IOI Properties Group Bhd May 30 (RM2.25)

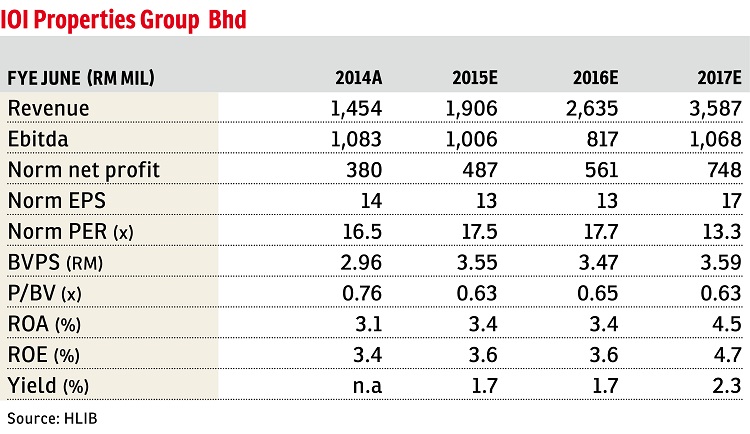

Maintain buy with an unchanged target price (TP) of RM2.77: IOI Properties Group Bhd’s (IOI Properties) third quarter of financial year 2016 (3QFY16) core profit after tax and minority interests (Patmi) (excluding a RM85 million fair value gain on investment properties and a RM71 million gain on purchase for land acquisition in IOI Resort City) increased 4% year-on-year (y-o-y), bringing ninth months of FY16 (9MFY16) core Patmi to RM402 million, accounting for 73% of our and the consensus full-year earnings forecasts.

9MFY16 revenue surged by 65% y-o-y, on the back of an improvement in all its business segments. Property development increased by 72% y-o-y, mainly contributed by the Triling project in Singapore and IOI Palm City in Xiamen.

New property sales in 3QFY16 were RM402 million (versus RM390 million in 3QFY15), with 50% from Malaysia, 31% from China and 19% from Singapore. 9MFY16 sales were RM1.46 billion, on track to exceed its RM1.7 billion sales target for the year.

With a strong recovery in China’s property market, the take-up rate of Phase 2 of IOI Palm City is more than 90%. The remaining gross development value of IOI Palm City is about 3.5 billion yuan (RM2.2 billion), which will sustain its sales for the next two to three years. The company is planning to launch Phase 3 in 4QFY16.

Unbilled sales also increased from RM1.4 billion to RM1.5 billion, representing about one times FY15 property development revenue.

In 3QFY16, operating profit from property investment surged by 74% y-o-y, contributed by IOI City Mall, Putrajaya, which enjoyed more than 90% occupancy. The company aims to increase its investment property income from 15% of total income to 30% to 40% in future.

IOI Properties is one of the value stocks under our coverage, given that it is only trading at 0.63 times FY17 price-to-book value, compared with its peers at an average of one times. We believe the stock warrants a rerating, given its strong track record in township development and its attractive valuation.

We see positives in its: i) highly liquid proxy to the property sector; ii) large war chest for land bank acquisition; iii) it has exposure to the Singapore and China property markets; and iv) it enjoys vast and cheap land bank.

However, negatives lie in the fact that it: a) could face sector headwinds in Malaysia; and b) the Singapore and China property markets are also currently at the low point of their cycles.

In conclusion, our TP remains unchanged at RM2.77, based on an unchanged 35% discount to realised net asset value. We maintain “buy”. — Hong Leong Investment Bank Research, May 30

Sometimes, even the value of your home can be a mystery. Go to The Edge Reference Price to find out.

This article first appeared in The Edge Financial Daily, on May 31, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Eastern Heritage, Setia Eco Glades

Cyberjaya, Selangor

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Twentyfive.7 Lucent Residences

Telok Panglima Garang, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)