Whither Wheat?

This is supposed to be prime time for wheat farmers. Instead, it's looking pretty dire.

Early harvests are bad ...

... Spring plantings are miserable ...

... But prices won't rally much

I've been doing a lot of bread baking around the house lately, and it has led to some interesting discussions with the kids about where flour comes from and what the difference is between the different ones we use. The market has been concerned with where that flour comes from lately too - mainly news centered on what wheat production is going to look like this year.

Let's start with what's in the ground already.

Winter Wheat

The crop calendar for winter wheat goes something like this: planting occurs from mid-September to the beginning of November. The crop lays dormant during the winter months and emerges mid-April to the beginning of June. Harvest begins in some areas as early as June 1 and continues through the beginning of August. There are two types of winter wheat - Hard Red Winter Wheat (HRW) and Soft Red Winter Wheat (SRW), both heavily traded commodities.

Hard red winter wheat (which is used primarily in bread like mine) is forecast by the USDA to drop 16% to 871 million bushels this year because of fewer planted and harvested acres, as well as reduced yields, with the average harvested bushels per acre falling from 46.8 to 44 this year.

The USDA expects soft red winter wheat (more often used in things like cookies and pastries) to drop by 31% (433 million bushels compared with 614 million last year) because of reduced acreage planted (8.4 million acres down from 11.2 million last year). Farmers planted less because of sharply lower wheat prices compared with last year.

The problem is, the soft red winter wheat may be under attack by a fungal disease called Fusarium head blight, also known as "head scab" - lovely name, isn't it? Fusarium pops up in wet conditions and lowers crop yields by affecting the plant during flowering. In some areas, it is too early to tell if the disease is going to be a problem, and farmers are busy spraying fungicides in an effort to reduce the affected areas.

Spring Wheat

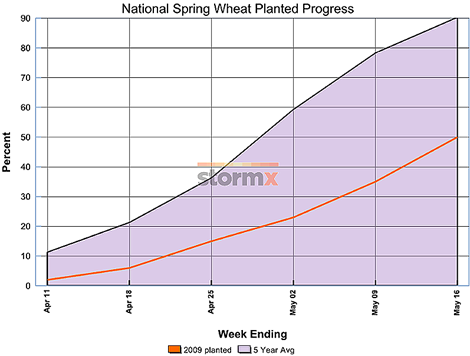

Then there is the wheat that farmers are supposed to have just planted. Spring wheat is planted early April through late May, spends June and July growing and can be harvested anywhere from early August to mid-September. As of May 16, only 50% of the spring wheat crop had been planted nationally - the five-year average for this time of year is 90%.

Some states are doing better than others. Idaho is almost on par with the five-year average, but Montana is at 69% instead of 91%, Minnesota has only 34% of its acres planted instead of 92% and North Dakota, the key spring wheat state, is way behind with a measly 31% of its acres planted as opposed to its five-year average of 89%.

Now it's always unwise to count your chickens before they are hatched, or in this case, your bushels before they are harvested, but the industry does have some good statistics on growth and harvest trends and there comes a point where there is just not enough time left in a season to grow the crop. The later the wheat gets planted, the worse the yield. The USDA has forecast that the 2009 spring wheat crop will be 524 million bushels, which is 17% lower than 2008's crop due to the lower acreage planted and the planting delays.

Of course, in ags, bad news is good news, right? Well sort of:

Wheat (W, CBOT)

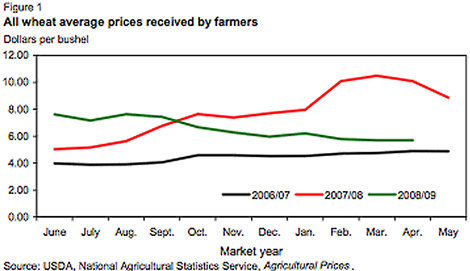

But even with the flirtation with $6/bushel, farmers are receiving much less for their crops than they did last year, when prices were often over $10. Still, they're managing to stay ahead of the 2006/07 market year.

It's important to understand the mechanics behind the headlines however, because even with all this miserable news, it would be unwise to expect a big pop in prices. Even with delayed plantings, lower yields and lower production overall, global wheat supply is still forecast to be the second highest in history, which will keep average wheat prices in the $4.70-to-$5.70 range, according to the USDA.

As a short-term trader, keep in mind that wheat prices - and all agricultural prices for that matter - are highly reactive to weather-related news. But over full market cycles, only the true supply/demand situation matters, and in this case, my bread-making days are far from over.

For an overview of what is going on in a variety of agricultural commodities, take a look at the latest news by StormX in the right-hand column of HAI's agricultural page.

Also at HardAssetsInvestor.com:

Ag Roundup May 4, 2009

Gaming Grains March 30, 2009

Recommended Stories