Volatility Spike may Give way to Opportunity in Biotech ETFs

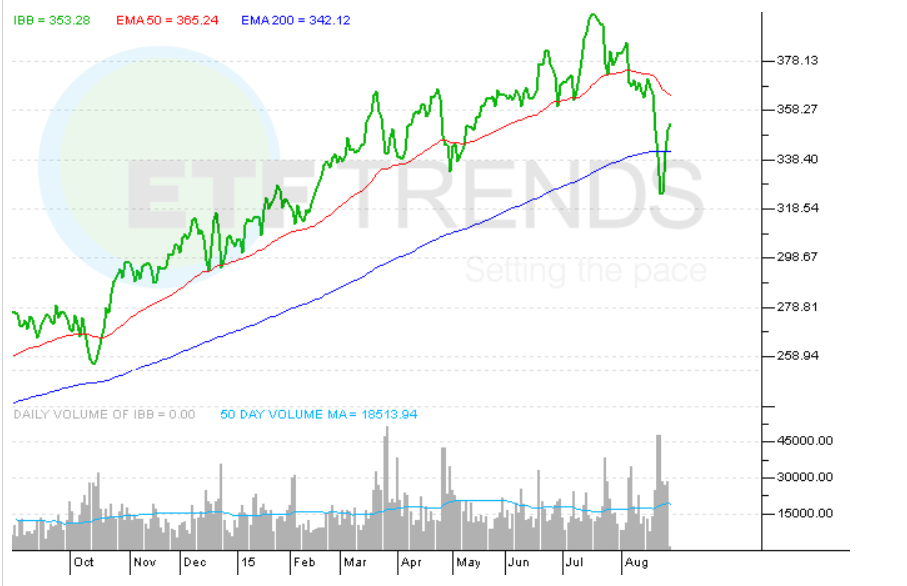

The iShares Nasdaq Biotechnology ETF (IBB) , the largest biotech ETF by assets, and other biotech ETFs proved vulnerable to the broader market’s recent surge in volatility, but the declines endured by IBB and friends could prove to be a buying opportunity for astute investors.

Given the lofty year-to-year returns, some are growing cautious over the biotech sector. Some argue that the high valuations in the biotech sector have been supported by a low interest rate environment. However, with the Federal Reserve eying an interest rate hike, biotechs may be more vulnerable ahead.

Biotech fundamentals, broadly speaking are sound, but plenty of critics point to the industry’s richer-than-average multiples, which could make the likes of IBB vulnerable to more downside. Gven the lofty year-to-year returns, some are growing cautious over the biotech sector. Some argue that the high valuations in the biotech sector have been supported by a low interest rate environment. [Don’t Mess With the Leveraged Biotech Bull]

“Using IBB as a proxy, based on annual and cumulative performance throughout both bear and bull markets, IBB may provide the opportunity investors have been waiting for in the face of the current market downturn. IBB is touched down to register a 20% decline from its 52-week high, shares have plunged from $400 to $320 at one point per share during the recent market weakness, presenting a potential buying opportunity,” according to a Seeking Alpha post.

While some of this year’s best biotech ETFs are smaller, new breed, niche funds, the old guard of biotech ETFs are well represented among this year’s best funds. That includes IBB, which tracks the Nasdaq Biotech Index, and the SPDR S&P Biotech ETF (XBI) , the third-largest biotech ETF by assets. [Biotech ETFs for the Long Term]

“In terms of prescription drug expenditures, spending is projected to have grown 12.6 percent in 2014 to $305.1 billion. Driving growth were new specialty drugs and increased prescription drug use among people who were newly insured. Prescription drug spending growth is projected to average 6.3% annual growth from 2015 through 2024. Taken together, as the biotechnology sector continues its innovation and continuous supply of medications to treat and cure many different diseases coupled with the growth in overall medical spending may present an investment opportunity especially given the recent market volatility,” notes the aforementioned Seeking Alpha Post.

On the other hand, investors who are wary of a potential biotech pullback can utilize a few inverse or bearish ETF options to hedge their positions. For instance, the recently launched Direxion Daily S&P Biotech Bear Shares (LABD) takes the -3x or -300% daily performance of the biotech sector and the ProShares UltraPro Short NASDAQ Biotechnology (ZBIO) tracks the -3x or -300% daily performance of the Nasdaq Biotechnology Index.

iShares Nasdaq Biotechnology ETF

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.