Huge sell-off across the globe led by Chinese equities meltdown and geo-political tension between South Korea and North Korea raised the concerns of investors, denting domestic equity markets that witnessed panic selling pressure on Monday. Continued weakening of rupee also weighed on the sentiment. As a result, the key bechmark indices slid around 6 per cent in Monday’s trading session.

The BSE Sensex nosedived 1,624.51 points, or 5.94 per cent at 25,741.56. The index opened at 26730.40 and touched a low of 25,624.72.

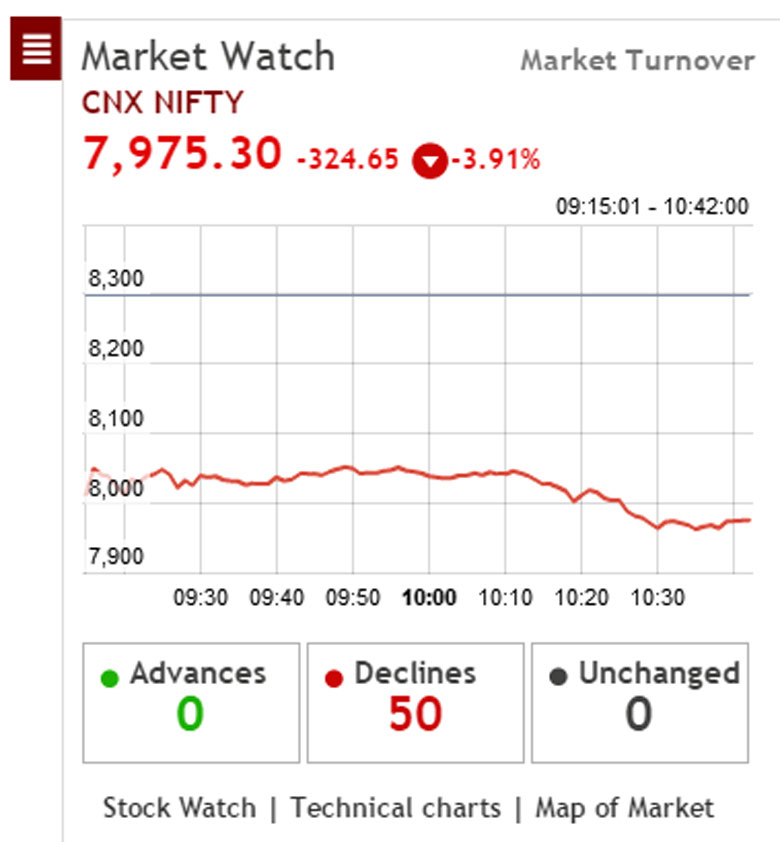

On the similar lines, the NSE Nifty index tanked 490.95 points, or 5.92 per cent at 7,809. The index opened at 8,055.95 and touched a high and low of 8,060.05 and 7,769.40, respectively. It took 65 days from June 15- August 22 this year for the markets to go up from 7,950 to 8,650 but it took the bears six days to wipe off these entire gains. Nearly Rs 7 lakh crore got wiped out from the investors’ wealth as rout in Chinese stocks triggered a global sell-off.

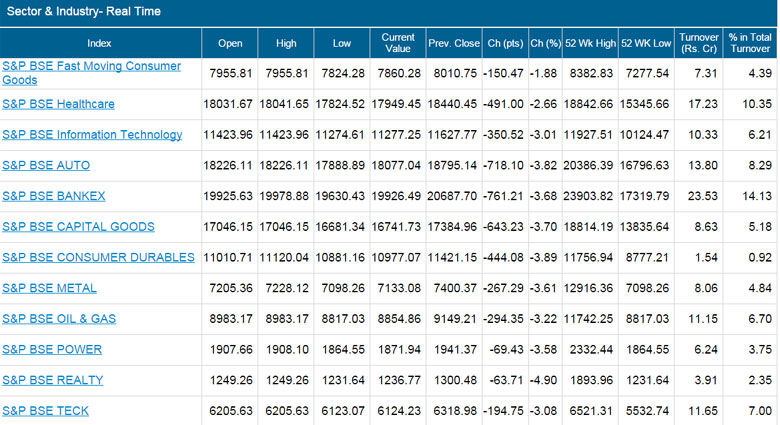

Among the sectoral indices on the Bombay Stock Exchange (BSE), the BSE Realty index tumbled the most — 10.93 per cent at 1158.36, it was followed by the BSE Oil & Gas index (down 9.2 per cent), BSE Power index (down 8.12 per cent) and BSE Consumer Durables index (down 7.23 per cent).

