Wilful defaulters owed the country’s public sector banks (PSBs) a staggering R66,190 crore at the end of 2015, up 138% from the level three years ago, minister of state for finance Jayant Sinha told Parliament on Tuesday.

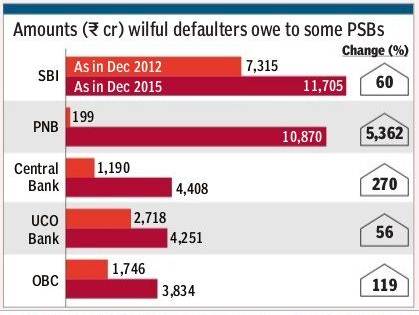

The outstanding amount rose the steepest (5,363%) in the case of Punjab National Bank (PNB) which in December 2015 needed to recover R10,870 crore from such borrowers. PNB listed Winsome Diamonds & Jewellery, Zoom Developers and the defunct Kingfisher Airlines and its guarantors United Breweries Holdings and United Spirits chairman Vijay Mallya among its wilful defaulters.

“The total exposure of top 50 defaulters of PSBs as on December 2015 was Rs 1,21,832 crore,” Sinha said in a written reply in the Rajya Sabha. In another reply, he said there were 1,365 borrower accounts having funded outstanding loans of Rs 500 crore and above at the end of 2015. He further said that the government has taken specific measures to address issues in sectors such as infrastructure, steel and textiles, where the incidence of non-performing assets (NPAs) is high.

While advocating strong action against wilful defaulters, Reserve Bank of India governor Raghuram Rajan had earlier said that it would be wrong to assume mala fide in all cases where loans turn into bad debts.

State Bank of India (SBI) retains the top slot among PSBs with exposure to wilful defaulters: Its exposure rose 60% to Rs 11,705 crore in the three years to December 2015. Other PSBs with high exposure to wilful defaulters are: Central Bank of India (Rs 4,408 crore ), UCO Bank (Rs 4,251 crore) and Oriental Bank of Commerce (Rs 3,834 crore).

According to a recent report from rating agency Crisil, significant stress in the corporate loan book of PSBs is expected to result in their weak assets ballooning to Rs 7.1 lakh crore by March 31, 2017 (11.3% of total loan book) from around Rs 4 lakh crore as on March 31, 2015 (7.2% of loan book).

The issue of wilful defaulters has hogged the limelight after a surge in NPAs in October-December 2015 due to the recognition of certain stressed accounts by banks as per RBI norms. With the case of the erstwhile Kingfisher Airlines and its wilful defaulter promoter Mallya in focus, PSBs have accelerated recovery actions by filing FIRs, suits in courts and steps under the Sarfaesi Act to recover loans.

According to the government, while the number of wilful defaulters increased 38% to 7,686 by the end of 2015, suits were filed in 6,816 cases involving Rs 58,500 crore and FIRs in 1,669 cases involving Rs 18,212 crore. Also, action under the Sarfaesi Act was taken in 5,840 cases involving Rs 53,407 crore.