3.30 pm: Benchmark indices BSE Sensex and NSE Nifty fell over 3 per cent on Thursday for the first time since January 6, 2015 on account of massive sell-off in bank, power, realty and stocks coupled with weak global cues.

Sensex closed 807.07 points down at 22951.83, while Nifty settled 239.35 points down at 6976.35.

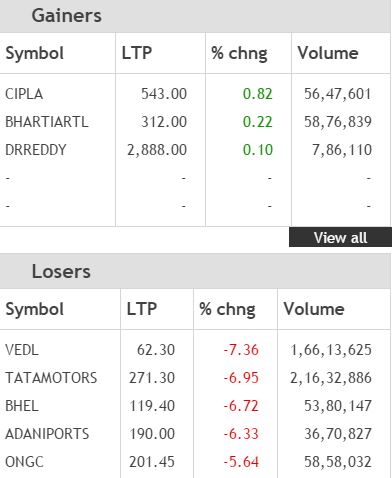

Barring Cipla (up 0.21 per cent) and Dr Reddy’s Labs (up 0.04 per cent), rest all the stocks in the 30-share Sensex ended the day in red. Adani Ports, BHEL and Tata Motors tanked 6.94 per cent, 6.01 per cent and 5.55 per cent, respectively.

Read: 5 reasons why Sensex falls over 800 points today

Sectorwise, the BSE Realty index fell the most — 5.94 per cent, followed by Power (4.81 per cent), Oil & Gas (3.82 per cent) and Metal (3.81 per cent). Rest all other sectoral indices also ended in red.

Dipen Shah, senior vice-president and head of private client group research, Kotak Securities, said, “Markets fell steeply on the back of continuing concerns about a global slowdown and the consequent impact on the financial sector. The US Fed also did not provide any further clarity on the possible interest rate movements. Quarterly results declared over the past few days have also not met up to the muted expectations and that also impacted sentiments.”

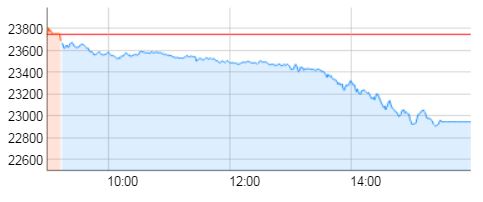

S&P BSE Sensex as on Feb 11, 2016

Market sentiments were further hit after the biggest nationalised bank State Bank of India (SBI) reported grim Q3 numbers. SBI reported a 62 per cent year-on-year fall in Q3 net profit figures at Rs 1,115 crore against market expectations of over Rs 3,250 crore. The share price of the bank 3 per cent down at Rs 154.20.

Tata Motors shares plunged over 5 per cent on Thursday after the company reported 2 per cent decline in consolidated net profit figures at Rs 3,507.54 crore for the third quarter ended December 2015 against Rs 3,580.72 crore in the same period last fiscal.

Selling also got intensified after European counters have made an awful start on Thursday, with major counters declining around three per cent, led down by a renewed drop in banks and miners, with Societe Generale and Rio Tinto both under pressure after disappointing with their latest results. Hong Kong’s Hang Seng slumped around four per cent on Thursday leading another sell-off across Asian markets and extending a global rout. However, financial markets in China and Japan were closed for public holidays.

Asian markets ended mostly lower on Thursday, led by sharp drops in Hong Kong and South Korea, which were catching up to global market turmoil after being shut for Lunar New Year holidays. Investor sentiment remained shaky as the oil price recovery proved short lived and Federal Reserve Chair Janet Yellen warned the US economy is facing risks from tightening domestic financial conditions as well as global economic turmoil. She was non-committal on taking a pause in plans to raise interest rates despite emerging headwinds. The markets in China and Taiwan remain closed for the Lunar New Year holiday, while Japan was shut for the National Foundation Day.

| Asian Indices | Last Trade | Change in Points | Change in % |

| Hang Seng | 18,545.80 | -742.37 | -3.85 |

| Jakarta Composite | 4,775.86 | 43.38 | 0.92 |

| KLSE Composite | 1,643.95 | -0.46 | -0.03 |

| Straits Times | 2,538.28 | -43.82 | -1.7 |

| KOSPI Composite | 1,861.54 | -56.25 | -2.93 |

————————————————————————————————————————-

Markets through the day

3.30 pm: Sensex closed 807.07 points down at 22951.83, while Nifty settled 239.35 points down at 6976.35.

