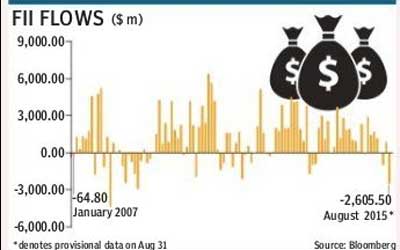

Foreign portfolio investors (FPIs) pulled out $2.6 billion from the Indian markets in August — the worst monthly outflows since October 2008. Foreign funds took risk off the table spooked by the wild gyrations in Chinese stocks last week as also profit-taking in many other markets across the globe. In the last five sessions alone, FPIs offloaded some $2 billion worth of stock and foreigners were net sellers for 20 out of 25 sessions in August, Bloomberg data showed.

In contrast, domestic institutions picked up equities in the cash segment worth approximately $2.3 billion (Rs 15,769.83 crore), the biggest quantum bought since Sebi started maintaining the data in 2007. Surprisingly, despite the volatility in the markets, mutual funds received inflows of Rs 1,535 crore in August, Sebi data showed.

UR Bhat, director, Dalton Capital Advisors, said, he foresees FPIs paring their exposure to riskier assets, including equities, primarily due to problems arising out of China.

“FPI selling is expected to continue albeit more mildly until the next sell-off happen in the Chinese markets,” Bhat, who advises many FPIs on their strategies on Indian equities, told FE.

The selling by FPIs saw the index of blue-chip stocks fall more than 6% in August, wiping out Rs 3.01 lakh crore in market capitalisation of the top 30 companies. The rupee breached the 66-mark against the dollar to fall to its two-year low.

The outflow scenario was prevalent through out the Asia and Emerging Markets. South Korea witnessed outflows worth $3.6 billion, while Taiwan and Thailand saw FPI pulling out $1.6 billion and $1.25 billion, respectively.

Bhat highlighted a major difference in the FPI selling trend compared to 2008. He said, “About seven to eight years ago, when FPIs sold equities there was hardly anyone with enough muscle to absorb the selling pressure, that too without a significant price damage. However, markets have received some cushion recently from DII buying and they been able to absorb most of the impact of FPI selling.”

Overseas funds had sold $4.36 billion at the peak of the previous bull run in January 2008, followed by $2.92 billion in October 2008 in the aftermath of Lehman Brothers’ bankruptcy that triggered the global financial crisis.

FPIs encompass all foreign institutional investors, their sub-accounts and qualified foreign investors under a new regime that came into force on June 1, 2014. Sebi data show that there are more than 8,200 FPIs registered in the Indian capital market.