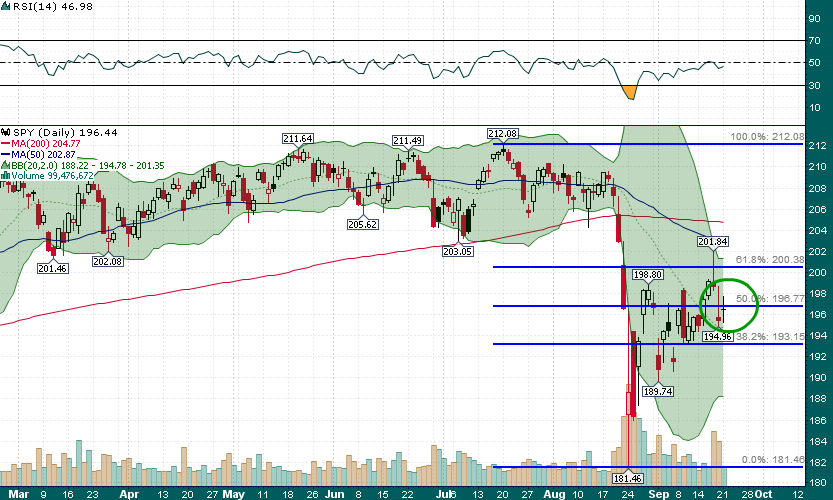

Something unusual happened yesterday in the S&P 500 exchange-traded fund SPDR S&P 500 (NYSE:SPY); a perfect doji candlestick:

SPY opened at 196.44 and closed at 196.44 while traversing a nearly 2 1/2 point range during the session. There are a few notable observations:

- The 50% retracement level of the entire July-August decline has become an important price magnet

- After Thursday’s Fed announcement volatility/volume expansion we are seeing volume and volatility normalize

- A doji candlestick technically denotes ‘indecision’ among market participants – given the market action of the last couple of months I would say that yesterday’s doji signifies an unusually high degree of indecision

After a large decline such as the one we experienced during August, it is normal to see a rebound (50%-65% of the decline) followed by a smaller range consolidation. Price action is evolving according to the script thus far; Next we should expect a resolution to the range within a couple of weeks. Resolution would likely mean a decisive move above the 61.8% Fibonacci level at 200.38 or a decline below the 38.2% Fib level at 193.15.