Causeway Invests in Royal Dutch Shell in ast Quarter

- By David Goodloe

Causeway International Value (Trades, Portfolio) made four new buys in the first quarter a the largest in an oil and gas company and the others in financial services and retail.

Warning! GuruFocus has detected 9 Warning Signs with LSE:RDSB. Click here to check it out.

The intrinsic value of LSE:RDSB

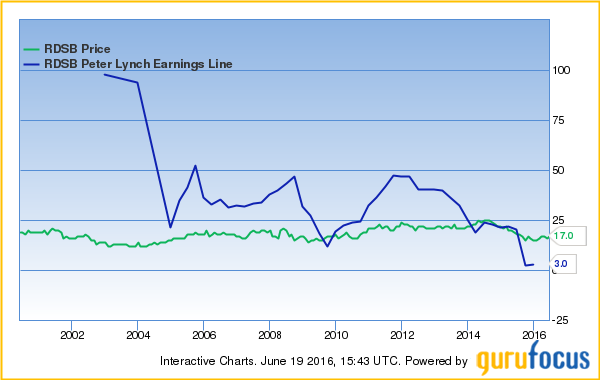

Causewayas purchase of a 3,954,497-share stake in Royal Dutch Shell PLC (RDSB.L), an oil and gas company with offices in London and The Hague, was its largest of the first quarter. The firm paid an average price of A15.47 ($22.20 in U.S. currency) per share in a deal that had a 1.86% impact on Causewayas portfolio.

The stake is 0.05% of Royal Dutch Shellas outstanding shares and 1.86% of Causewayas total assets. The acquisition made Causeway the companyas leading shareholder among the gurus.

Royal Dutch Shell has a forward P/E of 19.3, a P/B of 1 and a P/S of 0.7. GuruFocus gives Royal Dutch Shell a financial Strength rating of 5/10 and a Profitability and Growth rating of 6/10 with an ROE of -1.13 and an ROA of -0.55% that are lower than 68% of the companies in the Global Oil & Gas Integrated industry.

Royal Dutch Shell sold for A17.87 ($25.65 in American money) per share Friday. The DCF Calculator gives Royal Dutch Shell a fair value of A-2.31.

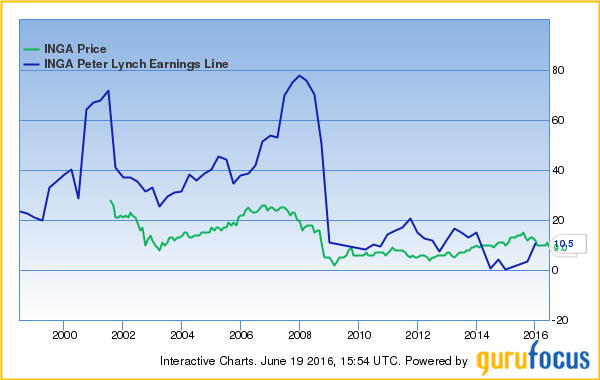

Causeway purchased a 3,615,970-share stake in ING Groep NV (INGA.AS), an Amsterdam-based banking and financial services company, for an average price of a10.9 ($12.29 in U.S. dollars) per share. The transaction had a 0.84% impact on Causewayas portfolio.

The stake is 0.09% of INGas outstanding shares and 0.84% of Causewayas total assets. Causeway is INGas only shareholder among the gurus.

ING has a P/E of 11.7, a forward P/E of 9.5, a P/B of 0.9 and a P/S of 4.2. GuruFocus gives ING a Financial Strength rating of 5/10 and a Profitability and Growth rating of 4/10 with an ROE of 6.95% that is lower than 60% of the companies in the Global Banks a Global industry and an ROA of 0.39% that is lower than 77% of the companies in that industry.

ING sold for a9.98 ($11.25 in American currency) per share Friday. The DCF Calculator gives ING a fair value of a10.06 with a margin of safety of 6%.

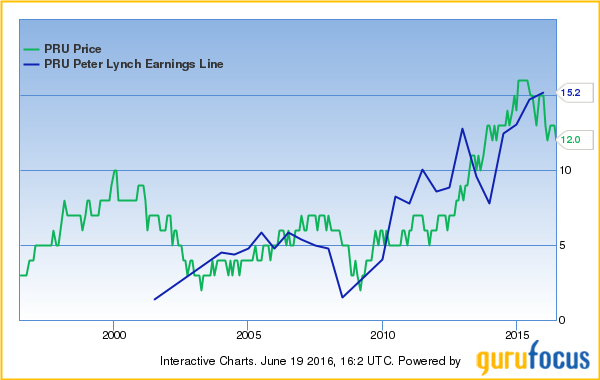

Causewayas third-largest new buy of the quarter was a 598,534-share stake in Prudential PLC (PRU.L), a London-based life insurance and financial services company, for an average price of A13.07 ($18.76 in U.S. money) per share. The deal had a 0.22% impact on Causewayas portfolio.

The stake is 0.02% of Prudentialas outstanding shares and 0.22% of Causewayas total assets. Causeway is Prudentialas leading shareholder among the gurus.

Prudential has a P/E of 12.1, a forward P/E of 10.3, a P/B of 2.4 and a P/S of 0.8. GuruFocus gives Prudential a Financial Strength rating of 5/10 and a Profitability and Growth rating of 6/10 with an ROE of 20.98% that is higher than 91% of the companies in the Global Insurance a Life industry and an ROA of 0.68% that is lower than 56% of the companies in that industry.

Prudential sold for A12.25 ($17.58 in American dollars) per share Friday. The DCF Calculator gives Prudential a fair value of A10.81.

Causeway also invested in a 576,506-share stake in Marks & Spencer Group PLC (MKS.L), a London-based retailer, for an average price of A4.2 ($6.03 in U.S. currency) per share. The transaction had a 0.06% impact on Causewayas portfolio.

The stake is 0.04% of Marks & Spenceras outstanding shares and 0.06% of Causewayas total assets. Causeway is Marks & Spenceras only shareholder among the gurus.

Marks & Spencer has a P/E of 14.1, a forward P/E of 10.2, a P/B of 1.7 and a P/S of 0.6. GuruFocus gives Marks & Spencer a Financial Strength rating of 5/10 and a Profitability and Growth rating of 6/10 with an ROE of 12.57% that is higher than 70% of the companies in the Global Department Stores industry and an ROA of 4.91% that is higher than 64% of the companies in that industry.

Marks & Spencer sold for A3.52 ($5.05 in American money) per share Friday. The DCF Calculator gives Marks & Spencer a fair value of A2.57.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 9 Warning Signs with LSE:RDSB. Click here to check it out.

The intrinsic value of LSE:RDSB