Singapore Airlines reports higher profits but future outlook hinges on Scoot & Tigerair improvements

The Singapore Airlines Group turned a SGD111 million (USD83 million) operating profit for the three months ending 30-Jun-2015 (1QFY2016), marking its best first quarter showing since 2011. An operating profit of SGD108 million (USD81 million) at the parent airline drove the overall result. Full service regional subsidiary SilkAir also remained in the black while the group's two LCC subsidiaries Tigerair and Scoot, were break-even and incurred a SGD20 million (USD15 million) operating loss respectively.

But the outlook for Tigerair and Scoot should brighten as the two carriers continue to pursue closer cooperation. Scoot should also see a significant improvement after it completes the transition to an all-787 fleet and expands its operation, enabling it to achieve higher economies of scale.

Scoot plans to phase out its last 777 in the current quarter and nearly double the size of its fleet during FY2016 from six to 11 aircraft. The loss reported for Scoot for 1QFY2016 marks the first time SIA has reported financials for the long-haul LCC since it launched in mid-2012.

- Singapore Airlines Group reported its best first quarter operating profit since 2011, with an operating profit of SGD 111 million (USD 83 million) for 1QFY2016.

- The group's net profit more than doubled from SGD 35 million (USD 28 million) in 1QFY2015 to SGD 91 million (USD 68 million) in 1QFY2016.

- The group's LCC subsidiaries, Tigerair and Scoot, reported break-even and an operating loss of SGD 20 million (USD 15 million) respectively for 1QFY2016.

- Scoot plans to phase out its last 777 aircraft and nearly double its fleet during FY2016 from six to 11 aircraft.

- Scoot's load factor exceeded 80% in 1QFY2016, and it carried 482,000 passengers, an increase of 11% compared to 1QFY2015.

- Scoot's unit costs (CASK) for 1QFY2016 was SGD 5.3 cents (USD 3.95 cents), or about 7% less than Tigerair, despite Scoot having a much longer average trip length.

SIA reports improved profits for quarter ending Jun-2015

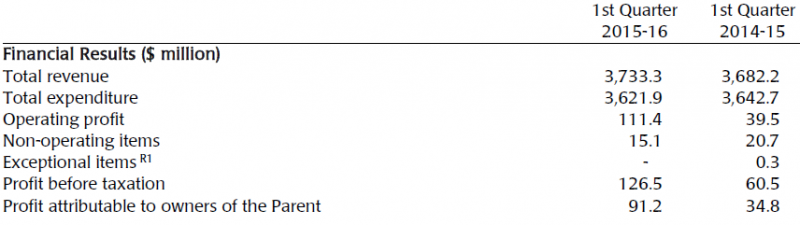

SIA on 29-Jul-2015 reported a group operating profit of SGD111 million (USD83 million) for 1QFY2016, representing a 182% increase compared to the SGD40 million (USD32 million) operating profit for the three months ending 30-Jun-2014 (1QFY2015). It also represented the highest first quarter operating profit for the group since FY2012.

Singapore Airlines Group fiscal 1Q operating profit (in SGD million): FY2011 to FY2016

|

1QFY2011 |

1QFY2012 |

1QFY2013 |

1QFY2014 |

1QFY2015 |

1QFY2016 |

|---|---|---|---|---|---|

|

$251 |

$11 |

$72 |

$82 |

$40 |

$111 |

The group's net profit more than doubled from SGD35 million (USD28 million) in 1QFY2015 to SGD91 million (USD68 million) in 1QFY2016.

The SIA Group generated SGD3.733 billion (USD2.783 billion) in revenues in 1QFY2016, representing an increase of 1% compared ty 1QFY2015. But group revenues actually decreased by 3% when removing the 1QFY2016 contribution from Tigerair, which was not included in the 1QFY2015 results as at the time the short-haul LCC was only an SIA Group affiliate.

SIA Group financial highlights: 1QFY2016 vs 1QFY2016

Tigerair became an SIA Group subsidiary in Oct-2014, when the group increased its stake in the Singapore-based LCC from 40% to about 55%. Scoot has always been a fully owned subsidiary of SIA but the group has until now deemed the medium/long-haul LCC not to be significant enough in size to include in its breakdown of operating results.

