- India

- International

India-EU Trade pact: Antibiotic for common cold

The move by the European Union to ban sale of around 700 generic drugs clinically tested by GVK Biosciences, has provoked India to abruptly defer talks.

At this point in time, there is greater urgency for India to conclude its trade pact with the EU — our largest trade partner — if it has to remain competitive amid a slew of regional and bilateral FTAs being inked across the globe. (Illustration: Pradeep Yadav)

At this point in time, there is greater urgency for India to conclude its trade pact with the EU — our largest trade partner — if it has to remain competitive amid a slew of regional and bilateral FTAs being inked across the globe. (Illustration: Pradeep Yadav)

Less than four months ago, on April 14 in Berlin, Prime Minister Narendra Modi had made a plea in favour of resuming the final stages of negotiations for wrapping up a free trade agreement between India and the European Union, one that has been hanging fire for the last eight years.

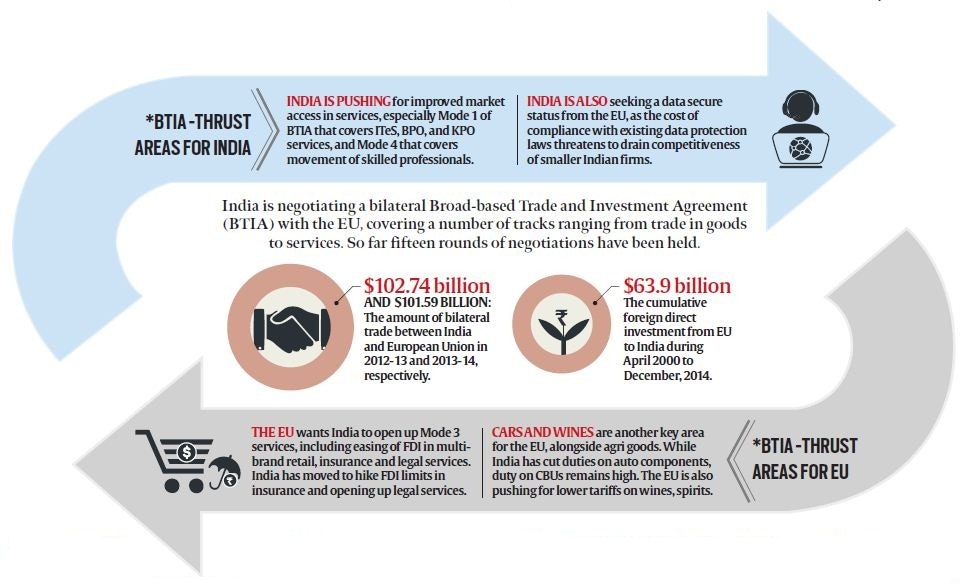

Then, just ahead of an impending August 28 meeting of the chief negotiators of India and the EU for resuming talks on the Broad-based Trade and Investment Agreement (BTIA) after a two-year hiatus, the commerce ministry, on August 5, decided to make an abrupt announcement citing the Indian government’s decision to defer the proposed talks in protest against the EU imposing a legally binding ban on the sale of around 700 generic drugs clinically tested by GVK Biosciences, Hyderabad. This was in reaction to the EU having imposed the ban citing the alleged manipulation of clinical trials by drug research company GVK Biosciences.

[related-post]

The legality of the EU action against GVK Biosciences aside, India’s latest attempt to delay the BITA talks is broadly consistent with the typical dilly-dallying stance adopted by the country during world trade negotiations, with nationalism, almost always, being used as the alibi for the protectionist stance. The sense of urgency to clinch the deal displayed by the Prime Minister in the April joint press conference with German Chancellor Angela Merkel appears to have been backed by a measure of rational thinking, especially in the wake of the fact that just a month ahead of Modi’s trip to Germany, the government had steamrolled a major sticking point in the trade pact negotiations by operationalising increased FDI limit of up to 49 per cent in the insurance sector.

The commerce ministry’s latest move, though, has confounded many. In terms of sheer timing, the postponement of the India-EU trade talks could not have come at a worse point in time, considering that the EU has already kick-started trade negotiations with the US and talks on a pact with Japan are on the cards, both of which are of considerable importance for the 28-nation bloc and is expected to draw much of the energies of trade negotiators in Brussels. For India, the shift in priorities for the EU was exemplified as far back as two years ago when Ignacio Garcia Bercero, the chief negotiator for the India pact, was moved to the Transatlantic Trade and Investment Partnership (TTIP) — the pact planned between the EU and the US.

The commerce ministry’s latest move, though, has confounded many. In terms of sheer timing, the postponement of the India-EU trade talks could not have come at a worse point in time, considering that the EU has already kick-started trade negotiations with the US and talks on a pact with Japan are on the cards, both of which are of considerable importance for the 28-nation bloc and is expected to draw much of the energies of trade negotiators in Brussels. For India, the shift in priorities for the EU was exemplified as far back as two years ago when Ignacio Garcia Bercero, the chief negotiator for the India pact, was moved to the Transatlantic Trade and Investment Partnership (TTIP) — the pact planned between the EU and the US.

