Auto manufacturers are betting heavily on a pick up in retail sales during the festive season, which kicked off with Onam and Raksha Bandhan during the weekend, and would be followed by Ganesh Puja next month and Durga Puja and Diwali later. Since the past two years, sales during the festive season have not been up to expectations, but the industry has reason to be optimistic this year on the back of several new launches and improved consumer sentiment.

Ideally, a good festive season means that sales are 20-30% higher during these months compared to the rest of the year.

The signs so far look good. Sales during this fiscal have been improving with each passing month — car sales during April-July were up 7.46% on a yearly basis. During July, car sales in the domestic market saw a growth of 11.43%, with Maruti Suzuki and Hyundai Motor registering 22.5% and 24.7% year-on year growth, respectively.

However, Maruti Suzuki chairman RC Bhargava is quick to dispel any such perception. “The situation on the whole has not improved at all significantly, because the numbers that you see and which you report are all wholesale sales numbers. These wholesale sales numbers do not reflect accurately what is happening at the level of the retail customer. If you look at retail sales, Maruti’s sales themselves have been in single digits. If you exclude Maruti from the rest of the industry, the growth is virtually absent in retail terms. It is difficult to say that there has been any real pick up of consumer demand. It is possible that now with the festival season starting, we might see a retail pick-up, because all these wholesale sales have resulted in inventory build-up in anticipation of good sales during the festival season,” he told a business news channel recently.

On the sales outlook during the festival season, Bhargava said, “I am hoping that during this festival season, which is now starting, we will see a pick-up in retail sales. The overall projection, which we had made in the beginning of the year that we at Maruti will get into double-digit sales and industry as a whole will be around 6-7%. I think that number still is reasonably accurate; I think it will happen.”

Rakesh Srivastava, senior vice-president, Hyundai Motors India, is more optimistic. “At Hyundai we expect a 20% increase in volumes during the festive period this year as the customer sentiment has improved with low inflation, softening commodity prices and successful new launches,” he told FE.

The sentiment was echoed by Jnaneswar Sen, senior vice-president, sales and marketing, Honda Cars. “We expect good upswing in demand during the festive period as fuel prices have come down and rates are also slightly lower,” he said.

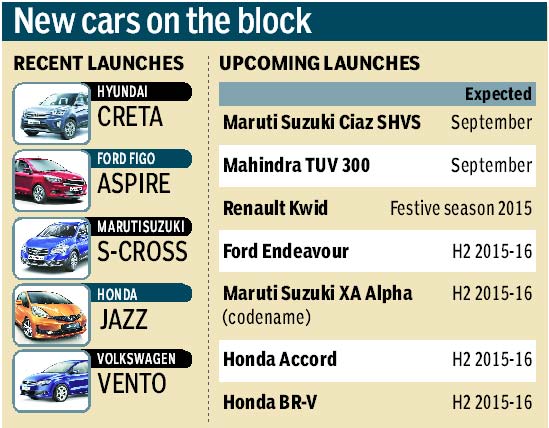

Among the recent new launches are Maruti’s S-Cross, Hyundai’s Creta and Honda’s Jazz. There are more launches planned by manufacturers over the next few months. For instance, utility vehicle manufacturer Mahindra and Mahindra (M&M) is set to launch its first sub-four metre compact sports utility vehicles named TUV 300 on September 10.

In July, Hyundai sold 6,783 volumes of Creta, while the number for Honda’s Jazz stood at 6,676 units in the first month after it was launched. The car markers are confident of maintaining the momentum in the festive seasons.

Dealers are also hopeful of a good festival season sales this time around. Most of them told FE enquiries for the upcoming launches as well as bookings for the Dussehra-Diwali period have started trickling in, but actual sales are likely to pick up after September.

On bestselling models like Maruti Suzuki’s Dzire and EEco, Hyundai’s Creta and Honda Jazz and City, there’s a waiting period ranging from a month to six months, depending on models and variants. Also, the top selling models have no discounts currently, which might change around the time of Diwali.

There’s another aspect. During December dealers push in more discounts as consumers want to defer purchases to next year because the year of manufacture gets changed by a year.

Regarding inventories, dealers said currently the stock is at nominal levels of close to one month. However, from next month onwards it would start increasing.