Financial inclusion to be spread

Elita Chikwati Agriculture Reporter

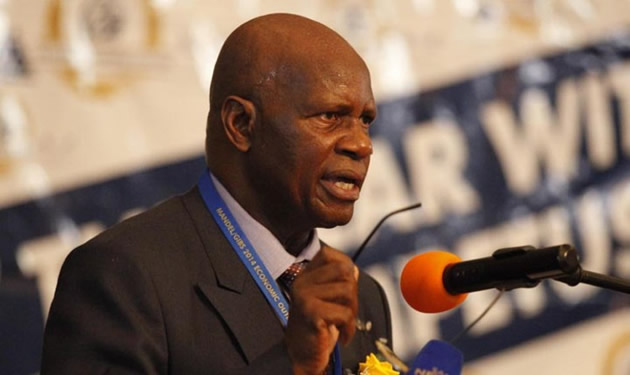

THE Zimbabwe National Financial Inclusion Strategy (ZNFIS) which was introduced in the tobacco sector this season will be extended to other sectors as Government increases efforts to address liquidity challenges, a senior Government official has said. Presenting a paper on the effects of Zimbabwe’s current economic challenges on development and national security at the National Defence College last Thursday, Finance and Economic Development Minister Patrick Chinamasa said the Reserve Bank of Zimbabwe launched ZNFIS in March this year to promote access to financial services by the disadvantaged, underserved and excluded members of the society.

The financial inclusion strategy saw tobacco farmers being paid through bank accounts instead of getting cash as they used to. The farmers’ accounts will not attract any charges and the RBZ made it easier for those without accounts to get them. For a tobacco farmer to have a bank account, he or she produces a grower’s numbers and national identity card.

“As part of Government efforts to promote financial inclusion, a payment facility has since been introduced for tobacco farmers. There are no spot cash payments; instead the payments will be made into the farmers’ bank accounts with an understanding that there would be no bank charges raised on such accounts.

“We are going to extend this to other sectors especially to the Grain Marketing Board for the payment of farmers. It will be extremely difficult to address liquidity challenges for as long as the economy remains cash based,” he said.

Comments