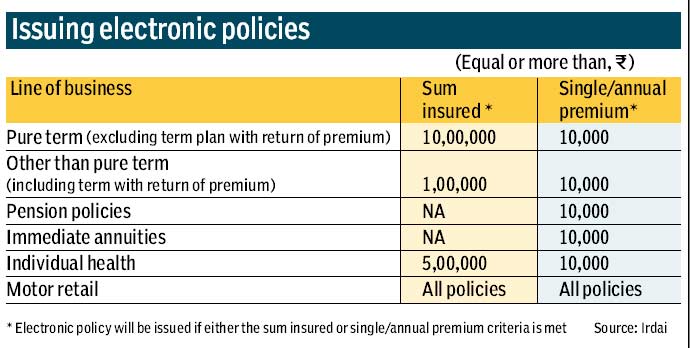

In a move to make insurance policies paper less, the regulator has notified Issuance of e-Insurance Policies Regulations under which every insurer soliciting insurance business through the electronic mode will have to create an e-proposal form similar to the physical proposal form approved by the authority. It will capture information in the electronic form that will enable easy processing and servicing. The e-proposal form will capture the electronic Insurance Account (eIA) number, which can be quoted by the customer.

The Insurance Regulatory and Development Authority of India’s (Irdai) regulations state that every insurer will issue electronic insurance policies directly to the policyholder or through the registered insurance repositories. Physical version of the electronic insurance policies will not be issued by the companies when electronic insurance policies are issued. Similarly, copies of the proposal form will also be sent in electronic form to the insured along with the electronic insurance policies. However, the electronic policy will be deemed compliant only when issued with digital signature.

An insurer can offer discount in the premium rates to the policyholders for electronic insurance policies, which is not the case in case of physical form. The regulations state that the discount rates will have to be in accordance to the rates files under the product approval or the File and Use guidelines or as specified by the insurance regulator.

Even existing policy holders can avail the facility of electronic insurance by registering with the insurer. Also, it is mandatory for every insurer to issue electronic insurance policies in disaster-prone and vulnerable areas as specified by the regulator.

One of the major advantages of keeping insurance policies in the electronic form is safety as there is no risk of loss or damage. As all policies can be held under a single e-insurance account, a person can access them from anywhere and even download a copy. Also, a single change-of-address request made to the repository can update details for policies issued by multiple insurers, thus reducing the paper work. Online insurance accounts are opened free of cost, are highly secure and are always available online.

Moreover, an e-insurance account holder will be spared the trouble of submitting KYC details for policies across life, non-life, health and pension products each time a new policy is taken. Every year, the repository will send a statement of account to the e-insurance account holder with the details of the policies. A single view of all policies will be made available to an authorised person in case of death of the e-insurance account holder, which will help in faster claim settlement.

New customers can submit the eIA application form along with the new business application form. One can opt for one of the repositories namely CDSL Insurance Repository Limited, National Insurance-policy Repository, KARVY and CAMS. An insurance repository captures KYC data, converts the policies into electronic mode, protects them and takes care of the servicing needs of policy holders. Every insurance repository will maintain records of e-insurance account with a unique number, record of instructions received from and sent to the policyholders and insurers and history of claims data.

The insurance repository will ensure that all documents related to proof of identity and proof of address are collected from all policyholders before opening e-insurance account. The repositories will have to verify the copy of the address proof. A policyholder can inform the insurer or the repository about the change of address. The policy holder can also appoint authorised representatives like a power of attorney in case he does not want to disclose the policy details to his nominees. If the policy holder wants to opt out of an insurance repository, he can inform the insurer who in turn informs the repository.

One can pay renewal premium through the portal of the insurance repository and the premium collected will be transferred to the designated bank account of the insurer. The repositories also have policyholders’ grievances cell for resolution of policyholders’ grievances. The grievances registered with the repositories will be managed through the Integrated Grievances Management System of the insurance regulator.

An individual cannot open multiple e-insurance accounts. To avoid duplication, Irdai has set up an insurance transaction hub, which will act as a central index server and a messaging hub. All transactions between the insurers and repositories will have to be routed through the hub. Every repository will carry out checks to avoid the duplication by the same policyholder and even insurers will carry out checks in their own systems before forwarding the application for opening the e-insurance account.