a Guru-Held British Stocks That May Be Impacted by Brexit

- By Sheila Dang

In just a little over a week, the U.K. will vote on June 23 whether to stay in the European Union, in response to growing calls from the Conservative Party and the U.K. Independence Party, who say itas been too long since Britons last voted to stay in the union in 1975.

Bloomberg Monday speculated about what the first 100 days may look like should Brexit happen, predicting chaos and loss of confidence through the rest of the EU. President of the EU Donald Tusk has said Brexit could lead to the end of awestern political civilization itself.a

Warning! GuruFocus has detected 6 Warning Sign with LSE:BATS. Click here to check it out.

The intrinsic value of LSE:BATS

Should the U.K. decide to leave the EU next week, itas almost certain currency markets will struggle in the aftermath. Using GuruFocusa All-in-One Screener, the following are three of the most-held British stocks among the gurus that may be impacted by the effects of Brexit.

British American Tobacco PLC (BATS.L)

British American Tobacco is a holding company with a brand portfolio that includes Dunhill, Kent, Lucky Strike and Pall Mall. It also launched the ecigarette brand Vype in the U.K. in 2013, which has been growing in market share. The stock is owned by five funds that GuruFocus follows including Tweedy Browne (Trades, Portfolio) Global Value and the Wintergreen Fund (Trades, Portfolio).

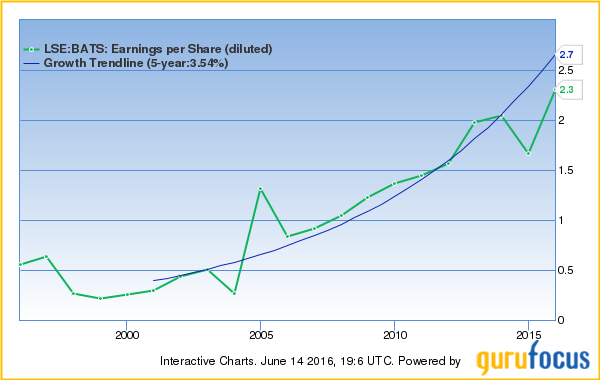

British American Tobaccoas stock has increased 19% over the past year and now trades at 18x earnings. In fiscal year 2015, the companyas diluted EPS was A2.30, an increase from A1.67 in 2014.

The operating margin has also held steady at about 30% since 2011.

The dividend yield, despite a payout ratio of 65%, is close to its five-year low. The trailing dividend yield is 3.71%.

Vodafone Group PLC (VOD.L)

Four gurus followed by GuruFocus currently own positions in Vodafone, which provides voice and data communications. This includes T Rowe Price Equity Income Fund (Trades, Portfolio) and the Causeway International Value (Trades, Portfolio) Fund.

Vodafoneas stock has declined about 9% over the past year and is down 3% year to date. Preliminary results for fiscal year 2016 ended March show the company lost 15 pence per diluted share, down from earnings of 22 pence the year before.

Net loss for fiscal year 2016 is about A3.8 billion. According to the annual report, Vodafone incurred restructuring costs of A236 million to improve future business performance.

WPP PLC (WPP.L)

WPP is a communications services company that serves national and multinational corporations. Steven Romick (Trades, Portfolio), David Herro (Trades, Portfolio) and Invesco European Growth Fund (Trades, Portfolio) hold positions in the company as of the beginning of the year.

GuruFocus rates WPPas business predictability as an excellent 4.5 stars based on earnings and revenue history. The stock is up 2% over the last year and down 2% year to date.

Over the past five years, revenue has grown by an average annual rate of 5.7% while EPS without NRI grew by an average 13.4% per share.

WPPas trailing dividend yield is 2.95%, close to the 10-year high. The payout ratio is 48%.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 6 Warning Sign with LSE:BATS. Click here to check it out.

The intrinsic value of LSE:BATS