Watch video: Sensex crashes most in seven years, but will the slide continue?’

Harsha Upadhyaya, chief investment officer (Equity), Kotak Mahindra Asset Management, said, “Panic has spread to Indian equities too on the back of global rout driven by Chinese actions. During this wave of selling, we may see a lot of investment opportunities from a medium-to-long-term perspective in Indian equities, which is what we are currently focusing on. We currently hold some cash in our portfolios, and will be looking to invest that into equities as the market becomes more attractive with every decline.”

Among day’s major market events that affected the sentiments across the world, Chinese markets tumbled more than 9 per cent in the day after government fresh moves to help the market sentiment failed. Over the weekend, the Chinese government formalised the rules to allow pension funds to invest in stock markets.

Achin Goel, head, wealth management and financial planning, Bonanza Portfolio said, “Chinese pension fund which amounts to around $547 billion, is the world’s largest, which if directed to Chinese markets, even in fractions, could help big way in uplifting market sentiments in the medium term. Conversely, the move sent the wrong signals as markets assumed lack of liquidity in the system and triggered a fresh sell-off. Looking at Chinese economy which is loosing steam, global crude prices hit a fresh 6 ½ year low in Monday’s trade.”

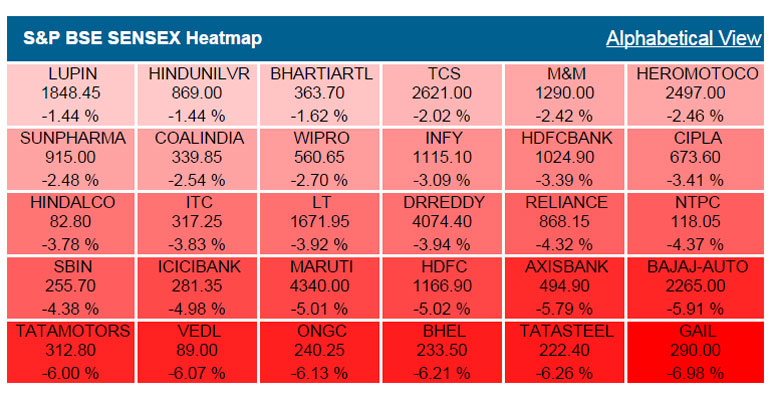

In the 30-share Sensex pack, share price of Vedanta, Tata Steel and GAIl dipped 15.30 per cent, 13.11 per cent and 12.78 per cent to Rs 80.25, Rs 206.15 and Rs 271.90, respectively. Other stocks in the Sensex pack also ended in negative.

Market breadth for the day remained negative as advances to declines ratio for Nifty stood at 0:49 for the day with NMDC being the only stock in Nifty to resist the market fall. Volumes for the day clocked 3,219 lakh, almost double the volumes logged on the previous trading session.

Sudip Bandyopadhyay, president, Destimoney Securities, said, “We may see some recovery in Tuesday’s trading session. For investment perspective, investors avoid banking and real estate stocks in the present market scenario.”

Hitesh Agrawal, head research, Reliance Securities, said, “The Nifty is likely to remain extremely volatile in the current week, more so on account of the August series F&O expiry.”

Among Asian peers, Shanghai, Nikkei and Hang Seng dipped 8.49 per cent, 4.61 per cent and 5.71 per cent at 3,209.91, 18,540.68 and 21,251.57, respectively.

——————————————————————————————————————

Markets through the day

3.30 pm: Sensex crashes over 1,700 points or 6.22 per cent in pre-close trade; investor wealth down over Rs 7 lakh crore.

