The government’s decision to allow foreign direct investment (FDI) up to 74% through automatic route in existing pharmaceutical companies is likely to hit affordable healthcare in the country, especially in the vaccine (in which the government also runs programmes) and injectables segments, according to senior domestic industry executives.

Vaccines and injectables are challenging verticals with very few good manufacturing facilities in India and even fewer firms invest in research and development in these verticals. Hence, the acquisition of existing companies could potentially undermine the government’s efforts to keep costs of such essential public healthcare items at reasonable levels for the masses, they said.

Also read | 2,839 bottles made by Sun Pharma Inc being recalled in US

“The main issues before the government today are how it will ensure that healthcare costs, especially in the vaccine and injectables segments, remain affordable and the interest of the sun-rise domestic pharmaceutical industry isn’t compromised,” said Dilip G Shah, the secretary general of Indian Pharmaceutical Alliance (IPA) and the CEO of Vision Consulting Group.

Although such companies were also acquired by foreign firms earlier, such takeovers were subject to the approval of the Foreign Investment Promotion Board (so the government could put some checks and balances, if required and there have been instances in the past of the health ministry raising objections to such proposals).

In 2009, France’s Sanofi had bought a 80% stake in Shantha Biotech, a pioneer in developing, manufacturing and marketing indigenous Hepatitis B Vaccine at a fraction of the price at which it was being imported then, for around `3,000 crore. Later, the French company raised its stake even further.

Also, without any checks and balances, easier mergers and acquisitions by big pharma firms may not necessarily result in the transfer of advanced foreign technology or an increase in manufacturing prowess, according to analysts.

This is because foreign firms can now take over domestic companies to grab market shares or brands, aimed at just strengthening marketing muscles and supply chain, which can then be used to import finished formulations from units elsewhere and sell it in India, they say. This may also impact the country’s current account deficit.

For instance, the acquisitions of the formulations business of Piramal Healthcare by US company Abbott Inc for $3.7 billion in 2010 and some popular brands of Universal Caps by France’s Sanofi didn’t bring fresh investment in manufacturing or result in any transfer of technology or know-how, said an industry executive.

The latest FDI policy will also discourage whatever little investments that were flowing into new projects where 100% FDI was already allowed through the automatic route. The latest announcement will just provide a fresh leg-up to foreign companies, who were forced to change their business models due to a stagnation in the mature markets, rapidly growing demand from emerging markets and stiff competition from low-priced quality products from India, the industry executives say.

They say the government’s latest FDI move is intriguing. “On the one hand, the government says it won’t give in to demands of the Big Pharma and stick to provisions of Section 3(d) and compulsory licensing of the Patents Act to make life-saving drugs available at a reasonable cost.

But on the other hand, it is facilitating the acquisition of brownfield projects, which will serve to enhance the power of foreign companies in pricing of drugs in the domestic market and can potentially raise healthcare costs,” said another domestic industry executive.

Section 3(d) prevents ever-greening of drug patents. Apart from novelty and inventive step, the section provides for improvement in therapeutic efficacy for the grant of patents when it comes to incremental inventions.

Compulsory licensing allows domestic players to produce cheaper versions of patented drugs in cases of national emergency or to meet “extreme urgency” or for public non-commercial use. India has invoked this provision only once — in 2012, Hyderabad-based Natco Pharma was allowed to make and sell generic version of German drugmaker Bayer AG’s patented cancer drug Nexavar.

The US and the EU have been putting pressure on India to make appropriate changes to these provisions to boost innovation, research and development (R&D) and foreign investment.

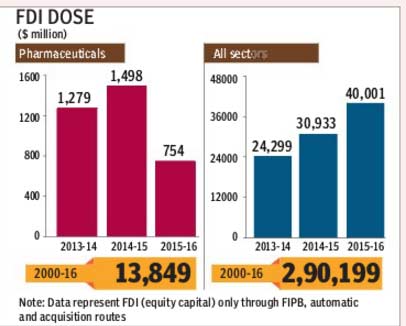

The pharmaceutical sector has been the sixth largest beneficiary of FDI over the years, accounting for roughly 5%

($13.85 billion) of the total FDI inflows into the country since March 2000.

Some of the brownfield acquisitions by foreign firms in recent years include the takeover of Ranbaxy Labs by Daiichi Sankyo (Japan), formulation business of Piramal Healthcare by Abbott Inc (US), Matrix Labs by Mylan (US), Shantha Biotech by Sanofi (France), J K Drugs and Pharmaceuticals by Teva (Israel), injectable business of Orchid Chemicals by Hospira (US) and some popular brands of Universal Caps by Sanofi.