- News

- Business News

- India Business News

- Equitas debut to mark small financer's big growth

Trending

This story is from April 4, 2016

Equitas debut to mark small financer's big growth

Company brought in new innovations that soon became best practice for industry.

Company brought in new innovations that soon became best practice for industry.

CHENNAI: Serving piping hot idlis with chutney, sambar and the city's quintessential vadacurry, S Kala, a budding entrepreneur with brisk sales in Kodambakkam's Rangajapuram, little knows how much her growth in a way symbolises the success story of Equitas, whose public float open on Tuesday.

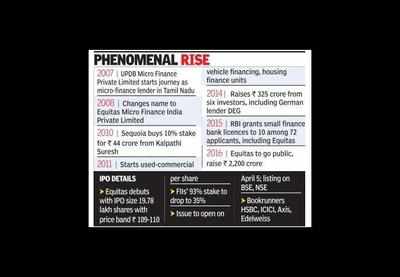

With a whopping Rs 2,200-crore initial public offering (IPO), microfinance lender Equitas is the first company from Chennai to debut in 2016.After having bagged the license from the Reserve Bank of India to operate as a small finance bank (SFB), Equitas founder P N Vasudevan hopes that as a bank he can help more women like Kala achieve their goals. "With loan tickets sizes on average between Rs 10,000-Rs 30,000 our focus has always been lending to women and empowering them. Almost all our customers are women - who generally work as domestic maids, tailors, shop assistants. With our loans, they've managed to set up petty shops, eateries, tailoring units, etc," said Vasudevan. "As a bonus their menfolk can no longer bully them, because now the financial/spending power of the household is firmly in their hands," he adds with a smile.

Something that's worked true in the case of Kala and her SHG friends in Kodambakkam. "I used to work long hours as a maid earning peanuts. I barely used to make ends meet till I took my first loan with Equitas in 2009 and started my own food outlet. I paid that off and took another loan. Today, I am earning four times what I earned earlier and I am able to send both my kids to college," says Kala as dishes out piping hot masala dosas, mutta dosas, poori, appam, chutney to a long queue of customers.

"They charge me less than at pawn brokers," adds Kala, referring to Equitas' practise of reducing balance. At a time, when micro-finance lenders (MFIs) were charging flat rates for their clients, Equitas charged on reducing balance, where when payment is made on the principal amount of a loan the interest payment reduces as well.

Decisions, which have today led to what its merchant banker HSBC terms as "one of the biggest and most spectacular IPOs in the last couple of years." HSBC is one of the underwriters of the issue, along with Axis Capital, ICICI Securities and Edelweiss Financial Services. With the IPO, which has a price band at Rs 109-110 per share, foreign institutional investors' (FIIs) stake in the company will come down to 35% from 93%, "giving enough room for FIIs to buy up to 49% if they choose to in later years."

Of the Rs 2,177 crore planned to raised through the IPO, about Rs 620 crore, will be deployed in growing Equitas' three units - micro-finance, commercial vehicle and housing finance. The offering proceeds will also be used for the IT core-banking requirements - after the three units are merged into one small finance bank (SFB), pending Madras High Court approval.

Equitas' venture into the small banking space comes at a time when his former employer Cholamandalam Finance has decided to exit the payment banking industry by surrender its license to the RBI. Vasudevan, who started his career with Cholamandalam as a secretary moved up the ranks fast to head the chain's commercial vehicle financing unit. Known among old-timers as the boy "teaming with ideas," he managed to get his former bosses to continue to believe in them even after his exit from the company. Equitas, founded in 2007, got its seed capital in part from then Murugappa Group executive chairman MA Alagappan, Cholamandalam's former MD and Aptas head M Anandan. Aptas Value Housing Finance and Cholamandalam Finance today compete in many of the spaces that Equitas today operates in.

"We wish him well. We've known him for 20 years and Vasu (as he is referred to in busines circles) is a smart, humble, down to earth person. I've been taken out for field trips and seen the work Equitas does, which is commendable," says Murugappa group’s MA Alagappan. Sundaram Finance MD Srinivas Acharya concurs with the view, adding that "Vasu has always approached the business with empathy. He's running schools, career fairs, skill development programmes. It's hard to get the balance right between running a profitable business and running it with one's heart in the right place."

