AmorePacific chairman’s siblings suspected of running paper companies

By Sohn Ji-youngPublished : April 22, 2016 - 16:08

Two children of AmorePacific Group’s late founder Suh Sung-hwan were found to have established paper companies in the U.S. Virgin Islands in an apparent scheme to evade taxes, a local news outlet reported on Thursday.

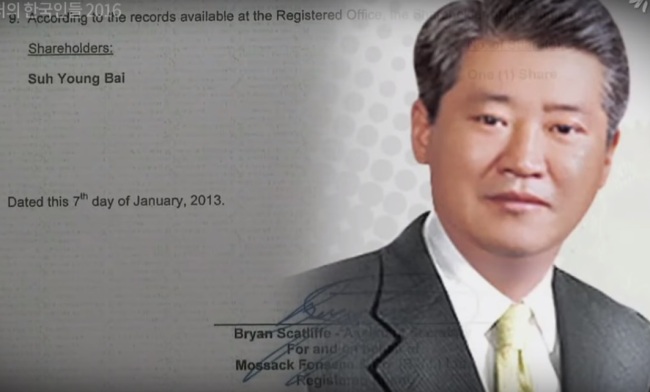

Citing legal documents leaked by Panama-based law firm Mossack Fonseca, Newstapa said it has discovered two ghost companies each established under the name of the founder’s oldest son Suh Young-bai and youngest daughter Suh Mi-sook.

The two are siblings of AmorePacific chairman Suh Kyung-bae, the youngest of the group founder’s two sons and four daughters. The Korean cosmetics giant said that the chairman’s siblings “have zero ties to the group’s businesses” and that their actions are strictly independent.

Citing legal documents leaked by Panama-based law firm Mossack Fonseca, Newstapa said it has discovered two ghost companies each established under the name of the founder’s oldest son Suh Young-bai and youngest daughter Suh Mi-sook.

The two are siblings of AmorePacific chairman Suh Kyung-bae, the youngest of the group founder’s two sons and four daughters. The Korean cosmetics giant said that the chairman’s siblings “have zero ties to the group’s businesses” and that their actions are strictly independent.

The two ghost companies, both formed through the then-ING Asia Private Bank based in Singapore, were likely established for tax evasion purposes, the news outlet claimed, citing details of the seized documents.

Suh Young-bai, chairman of Pacific Engineering & Construction, established a ghost company named Watermark Capital in the U.S. territory, with himself as the sole shareholder in September 2004.

In June 2013, ownership of the ghost company — created to hide his assets in the Singaporean bank — was passed onto Alliance Corporate Services, another paper company operated by Mossack Fonseca, in a perceived move to evade regulatory watch, the news outlet said.

Suh Mi-sook also established a paper company named Weise International, categorized as an “investment holding company,” in the Virgin Islands in April 2006, with herself and her three sons as the sole shareholders. The firm was dissolved in November 2014.

Though Suh’s lawyer claimed the firm was a part of legal procedures taken to transfer capital in preparing to immigrate to Canada at the time, Newstapa raised concerns of potential inheritance tax evasion.

By Sohn Ji-young (jys@heraldcorp.com)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)