Dr Doom: Gloomy Market Outlook; Hope Lies in Emerging Markets

Marc Faber (also known as Dr Doom) has a new advice for investors: Drink up! The reason: He perceived that the market’s medium term outlook is so bad that the only way out for investors is to drown their anxieties in a pool of beer.

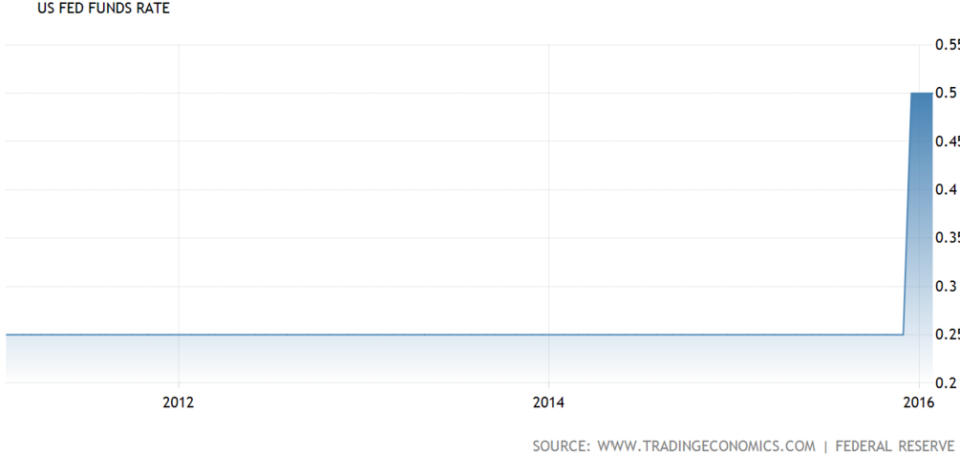

Effects of the Fed— Credit Bubbles and Highly Priced Equities

Source: US Fed Funds Rate, Trading Economics

Dr Doom highlighted that the main issue in the market now is the unintended consequences caused by the Federal Reserve (Fed). Quantitative easing (QE) and prolonged low interest rates by the Fed and global central banks has pushed up prices of equities and created credit bubbles.

Such a phenomenon is also evident in China, where years of easy credit has created a bubble.

Dr Doom warned investors that there will not be anyone who will make it out of this crisis unscathed except for the central bankers who “may lose their jobs for poor performance but can always take high-paying jobs at big Wall Street banks”.

Emerging Markets—Look at Cambodia, Vietnam and India for Asia

Source: 5 Year Graph of Vietnam’s Annual GDP Growth Rate, Trading Economics

As funds flee the emerging market in the past year, Dr Doom expressed that he is still confident about the emerging markets in the long term. He expects emerging markets to outperform US markets in the next bull run. Brazil and Russia are his top picks for the potential to rebound and he also sees growth in emerging Asia countries such as Cambodia and Vietnam.

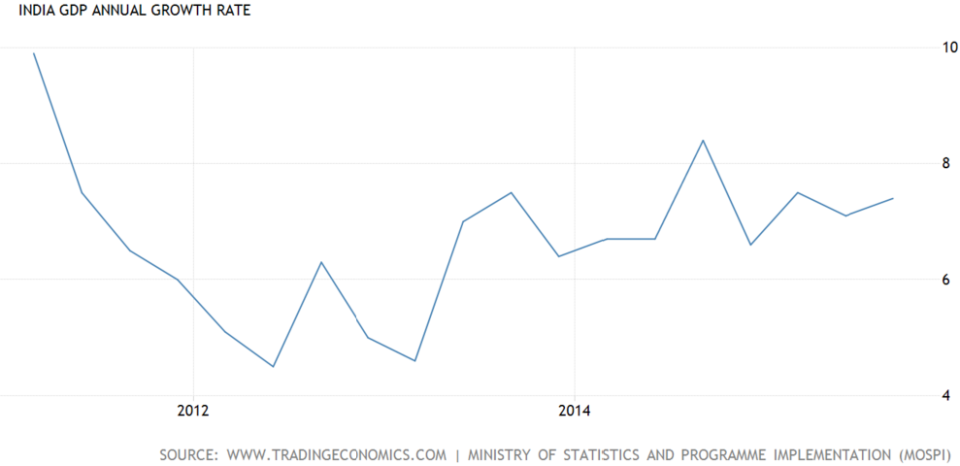

Source: 5 Year Graph of India’s Annual GDP Growth Rate, Trading Economics

Marten Hoekstra, CEO of Emerging Global Advisors, is optimistic about the Indian economy due to their low reliance on oil or natural resources. As India is the world’s second most populous country, he is bullish on India’s consumer discretionary, consumer staple, healthcare, telecom and utilities companies.

Yahoo Finance

Yahoo Finance