"He is multi-faceted. He know his lending business inside out," adds Sundaram Finance's Acharya. Something that will come in handy, when Equitas turns a bank on or before April 2017 - the deadline the RBI has set for it. Equitas said a majority of its 539 branches across 12 states will become part of its core-banking system - setting a new milestone for Tamil Nadu, where it largely operates.

With a whopping Rs 2,200-crore initial public offering (IPO), microfinance lender Equitas is the first company from Chennai to debut in 2016.After having bagged the license from the Reserve Bank of India to operate as a small finance bank (SFB), Equitas founder P N Vasudevan hopes that as a bank he can help more women like Kala achieve their goals. "With loan tickets sizes on average between Rs 10,000-Rs 30,000 our focus has always been lending to women and empowering them. Almost all our customers are women - who generally work as domestic maids, tailors, shop assistants. With our loans, they've managed to set up petty shops, eateries, tailoring units, etc," said Vasudevan. "As a bonus their menfolk can no longer bully them, because now the financial/spending power of the household is firmly in their hands," he adds with a smile.

Something that's worked true in the case of Kala and her SHG friends in Kodambakkam. "I used to work long hours as a maid earning peanuts. I barely used to make ends meet till I took my first loan with Equitas in 2009 and started my own food outlet. I paid that off and took another loan. Today, I am earning four times what I earned earlier and I am able to send both my kids to college," says Kala as dishes out piping hot masala dosas, mutta dosas, poori, appam, chutney to a long queue of customers.

"They charge me less than at pawn brokers," adds Kala, referring to Equitas' practise of reducing balance. At a time, when micro-finance lenders (MFIs) were charging flat rates for their clients, Equitas charged on reducing balance, where when payment is made on the principal amount of a loan the interest payment reduces as well.

One of several things, Equitas did which were an industry first or became a best practice for industry. It never lent to anyone at rates beyond 25.5%, even when other MFIs were selling loans anywhere between 30%-45%. "We felt validated when years later, the RBI itself brought in guidelines that MFIs can't charge an interest higher than 26%," Vasudevan said. Another innovation was disclosing cost of funds to borrowers, a decision to forgo insurance commission and pass on the same to the policyholder and no "fat cat" banker salaries to any member of the top management.

Decisions, which have today led to what its merchant banker HSBC terms as "one of the biggest and most spectacular IPOs in the last couple of years." HSBC is one of the underwriters of the issue, along with Axis Capital, ICICI Securities and Edelweiss Financial Services. With the IPO, which has a price band at Rs 109-110 per share, foreign institutional investors' (FIIs) stake in the company will come down to 35% from 93%, "giving enough room for FIIs to buy up to 49% if they choose to in later years."

Of the Rs 2,177 crore planned to raised through the IPO, about Rs 620 crore, will be deployed in growing Equitas' three units - micro-finance, commercial vehicle and housing finance. The offering proceeds will also be used for the IT core-banking requirements - after the three units are merged into one small finance bank (SFB), pending Madras High Court approval.

Equitas' venture into the small banking space comes at a time when his former employer Cholamandalam Finance has decided to exit the payment banking industry by surrender its license to the RBI. Vasudevan, who started his career with Cholamandalam as a secretary moved up the ranks fast to head the chain's commercial vehicle financing unit. Known among old-timers as the boy "teaming with ideas," he managed to get his former bosses to continue to believe in them even after his exit from the company. Equitas, founded in 2007, got its seed capital in part from then Murugappa Group executive chairman MA Alagappan, Cholamandalam's former MD and Aptas head M Anandan. Aptas Value Housing Finance and Cholamandalam Finance today compete in many of the spaces that Equitas today operates in.

"We wish him well. We've known him for 20 years and Vasu (as he is referred to in busines circles) is a smart, humble, down to earth person. I've been taken out for field trips and seen the work Equitas does, which is commendable," says Murugappa group’s MA Alagappan. Sundaram Finance MD Srinivas Acharya concurs with the view, adding that "Vasu has always approached the business with empathy. He's running schools, career fairs, skill development programmes. It's hard to get the balance right between running a profitable business and running it with one's heart in the right place."

"He is multi-faceted. He know his lending business inside out," adds Sundaram Finance's Acharya. Something that will come in handy, when Equitas turns a bank on or before April 2017 - the deadline the RBI has set for it. Equitas said a majority of its 539 branches across 12 states will become part of its core-banking system - setting a new milestone for Tamil Nadu, where it largely operates.

End of Article

FOLLOW US ON SOCIAL MEDIA