Seth Klarman Adds to Stake in EMC

- By Kyle Ferguson

During the first quarter, Seth Klarman (Trades, Portfolio) added 22,602,881 shares of EMC Corp. (EMC) at an average price of $25.32. The addition had a 8.77% impact on Klarman's portfolio. He now owns 51,851,500 shares of EMC Corp.

Warning! GuruFocus has detected 4 Warning Sign with EMC. Click here to check it out.

The intrinsic value of EMC

EMC is a Massachusetts corporation, incorporated in 1979. EMC is a global leader in enabling businesses and service providers to transform their operations and deliver information technology as a service. Fundamental to this transformation is cloud computing. Through innovative products and services, EMC accelerates the journey to cloud computing, helping IT departments to store, manage, protect and analyze their most valuable asset -- information -- in a more agile, trusted and cost-efficient way.

EMC has a market cap of $53.3 billion, a P/E ratio of 26.49, an enterprise value of $51.58 billion and a P/B ratio of 2.47.

According to GuruFocus, EMC has a 7/10 financial strength rating with a cash to debt ratio of 1.53. The company also has a 9/10 profitability and growth rating with an operating margin of 11.70%, ranking it above 82% of the companies in its industry.

Klarman is a legendary value investor who attributes much of his investing philosophies to the legendary Benjamin Graham. He may have added 22,602,881 shares of EMC for the following reasons:

According to the company's most recent 10-K filing, the company has implemented a cost savings program which is supposed to reduce costs annually by $850 million.

In the second quarter of 2015, we initiated a cost reduction and business transformation program to better align our expenses and improve the operations of our federation of businesses. This program is primarily in response to increased pressure on our traditional storage businesses and accordingly, the vast majority of this program will be focused on our EMC Information Infrastructure segment. The goal of this new cost reduction and business transformation program is to reduce our current annual cost base by $850 million and currently addresses eleven major areas including direct materials procurement, facilities and manufacturing optimization and SKU simplification. We expect the $850 million reduction in our annual cost base to be achieved in 2017.

EMC has a Piotroski F-Score of 7, which indicates a very healthy financial situation.

EMC is trading below its DCF (FCF based) intrinsic value, which is $45.65 as of today. This provides a 40.22% margin of safety for Klarman.

EMC is the global leader in the information technology as a service industry

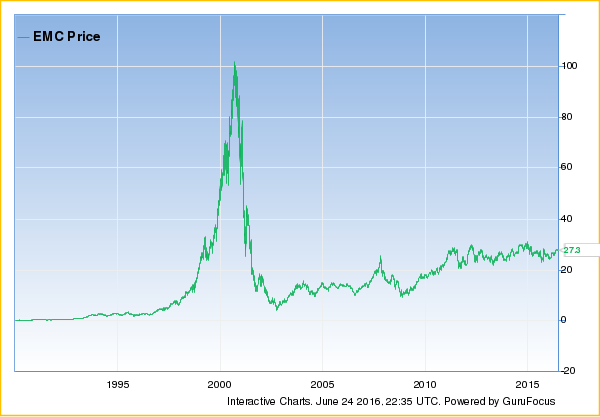

Below is a Peter Lynch chart for EMC Corp.

EMC is a global leader in its industry. It has been expanding its operations, reducing costs, while maintaining a strong Piotroski F-Score. All of these factors may have influenced Klarman to increase his stake during the first quarter.

Klarman grew up in Baltimore and attended Cornell University, where he graduated in 1979. He went on to graduate with an MBA from Harvard in 1982. He founded the Baupost Group, an investment firm that focuses on long term value with similar investment philosophies to the legendary guru Benjamin Graham.

Cheers to your investment success.

Disclosure: Author does not own any shares of this company.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with EMC. Click here to check it out.

The intrinsic value of EMC