Investing in Dutch startups presents lucrative opportunities for investors seeking to diversify their portfolios and tap into Europe’s thriving startup ecosystem. This article explores key approaches to investing in Dutch startups, strategies for spreading risk in the Netherlands startup market, and adaptive strategies for thriving in the dynamic Dutch startup landscape.

Key Approaches to Investing in Dutch Startups

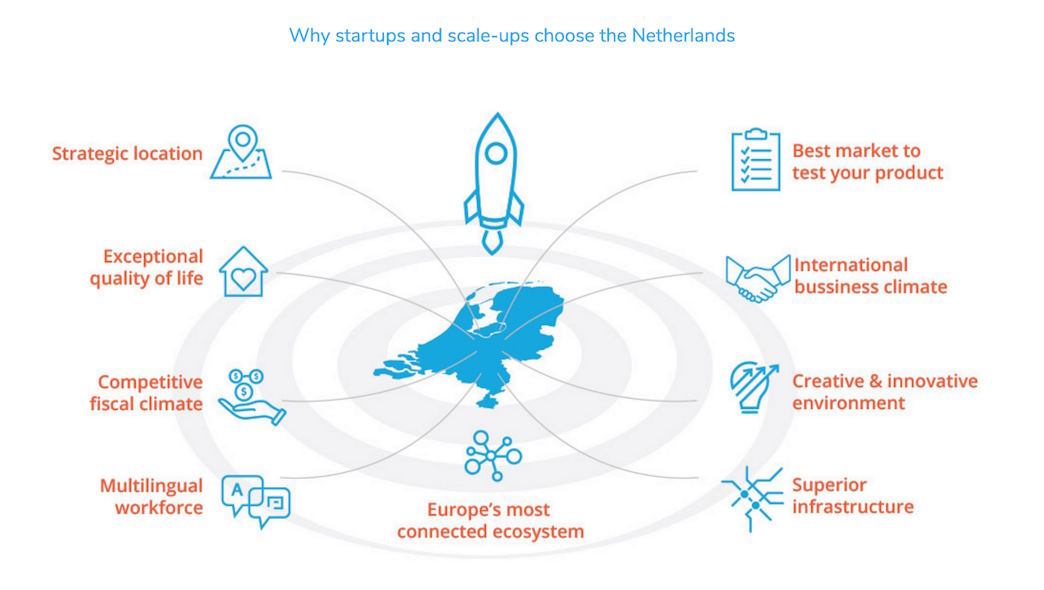

Understanding the Dutch Startup Ecosystem: Before diving into investments, it’s essential to gain a comprehensive understanding of the Dutch startup ecosystem. Familiarize yourself with key industry sectors, emerging trends, and prominent players in the market.

Diversification Across Sectors: Spread your investments across diverse sectors to minimize risk and maximize potential returns. The Netherlands boasts a vibrant startup scene across various industries, including technology, life sciences, agri-food, and sustainability.

Spreading Risk in the Netherlands Startup Market

Investing in Early-Stage Ventures: While early-stage startups carry higher risks, they also offer the potential for substantial returns. By investing in a portfolio of early-stage ventures, you can spread risk and increase your chances of backing a successful startup.

Co-Investment Opportunities: Consider co-investment opportunities to spread risk and leverage the expertise of other investors. Collaborating with angel investors, venture capital firms, and corporate investors can provide access to valuable resources and networks.

Adaptive Strategies for Thriving in the Netherlands Startup Landscape

Staying Agile and Informed: The Dutch startup landscape is dynamic and constantly evolving. Stay agile and adapt your investment strategies based on market trends, regulatory changes, and emerging opportunities.

Building Strong Partnerships: Forge strategic partnerships with incubators, accelerators, and startup networks to gain access to deal flow and high-potential startups. Collaborating with local stakeholders can provide valuable insights and opportunities for co-investment.

Successful startup investments in the Netherlands require a strategic approach, risk management, and adaptability. By understanding the Dutch startup ecosystem, diversifying across sectors, and leveraging co-investment opportunities, investors can spread risk and increase their chances of success. Additionally, staying agile and informed and building strong partnerships are essential for thriving in the dynamic Dutch startup landscape. As investors navigate the opportunities and challenges of the Netherlands startup market, strategic investment decisions will be key to unlocking growth and maximizing returns.