Tune Protect Group – Why You Should Consider Adding this Insurance Group to Your Portfolio

Early in June 2016, SI Research took an interest in AirAsia, a low-cost airline listed on the Mainboard of Bursa Malaysia. The airline’s shares, which closed at RM2.30 on 31 May 2016, went on to hit a high of RM2.73 two weeks later.

This issue, SI Research takes a look at Tune Protect Group (Tune Protect), an insurance company which depends heavily on AirAsia and is partially (13.7 percent) owned by the airline.

After hitting a 52-week low of RM1.10 in mid-January 2016, Tune Protect closed at RM1.43 on 21 June 2016, adding 10.9 percent from the start of the year.

Presence in 50 Countries Across Asia-Pacific, the Middle-East, and North Africa

Tune Protect was initially listed on the main market of Bursa Malaysia in February 2013 as Tune Ins Holdings, before changing its name as part of a rebranding initiative. With a presence in 50 countries across Asia-Pacific, the Middle-Eastern and North-African regions, the group’s core business is insurance and reinsurance, which are underwritten via several subsidiaries.

The group, which specialises in the manufacturing and distribution of travel insurance products through online channels or via travel agents, aims to be recognised as the leading digital insurer.

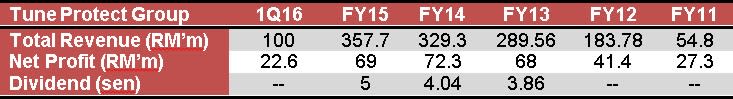

3.8% Dividend Yield; Revenue Grew 6 times, Net Profit Doubled over 5 Years

As of FY15, the group’s general insurance segment contributed 59.2 percent of net earned premium (NEP), while the global travel segment contributed 40.8 percent. Tune Protect’s general insurance business derives most of its revenue locally, while approximately 80 percent of the global travel segment is derived from Malaysia, Thailand and Indonesia.

For FY13, the group declared its maiden dividend of RM0.0386 in line with its dividend policy to payout a minimum of 40 percent of profit after tax. In FY15, dividend payout increased to RM0.05, providing investors with a decent yield of 3.8 percent as of the date of the announcement. The group displayed a stellar top line growth over the years as total revenue grew by more than six times from RM54.8 million in FY11 to RM357.7 million in FY15, largely supported by its strong partnership with AirAsia. During the same period, net profit more than doubled up to RM69 million from just RM27.3 million in FY11.

Expected to Maintain Double-Digit Growth in Premium Income for 2016

Tune Protect made a good head start in 2016 as first quarter NEP grew 25.2 percent, driven by marketing initiatives and new product launches. The impressive results made up 28 percent and 32.8 percent of FY15’s full year revenue and net profit respectively, setting the insurer up for a strong growth this year.

The group, which expects to maintain double-digit growth in premium income this year, reported higher contributions of RM12.3 million from the general insurance business and an increase of RM4.3 million from the global travel business.

Chief Executive Officer, Junior Cho, who will be stepping down in July, commented that the group is still seeking to acquire an insurance company in Indonesia despite having two previous acquisitions mutually terminated due to regulatory issues.

The group is also confident of its third attempt, having taken pre-emptive measures to prevent similar problems. A successful venture into the Indonesian market, which has a low insurance penetration rate and rising income, would be a major growth catalyst for the group.

AirAsia Partnership – Riding on AirAsia’s Success

Tune Protect, which started out as the only insurance provider to AirAsia, has since expanded its reach into general insurance as well as digital insurance, serving more than 30 million policyholders today.

Despite the group’s effort to reduce its heavy dependence on AirAsia, policies issued through partnerships with the airline remain the highest contributor to the global travel business, accounting for 90 percent of total sales as the insurer continues to ride on the airline’s success.

In 2015, Tune Protect’s business from AirAsia grew by 23 percent, as the airline carried 11.2 percent more passengers during the year. Early this month, we identified key growth factors for the airline, such as major airport developments in Malaysia as well as new routes to boost connectivity. These factors are expected to contribute positively to the insurer as well.

Valuation

Based on the latest closing price, Tune Protect’s shares are currently trading at a price-to-book ratio (P/B) of 2.3 times and price-to-earnings (P/E) ratio of 15.6 times. A close competitor in the insurance industry, Syarikat Takaful Malaysia, last closed at RM3.94 equivalent to a P/B of 4.8 times and P/E of 20.7 times.

Given Tune Protect’s lower valuations and strong tailwinds ahead, we believe that the insurer’s shares should be trading at higher valuations. Currently, the average street target price stands at RM1.95, presenting the potential for an approximate 36.4 percent upside.

This article is brought to you by Bursa Malaysia Berhad. The research in this article was conducted independently by Pioneers & Leaders (Publishers) Pte Ltd (“Pioneers & Leaders”) and the views and opinions expressed in this article are Pioneers & Leaders’ own and do not represent the views and opinions of Bursa Malaysia. Bursa Malaysia does not warrant or represent, expressly or impliedly as to the accuracy, completeness and currency of the information in this article. In no event shall Bursa Malaysia be liable to the reader or any other third party for any claim howsoever arising out of or in relation to this article.

Yahoo Finance

Yahoo Finance