Bankers are pushing the debt-laden Adhunik Power and Natural Resources to sell its 540 MW thermal power plant in Jharkhand, a senior banker with knowledge of the discussions told FE. “We have asked the management of Adhunik Power to look for a buyer for the plant since the firm’s financials are very weak,” the banker said.

The Kolkata-headquartered firm is in trouble following the cancellation of its Ganeshpur coal block, which is likely to cause a further deterioration in the firm’s financials since the plant will operate at suboptimal levels. The strain on cash flows, bankers anticipate, will reduce the company’s ability to service its loans.

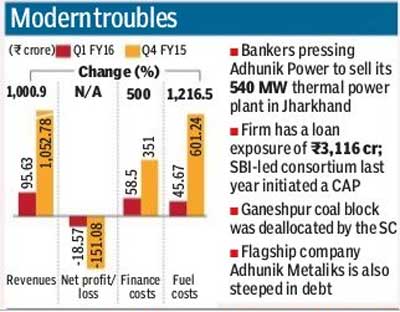

The firm’s losses widened to Rs 151.08 crore in 2013-14 from Rs 18.57 crore in FY13; its borrowings amount to Rs 3,116 crore, including Rs 2,474 crore of project debt and working capital limits of Rs 694 crore. A report by Brickwork Ratings, which downgraded the ratings, estimates the debt to tangible net worth levels at 4.13 times for FY14.

The State Bank of India-led consortium of around 12 banks had, in November last year, initiated a corrective action plan — under the joint lenders’ forum — since the firm had delayed repayments by more than 60 days. Lenders had extended the firm additional short-term loans of Rs 295 crore. The company did not respond to emails or calls for this story.

The Adhunik Group has interests in steel, mining and power and its flagship firm Adhunik Metaliks is also financially stressed with loans being recast under the corporate debt restructuring (CDR) cell.

Adhunik Power had entered into a memorandum of understanding with the Jharkhand government to set up a 1,080 MW coal-based thermal power plant. Both the units were commissioned in calendar year 2013. The company had been allocated a coal block in Ganeshpur in Jharkand jointly with Tata Steel but lost the mines when the Supreme Court declared that 214 of 218 coal blocks allocated since 1993 were illegal.

The company has signed power purchase agreements with state-owned electricity distribution companies in Jharkhand, West Bengal and Tamil Nadu. According to the Adhunik Power’s FY14 annual report, it was sourcing coal from Central Coalfields as part of tapering linkage. “Since the linkage coal is meeting our requirement partly, the balance quantity is being sourced from various sources which would include e-auction, import and domestic market,” the company said. The company is also said to have signed a fuel supply agreement to buy coal from Indonesia.

The loss of the captive mine reflects in the fuel costs incurred by the company. In FY13, when both units were commissioned, Adhunik Power had recorded fuel expenses of Rs 45.67 crore, which jumped more than 13 times to Rs 601.24 crore in FY14. Revenues also jumped 11 times, reflecting the commissioning of both units, to Rs 1,052.78 crore in FY14 but finance costs rose sixfold to Rs 351 crore.

The rise in expenses resulted in the net loss widening to Rs 151.08 crore at the end of 2013-14, compared with Rs 18.57 crore in fiscal 2013. In February 2015, Brickwork Ratings downgraded the company’s long -term and short-term credit facilities. Plant efficiency has been on the lower side with the plant load factor for Phase I expected to be around 65% for FY15 and that of Phase I I expected to be lower, the ratings agency noted in a report. The report added that the company’s negative cash flows company have been managed by increasing their term loans offtake.

Adhunik Power’s parent company Adhunik Metaliks is already steeped in debt and was one the last to have its loans restructured by the CDR cell in FY15. Adhunik Metaliks’ debt along with two of its subsidiaries Orissa Manganese & Minerals and Zion Steel was a part of the rehaul package. The steel company had a net debt of Rs 2,552.93 crore at the end of FY14, according to Bloomberg data. Its Q3FY15 net sales stood at Rs 162.36 crore, a fall of 62.5% year-on-year and posted a loss of Rs 116.03 crore compared with a profit of Rs 4.44 crore in the corresponding quarter in FY14. It had posted a net profit of Rs 31 lakh in FY14.

Orissa Manganese & Minerals owns an 80% stake in Adhunik Power, according to the latter’s FY14 annual report. Adhunik Power also has a clutch of private equity investors that have invested in the company.

An ICRA report dated July 2015 said that energy availability is showing an improvement led by generation capacity addition and, as a result, the energy deficit levels remained moderate during FY15. However the power sector continues to face challenges arising out of high fuel supply risks given the large quantum of affected coal-based capacity after the cancellation of coal block allocations by the Supreme Court as well as due to uncertainty over the improvement in domestic gas availability.