3.23 pm: The 30-share Sensex crashed over 1,700 points at 25,665.

3.20 pm: Sensex was down 1636 points at 25,730.

3.14 pm: The overall investors’ wealth, measured in terms of total valuation of all listed stocks, also plunged over Rs 4 lakh crore as it crashed below Rs 100-lakh crore mark and stood at Rs 95,49,578 crore in afternoon trade.

3.09 pm: The key benchmark indices declined further. Sensex and Nifty were down 1,545 points and 467 points at 25,821 and 7,831, respectively.

3.03 pm: Amtek Auto, Wockhardt and Vakrangee slid over 20 per cent on bourses. Sensex was down 1,455 points at 25,910.

3.01 pm: The market witnessed all-round heavy selling across realty, power, oil&gas, bankex, auto, metal, capital goods and IT sectors.

2.30 pm: Nifty and Sensex were down 5 per cent at 25,966 and 7,843, respectively.

Indian financial markets are in turmoil as a result of external factors and they should soon settle down. Domestic inflation and fiscal deficit are under control, Finance Minister Arun Jaitley said on Monday.

He spoke after a huge selloff in Chinese stocks following a recent devaluation of its yuan currency sent the Indian rupee to its lowest level since Sept. 2013.

2.19 pm: Sensex was down 1437 points at 25,929. Vedanta and Tata Steel were trading 14 per cent and 10.22 per cent lower at Rs 81 and Rs 213, respectively.

2.15 pm: Sensex was down 1367 points at 25,999. The BSE Realty index was down over 10 per cent.

2.00 pm: As many as 51 scrips witnessed their 52 week highs on BSE despite heavy selling and weak investor sentiment in the market. Sensex was down 1,236 points at 26,130.

1.49 pm: Around 145 companies hit their fresh 52-week low NSE on Monday. Some of the names are Bank of India, Andhra Cements, Atlas Cycles (Haryana), GAIL India, ICICI Bank, IVRCL, PTC India, Nalco, State Bank of Bikaner and Jaipur, Reliance Power and Steel Authority of India.

1.33 pm: Sensex down 1,087 points at 26,278.96, while Nifty was down 341.75 points at 7,958.20 during the same time. Nestle India shares up 0.85 per cent.

1.11 pm: Sensex was down over 1,200 points at 26,158. G Chokkalingam, founder and managing director, Equinomics Research & Advisory, said, “Today’s fall can be attributed to nervousness in US and China markets. I believe, Indian markets will recover faster and will do better than other markets.”

1.05 pm: Sensex was down 1104 points at 26,261. Nifty was down 350 points at 7,949.

12.46 pm: As stock markets witnessed bloodbath on Monday, the Sensex recorded an intra-day fall of 1,153.16 points till noon — making it the biggest crash in about seven years and the fourth biggest ever for the BSE benchmark index. Interestingly, eight out of the top-ten intra-day falls took place in the year 2008. Today’s fall is biggest since October 24, 2008.

12.27 pm: There were more than seven losers against every gainer on BSE.

The sharp setback on the domestic bourses was triggered by a rout in global equities. Chinese stocks led a sell-off in Asian markets on concerns about slowdown in China’s economic growth. The sharp setback in Chinese stocks materialised after US stocks tumbled during the previous trading session on Friday as fears about China’s economy and global growth spurred heavy selling.

Shanghai Composite index was down 8.26 per cent at 3,218.

12.14 pm: Among the sectoral indices on the Bombay Stock Exchange, BSE Realty index, BSE Power and BSE Oil & Gas were down over 5 per cent. The BSE Sensex and NSE NSE Nifty were down 4 per cent at 26,291 and 7,964.

11.37 am: Jimeet Modi, chief executive officer, SAMCO Securities said, “The fall in the Indian markets is largely attributed to a short term outflow of funds. Globally emerging markets have seen an outflow of close to a trillion dollars which is twice that of the 2008 outflows and this has led to pressure on the markets. From an investment perspective, the market correction presents a great opportunity. A short term 4-5 per cent down move should not make a difference for a long term investor looking to create wealth from a 50 per cent up move in the markets. Investors should not panic and look for opportunities which have become reasonably priced after this correction. It is a buy in dips market from an investors perspective.”