Nifty 50- Top Gainers and Losers

3.03 pm: Sensex was trading 828.86 points down at 22,930.04. NSE Nifty was trading 240.45 points down at 6,975.25.

3.01 pm: State-owned Union Bank of India shares were trading 3.50 per cent down at Rs 118.50 after it reported 74 per cent decline in net profit at Rs 78.5 crore for the third quarter of the current fiscal. Sensex was trading 792.04 points at 22,966.86. NSE Nifty was trading 235.30 points down at 6,980.40.

Read: Stock markets in bear grip in 2016 so far, 5 stocks to bet upon

2.55 pm: Nifty50 was trading 221.05 points down at 6,994.65.

2:48 pm: Sensex was down by 725.65 and trading at 23,033.25. While Nifty 50 was trading down by 213.45 points at 7,002.25.

2:38 pm: Sensex was 660 points down at 23,098.98. Nifty was trading 203.35 points down at 7,012.35.

2.31 pm: Sensex was down 620 points at 23,138.53.

2.24 pm: European shares fell on Thursday, led down by a renewed drop in banks and miners, with Societe Generale and Rio Tinto both under pressure after disappointing with their latest results. Back home, Sensex was down 588 points at 23,170.

2.11 pm: BSE Metal index was down 3.48 per cent. Sensex was trading 567.25 points at 23,191.65. Similarly, Nifty was trading 152.80 points down at 7,062.90.

2.08 pm: Public sector lender Bank of India shares were trading 6.07 per cent down at Rs 85.10 after it reported a net loss of Rs 1,505.58 crore for the third quarter ended December 31, on account of higher provisioning for bad loans. Sensex was trading 514.02 points down at 23,244.88, while NSE Nifty was trading 154.25 points down at 7,061.45.

1.51 pm: Sensex was down 457 points at 23,301. Nifty fell below 7100 mark and was trading 132.25 points down at 7,083.

1.26 pm: State Bank of India, the nation’s top lender by assets, reported a 61.67 per cent fall in quarterly profit although its bad loans rose less than expected. SBI shares gained more than 5 percent after the results. The scrip was trading 2.26 per cent up at Rs 162.55 (at 1.26 pm).

State Bank of India, the nation’s top lender by assets, reported a 61.67 per cent year-on-year fall in its standalone net profit figures at Rs 1,115.34 crore for the quarter ended December 2015 although bad loans rose less than expected. The bank earned Rs 2910 .06 crore in the corresponding quarter a year ago.

1.18 pm: TeamLease Services shares will be listed on bourses on BSE and NSE on Friday (February 12). Earlier, the IPO of the company received overwhelming response from investors as the issue was oversubscribed 66.02 times. Sensex was down 325 points 23,433. Nifty was down 97.20 points at 7,118.

12.46 pm: Union Bank of India gained as much as 5 per cent on Thursday after the bank reported a net profit of Rs 78.54 crore for the quarter ended December 2015 whereas the same was at Rs 302.42 in the corresponding quarter a year ago. During the quarter, the Bank has recognized deferred tax assets amounting to Rs 332.04 crore which was hitherto recognized as at the year-end, in accordance with the applicable Accounting Standards. Accordingly, figures of previous corresponding reporting periods are not comparable. The BSE Bankex was down 0.83 per cent at 16382.61.

12.39 pm: India’s economic growth is robust despite turmoil on global financial markets, Economic Affairs Secretary Shaktikanta Das said on Thursday.

12.28 pm: Sensex and Nifty were down over 1 per cent in the afternoon trade.

11.56 am: Sensex was down 253 points at 23,505. NIIT Technologies shares were up over 1 per cent after it launched intelligent automation to drive greater business benefits for its clients globally. It has partnered with UiPath, a software company specialized in Robotic Process Automation (RPA) solutions, for this initiative. RPA is the application of technology (software robot) to interpret existing applications for processing a transaction, manipulating data, triggering responses and communicating with other digital systems.

11.44 am: The market breadth on BSE was negative, out of 2,357 stocks traded, 465 stocks advanced, while 1,780 stocks declined on the BSE. Sensex was down 232 points at 23,526.

11.21 am: Alstom T&D India Ltd shares were trading 7.85 per cent down at Rs 389.75 after it reported standalone net loss of Rs 18.21 crore for the quarter ended December 31, 2015. Sensex was trading 204.83 points down at 23,554.07. NSE Nifty was trading 62.85 points at 7,152.85.

