The six Cs of the China stock slump

- Published

The repercussions from "Black Monday" - the global markets turmoil caused by a plunge in Chinese stocks - continue to be felt on Tuesday.

To the uninitiated, the situation may seem bafflingly complex, here's a breakdown of the issues:

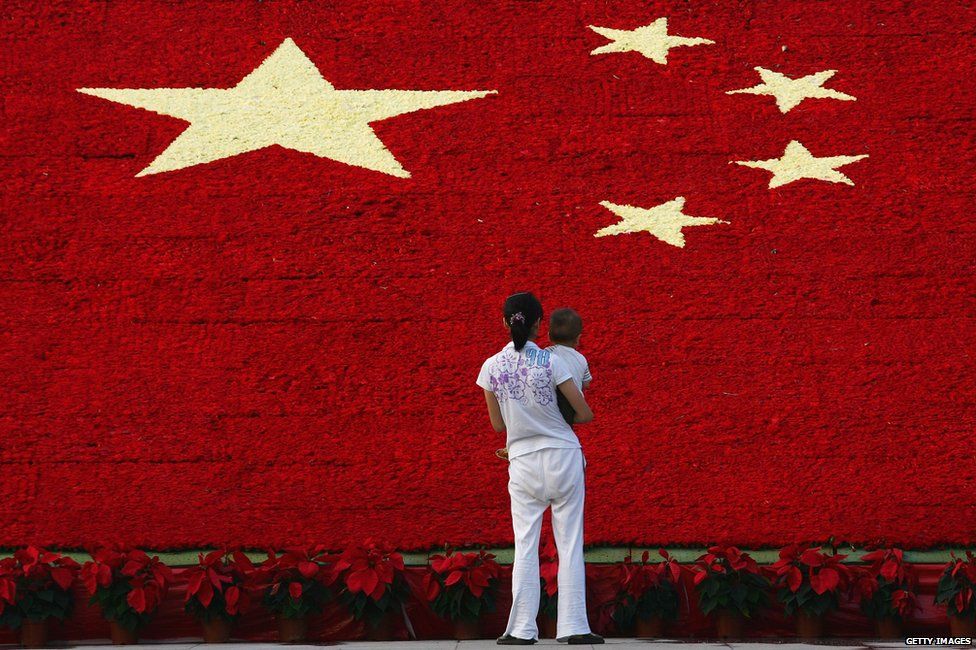

China

The story of China has been one of extraordinary growth in the last decade, but there have been recent concerns that there will be a significant economic slowdown.

One worry is that this would trigger panicked reactions from domestic investors and lead to a stock market crash.

With China establishing its Shanghai stock exchange only in 1990, its market is considered immature compared to the rest of the world.

The shares are almost entirely owned by domestic traders, many of whom are 'mom and pop' investors with little experience in investing.

The lack of large, experienced and professional organisations as investors means that the market can be much more volatile.

Central bank

Over the last few months, China's central bank has been repeatedly propping up the stock market to ensure stability.

They have been doing it through several big measures, such as cutting central bank interest rates - which allows more money to flow easily - and buying up shares to stop them from falling.

After losses last week, there was an expectation on Friday that there would be yet another such drastic move.

But that did not happen - causing panic to ripple out and a dramatic drop in shares on Monday. The stock market saw its worst single-day plunge since 2007.

Currency

One of the possible triggers for the drop in past trading sessions was the earlier decision by the central bank to devalue the yuan and allow it to trade more flexibly.

Unlike most currencies, the Chinese currency is not allowed to trade freely according to the number of buyers and sellers in international markets.

Rather, the central bank sets a daily rate to the US dollar and for the rest of the day, the yuan is allowed to trade 2% up or down from that rate.

Earlier in August, the bank cut that rate by almost 2%, sending a first wave of insecurity through markets. The move was seen as an attempt to help exports by making Chinese goods cheaper abroad.

The central bank also said it would set the daily rate based on how the yuan traded the previous day, which means that it could fall a lot further in future.

Contagion

China's stock market slump caused investor uncertainty to spread across the region and then around the globe, destabilising stock markets in New York and Europe.

This knock-on effect has highlighted how much of a linchpin China's stock market is in the global marketplace.

Hong Kong-based investment analyst Peter Churchouse says China's market was "irrelevant" 35 years ago and as recent as a decade ago, it merely followed trends in the global economy.

But now the tables have turned, he says. "The global economy and global markets have a 'Made in China' label on them."

Correction or Crash?

Monday's global turmoil sparked fears of another international financial meltdown, but analysts say it was merely over-inflated markets correcting themselves. They are however warning of further slumps in the long run.

Nicholas Teo of financial analysis firm CMC Markets says financial markets were "intoxicated" by easy and cheap funding in recent years, boosting stocks' value and consumer spending.

The turmoil caused by China's stock slump "suggested that the great unwind of the excesses is beckoning".

As for China itself, analysts say that as the market matures over the years and investors become more experienced, it will become less volatile.

This could also happen if China's government removes some of the restrictions that hinder foreign ownership of shares, thus paving the way for bigger more professional firms to come in and inject stability. Currently foreigners only own 2% of stocks.

Consequence

Observers have described this incident as a "rude awakening" for global investors who have paid scant attention to China.

Extreme movements in China's market will probably become a more common sight, given its peculiarity of being dominated by small-time inexperienced investors.

Meanwhile China's economy is still expected to slow which in turn would affect the global economy, particularly Western growth, says the BBC's Duncan Weldon.

The BBC's Robert Peston says that in the short term, the world will have an increase in spending power, but over the long term, this would make some countries like the UK considerably poorer.

But many anticipate that the Chinese government will continue to prop up the economy one way or the other, and even more so in light of this recent financial volatility.

"It's difficult to see officials allowing the economy to slide further without some countervailing action," says Frederic Neumann, who co-heads Asian economics research at HSBC.