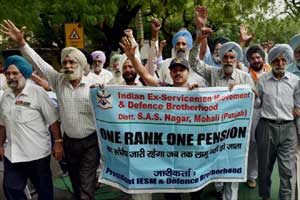

The fact that at least one Railways trade union is already looking at one-rank-one-pension (OROP) for its members should alert prime minister Narendra Modi to the dangers of his accepting this for defence personnel—there will be similar demands from the bureaucracy, para-military forces, and teachers, among others. Modi used his Independence Day speech to say an acceptable decision on this would be taken. Indeed, in an attempt to build pressure on Modi, two of the ex-servicemen protesting at Jantar Mantar have announced their decision to fast-unto-death. Given how a similar threat built up Anna Hazare and his Jan Lokpal Bill into a national movement, Modi would do well to ensure the protesters are not allowed to carry out this threat—and to do so before the TV channels make martyrs out of them.

Given how pensions are galloping, there is little doubt that, as the BJP’s candidate for prime minister, Modi made a grievous error in promising the veterans’ OROP during his election campaign. Pension payments of the government of India alone have risen 4.86 times in the last 11 years—those of the defence sector have kept pace, rising from Rs 11,250 crore in FY05 to Rs 54,500 crore in FY16. If this hike isn’t frightening enough, Modi would do well to look at what the next Pay Commission report—out later this month—will do to the pension bill as salaries of government employees get raised across the board; OROP will increase this dramatically.

Whatever decision Modi takes on OROP, to ensure the burden does not spiral out of control, it is critical he implements the New Pension Scheme (NPS) for all new army recruits as was done in 2004 for all new government employees. Instead of a pension based on the last salary—duly revised by each Pay Commission and indexed for inflation—it will be based on the returns from investments made on a corpus comprising the contributions made by the employee and the government each month as happens for civilians under the EPFO process. But how can this work in the case of defence personnel, over 80% of whom retire between 35 and 40? If their number of years of contribution is less, their savings will also be low. Dhirendra Kumar of Value Research has a good suggestion on this.

Let the government carry on contributing to the NPS—for both itself and the retired personnel till the age of 60—and the returns from this investment will form the pension corpus. This is not an alternative to OROP, it is a way to make NPS more attractive for defence personnel—returns on NPS have been 11% so far. The alternative is for the pension bill to get so large that, in the case of defence, this will compromise on equipment purchases.