Talking Points:

- Gold pricessubsided while risk assets rallied after strong China’s March exports

- Oil pricesreceded after larger than expected crude stockpiles

- Copper prices jumped following encouraging Chinese exports and copper imports data

Solid China’s March exports data at 18.7% year-on-year (CNY term) and 11.5% year-on-year (USD term) gave a strong boost to Asian equities and industrial metals. Iron ore was up 6% at one point. These data showed the first increase since June and the largest rise since February 2015.

Oil prices receded in Asian trade after a 4.4 percent rally overnight, as larger-than-expected U.S. crude inventories overshadowed positive news of a Russia-Saudi production accord. Prices have so far ignored good Chinese data to focus on supply fundamentals with a 6.2 million barrels build reported by API. Official stockpile data tomorrow will be another market driver,if only in the short-term.

News of a private deal reached between Russia and Saudi Arabia earlier today provided some optimism ahead of the Sunday’s meeting in Doha.

Gold pricesfell from a three-week high of $1262.79 as the US dollar regained its footing and solid China’s exports revived risk appetite in Asian trade. The widespread gains in regional stocks and metals dampened the appeal of safe haven bullion. Mixed Fedspeak overnight from Fed members Kaplan, Harker and Williams added more confusion to gold investors. While the first two members reiterated Chair Yellen’s call for caution, San Francisco Fed President Williams provisioned for two to three rate rises in 2016.

Copper prices climbed to the highest in nearly two weeks along withShanghai-traded metals, as strong Chinese copper imports in March accelerated the positive effect of a weaker US dollar. Along with encouraging manufacturing prospects from China, copper imports surged more than one third from the same time last year to hit a monthly record-high. However the head of Customs accredited some of these gains to a low base last year.

Need a hand to start trading: Free Guides

Want to read market’s momentum: Speculative Sentiment Index

Want to improve your trading strategy: Traits of Successful Traders

GOLD TECHNICAL ANALYSIS – Gold prices halted the rise as momentum turned flat after a week-long rally. The market’s focus has shifted to the downside, as gold faces possibility of sideways moves or a downward reversal.

Daily Chart - Created Using FXCM Marketscope

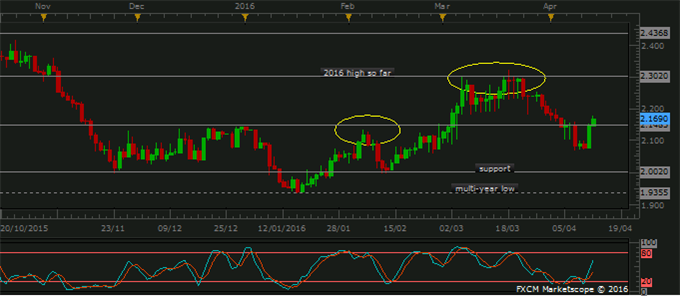

COPPER TECHNICAL ANALYSIS – Copper prices jumped above a recent resistance level at 2.1485, effectively opened up the area toward the 2016’s high of 2.3020. Strong upward market momentum likely provides plenty of support to the metal in the short term.

Daily Chart - Created Using FXCM Marketscope

CRUDE OIL TECHNICAL ANALYSIS – Oil prices receded in the face of fundamental drivers today, although the oil rally remained largely intact as prices approached the resistance area of 41.80-43.43. The strong resistance levels and waning momentum may prove a tough hindrance to oil prices.

Daily Chart - Created Using FXCM Marketscope

--- Written by Nathalie Huynh, Currency Strategist for DailyFX.com

To receive Nathalie’s analysis directly via email, please SIGN UP HERE

Contact and follow Nathalie on Twitter: @nathuynh