11.09 am: Sensex was down 218 points at 23,540. SAIL shares were trading 2.38 per cent down at Rs 36.95. The company has reported a net loss of Rs 1,528.73 crore for the quarter ended December 2015 as compared to net profit of Rs 579.09 crore for the same quarter in the previous year. Nifty was down 69.10 points at 7,146.

10.27 am: Shares of CMI Ltd gained as much as 2.69 per cent in the morning trade on Thursday after the company announced 138.98 per cent rise in its net profit figures for the quarter ended December 2015. CMI Ltd earned Rs 2.01 crore in the corresponding quarter a year ago. Gross sales of the company grew 80.66 per cent year-on-year to Rs 66.44 crore during the quarter under review.

“We are on target to cross the top line of Rs 225 crore for this fiscal and are bullish on the future prospects of the sector as well as our company. We are confident that with our new acquisitions going on stream, we will exceed the industry CAGR by a wide margin” says Amit Jain, MD, CMI Limited.

10.18 am: Sensex was down 202.65 points at 23,556. Nifty was trading 62.10 points down at 7,153. Oil prices slid on Thursday as record US crude inventories and worries about a global economic slowdown weighed on markets, and Goldman Sachs said prices would remain low and volatile until the second half of the year.

9.57 am: Sensex was down 191 points at 23,567. Nifty was down 56.35 points at 7,159. According to market experts, persistent selling by participants, tracking a weak trend at Asian markets where Hong Kong stocks plunged 4 per cent to three-year low today, leading another sell-off across Asian markets and extending a global rout.

9.50 am: The rupee lost 8 paise to 67.93 against the US dollar in early trade on Thursday at the Interbank Foreign Exchange market due to increased demand for the American unit from importers and banks amid a lower opening in the domestic equity market.

Click here to know the list of stocks which are in focus today

9.34 am: Just Dial shares were trading 1.46 per cent down at Rs 507.90. Just Dial will launch JD Omni, a Cloud Based Billing and Inventory Management System, a new product, on February 25, 2016 at Bandra-Kurla Complex, Mumbai in state of Maharashtra. Sensex was down 103 points at 23,556.

9.32 am: Surya Roshni shares were trading 2.08 per cent up at Rs 142.50. The company has received an approval to set-up new steel pipe unit in Hindupur Ananthapuramu district in state of Andhra Pradesh at a project cost of approximately Rs 66 crore for manufacturing of MS Black and GI Pipes at an installed capacity of 7500 MT per month. The board of directors at its meeting held on February 10, 2016 has approved for the same.

9.23 am: Share price of ACC slid were down 1.50 per cent in the early trade on Thursday after the company on Wednesday post market hours reported 68.61 per cent fall in consolidated net profit figures at Rs 102.39 crore for the quarter ended December 2015 against Rs 326.22 crore in the corresponding quarter a year ago.

However, gross sales of the company jumped 3.03 per cent year-on-year (yoy) to Rs 2,846.11 crore during the quarter under review.

9.19 am: Sensex was down 143.41 points down 23,615. Nifty was down 33.80 points 7,181. In the 50-share index, Ambuja Cement, Cairn India, ICICI Bank, BHEL and Punjab National Bank were down between 1.60 per cent and 3.05 per cent.

9.15 am: Domestic equity markets opened on a flat note on Thursday. Sensex opened 0.44 points down at 23,758.46, while Nifty opened 12.10 points down at 7,203.60.

8.47 am: The BSE Sensex and NSE Nifty are likely to open in red for the fourth straight session on Thursday tracking Nifty futures on the Singapore Stock Exchange (SGX Nifty) and weak global markets.

At 8.30 am (IST), SGX Nifty was down 0.69 per cent, or 49.50 points, at 7,200.

Asian shares sputtered on Thursday as US Federal Reserve Chair Janet Yellen’s tone of guarded optimism led to an indecisive finish for Wall Street and further weakness for the dollar. Hang Seng was trading 3.66 per cent, or 705.62 points, down at 18,585 in the morning trade.

The uncertainty made for a muddled finish on Wall Street. The Dow closed down 0.62 per cent, while the S&P 500 lost just 0.02 per cent and the Nasdaq added 0.35 per cent.

Back home, the benchmark BSE Sensex on Wednesday plunged by 262 points to close at a 21-month low of 23,758.90 as banks and realty sectors witnessed heavy selling pressure amid weak global cues.

The 50-share NSE Nifty tumbled 82.50 points or 1.13 per cent to close at 7,215.70 after touching a low of 7,177.75.

State Bank of India, Tata Motors and ONGC will announce their Q3 results today later in the day.

(With agency inputs)