The BSE Sensex was down 975 points at 26,391.

10.57 am: Sensex was down over 1,100 points 26,255.87

10.42 am: Brokers said sentiments suffered a jolt following a sell-off in other Asian markets with over 8 per cent plunge in Shanghai index. Sensex was down 3.73 per cent at 26,344.12.

10.35 am: In its biggest intra-day crash this year, stock market benchmark Sensex plunged by 1,086 points while Nifty fell below 8,000 level in early trade today due to heavy selling by funds amid global sell-off as worries about China’s economy deepen. The BSE Sensex was at 26,296. NSE Nifty was down 321 points at 7,979. All the 50 stocks in the NSE Nifty were trading in red.

GAIL, BHEL, Bank of Baroda, Tata Motors and ONGC were trading 6 per cent lower in the morning trade.

10.13 am: Rupee crashes to 66.49/dollar: RBI Governor Raghuram Rajan assures investors, says will intervene when needed

10.09 am: Share price of upstream companies dropped after further slide in global crude oil price. Among oil exploration and production companies, ONGC (down 5.12 per cent), Oil India (down 2.97 per cent), Cairn India (down 5.35 per cent), and Reliance Industries (down 3.82 per cent) declined.

Brent crude oil futures for October delivery hit fresh 6-1/2-year lows today as investors fretted that a slowing Chinese economy will lead to weaker demand amid a global supply surplus.

Lower crude oil prices would result in lower realisations from crude sales for oil exploration firms.

The BSE Oil and Gas index was down 3.84 per cent at 8,797.48.

9.59 am: In the 30-share Sensex pack, GAIL, Tata Motors, ONGC and BHEL were down over 5 per cent. NSE Nifty falls 252 points at 8,047.70.

9.52 am: The BSE Sensex was down 3 per cent at 26,530.

Source: BSE

9.46 am: The BSE Sensex was down 842 points at 26,524. NSE Nifty were down 265.90 points at 8034.05.

9.38 am: The BSE Midcap index was down 411.79 points or 3.70 per cent at 10,802. The BSE Smallcap index was down 465 points or 4 per cent at 11,144.

9.20 am: The S&P BSE Sensex was down 887.50 points or 3.24 per cent at 26,478.57. The index fell 635.67 points at the day’s high of 26,730.40 at the onset of trading session. The index fell 1,006.54 points at the day’s low of 26,359.53 at the onset of trading session, its lowest level since June 15, 2015.

The BSE Sensex and NSE Nift slumped in early trade as Asian shares collapsed.

At 9.21 am: The BSE Sensex and NSE Nifty were down 810.94 points and 270.20 points at 26,511 and 8,029.75, respectively, in the opening trade.

All the sectoral indices on the Bombay Stock Exchange (BSE) were trading in red. BSE Realty index was down over 5 per cent, it was followed by the BSE Auto index (3.82 per cent) and the BSE Power index (down 3.58 per cent).

The Indian rupee slumped to as low as 66.48 per dollar, its lowest since September 2013, as Asian markets reeled under fears of a China-led global economic slowdown.

Asian peers, Hang Seng, Nikkei and Shanghai were down 4.08 per cent, 3.21 per cent and 8.01 per cent at 21,495, 18,812 and 3,226.82, respectively.

Asian stocks dived to 3-year lows on Monday as a rout in Chinese equities gathered pace, hastening an exodus from riskier assets as fears of a China-led global economic slowdown roiled world markets.

Global Markets

New York: The S&P 500 suffered its biggest daily percentage drop in nearly four years on Friday and the Dow confirmed it had entered into correction territory as fears of a China-led global slowdown rattled investors around the world.

London: Britain’s FTSE 100 marked its biggest weekly loss of the year after data from China raised investors’ concerns over weak global growth and possible deflation.

Tokyo: Japanese stocks tumbled to a 5-1/2-month low on Monday morning on a broad sell-off triggered by China growth fears, hitting cyclical stocks hard.

(With inputs from agencies)