its production was behind the massive surge in its share price, however, that has not happened yet,” Sherman Securities analyst Sadiq Samin told The Express Tribune.

“Another factor that helped its share price to jump was the expectations of major restructuring in DFML, but again, there is still no official announcement from the company on both these developments,” he added.

In Pakistan, where the auto industry has always been dominated by Japanese players, DFML partnered with Korean brands like Hyundai and Kia to produce its first car on January 15, 2000. The company received an extraordinary response especially for its Hyundai Santro and Hyundai Shahzore; a one-ton truck.

The company sales grew well until 2008, but it has been a downhill ride from there.

This was a time when local banks were already cash-strapped due to the global financial crisis of 2008.

After a gap of three years, DFML produced a few hundred cars in fiscal year 2014 and 2015 based on its old inventory. However, the company is in desperate need for a partner with whom the company plans to resume full-scale vehicle production.

Published in The Express Tribune, June 30th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1713853507-0/MalalaHilary-(2)1713853507-0-270x192.webp)

COMMENTS (8)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