At this point in time, there is greater urgency for India to conclude its trade pact with the EU — our largest trade partner — if it has to remain competitive amid a slew of regional and bilateral FTAs being inked across the globe. Alongside the TTIP, a proposed Trans-Pacific Partnership (TPP) being negotiated by the US and 11 other countries of the Asia-Pacific would cumulatively account for nearly two-thirds of global GDP and over 30 per cent of imports. India is not in the reckoning to be a part of either trade bloc. Worryingly, both pacts signal the shifting of global trade away from the multilateral and MFN (most-favoured nation) model toward the bilateral and regional pact route. While China is reported to be weighing in the option of joining the TPP, India’s almost indifferent stance on the pact front — exemplified by the pullout from EU talks — could well be counterproductive.

The EU reacted cautiously to India’s decision to put off talks. Cesare Onestini, acting head of Delegation of the EU to India said: “The purpose of this meeting at chief negotiators level was to explore the possibility of resuming FTA talks, and was not meant to constitute in anyway a full-fledged negotiation round.” The EU, he said, remained “committed to continue working towards conclusion of an agreement” between India and the EU that will be acceptable to both sides. “For this reasons, the EU hopes that a solution will be found to the current deferral”.

For India, missing out on trade pact with the EU is clearly an opportunity lost. The EU-28 is India’s largest trading partner, accounting for about 15 per cent of total trade in goods and services and figuring as an important market for India’s export of textiles and apparel, pharmaceuticals, gems and jewellery and IT services. While negotiations on the BTIA has been on since 2007, the EU has during the period wrapped up trade agreements with South Korea, Canada and many countries in Latin America. While there have been strains on India-EU trade relations, the most recent being the ban by Brussels on the import of mangoes from India, coming on top of a bevy of tax disputes involving European firms in India, the GVK Biosciences issue is an unexpected stumbling block in the larger objective of clinching a trade pact. From the commerce ministry’s point of view, it is significant enough to put negotiations in deep freeze “for the present”.

The GVK Biosciences ban centres on allegations of clinical trial manipulations by the drug maker, resulting in the largest EU-wide suspension of sales and distribution of generic drugs by Brussels. It will come into effect on August 21 and will be applicable to all 28 nations, according to Germany’s drug regulator, the Federal Institute for Medicines and Medical Products (BfArM). GVK Bio had denied the allegations and is reported to have offered to conduct fresh studies of the medicines involved at its own cost.

The ban covers a number of medicines for which authorisation in the EU was primarily based on clinical studies conducted at GVK Biosciences in Hyderabad, according to the European Medicines Agency (EMA). The EU-wide step came following several country-specific bans, in Germany and France among others. ANSM, the French drug regulatory agency, as part of a May 2014 filing, had initially flagged concerns about how GVK Biosciences conducted studies at the site on behalf of marketing authorisation holders. In January 2015, following an inspection of GVK Biosciences’ site at Hyderabad by the French agency, data manipulations of electrocardiograms during the conduct of some studies of generic medicines were flagged, which appeared to have taken place over a period of at least five years.

During the re-examination, it was concluded that concerns about reliability of the clinical studies remained and therefore the recommendation of January 2015 to suspend medicines for which no supporting data from other studies were available was retained. This is with the exception of one medicine included in the re-examination for which concerns about studies were addressed and this medicine was subsequently removed from the list of medicines recommended for suspension.

According to the EU’s Onestini, the decision concerning a ban on 700 generic drugs was based on “scientific and not trade considerations” and “in accordance with the advice of the scientific Committee of the EMA”.

From the EU’s perspective, the medicines affected by the regulatory action taken are those for which clinical studies had only been done at GVK Biosciences in Hyderabad and deals with issues identified for one particular clinical trial site. The actual manufacture of these products occurs in several countries around the world including the EU.

Local industry body Pharmexcil, though, pegs India’s business loss arising from the European Union’s ban on 700 generic drugs to be around $1.2 billion. “We have estimated the value of the products banned by the European Union to be between $1 billion and $1.2 billion,” according to Pharmexcil director-general PV Appaji. India exported $15.4 billion worth of drugs in 2014-15, with Europe accounting for 20 per cent, or $3 billion. Of this, formulations or generic drug exports constituted about $1 billion and active pharmaceutical ingredients formed $2 billion, according to industry data.

While the impact of the GVK order may have serious implications for the Indian generics industry, what needs to be kept in mind is that the action by the EU regulators are just another red flag amid a bevy of similar concerns raised by foreign regulators – in most cases the US FDA – against data inconsistencies and clinical trial manipulations by domestic pharma manufactures.

The fate of talks on trade issues, though, goes far beyond just a sector or a company. The decision to unilaterally call off talks, therefore, warrants a more comprehensive assessment of the pros and cons of this action, across sectors and companies, and for the country as a whole.

Apr 24: Latest News

- 01

- 02

- 03

- 04

- 05