Tigerair and Scoot report financial improvements for 1QFY2016

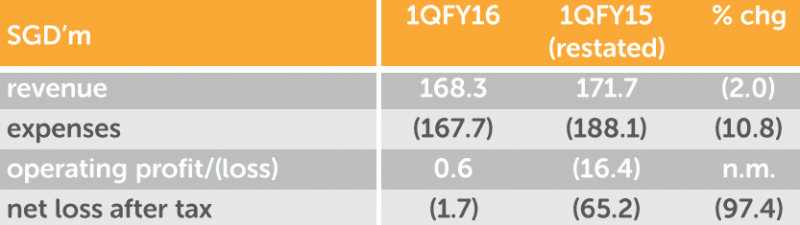

Tigerair, which continues to be listed separately, reported on 22-Jul-2015 a break-even operating result for 1QFY2016 compared to an operating loss of SGD16 million (USD13 million) in 1QFY2015. Tigerair incurred a net loss of less than SGD2 million in 1QFY2016 compared to a net loss of SGD65 million (USD52 million) in 1QFY2015.

Tigerair financial highlights: 1QFY2016 vs 1QFY2015

The loss from a year ago was driven by overseas affiliates which have since been closed or sold while the operating figure is an indication of the turnaround at Tigerair Singapore, which over the last year has reduced capacity and shrunk its fleet. Tigerair Singapore currently operates a fleet of 23 A320s and one A319 but plans to further reduce its fleet in Nov-2015, when it disposes of two A320s while placing back into service a second A319. Tigerair Singapore ASKs were down 7% in 1QFY2016 and RPKs were down 9%, resulting in a 1.2ppt drop in load factor to 83.5%.

See related report: The Singapore LCC sector Part 1: Tigerair's losses in FY2015 should reverse as capacity is cut

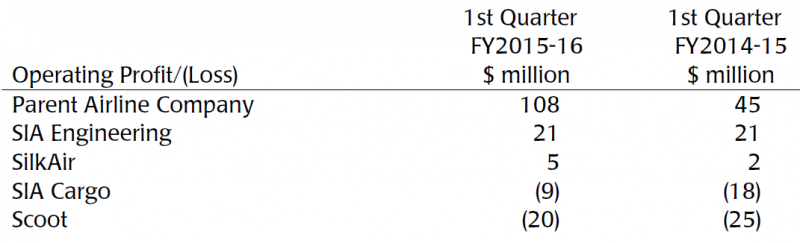

Scoot's SGD20 million (USD15 million) loss for 1QFY2016 compares to a SGD25 million (USD20 million) operating loss in 1QFY2015. The SIA Group also reported a narrower loss for SIA Cargo while profits for its two full-service passenger airline subsidiaries, SilkAir and SIA itself, more than doubled to SGD5 million (USD4 million) and SGD108 million (USD81 million) respectively.

SIA's only other major subsidiary, SIA Engineering, reported a flat operating profit at SGD21 million (USD16 million). The group has several other non-airline subsidiaries but as they are very small they are not included in any breakdowns.

SIA Group operating profits by subsidiary: 1QFY2016 vs 1QFY2015

SIA sees higher mainline profits despite lower yields and load factor

SIA mainline saw a 2% reduction in yields, an indication that market conditions continue to be challenging despite capacity reductions from some of its Southeast Asian competitors. The group warned that demand remains weak on long-haul routes to the Americas and Europe due to an extremely competitive environment and capacity increases by competitors. Yields are therefore expected to remain under pressure through at least the current quarter.

Gulf carriers in particular have pursued aggressive expansion in Singapore as well as in other Southeast Asian markets which SIA relies on to feed its long-haul network. Such increases likely offset reductions resulting from the restructurings at Malaysia Airlines and Thai Airways.

See related report: Qatar Airways pursues rapid expansion in Singapore after the first A350 lands at Changi

SIA first quarter mainline yields have now dropped for four consecutive years. While the drop has been gradual the total decline has been more than 10%. The steady and consistent decline also indicates there has been a structural change in the marketplace which will likely impact SIA's profitability over the long-term, particularly if fuel prices increase again.

SIA parent airline fiscal 1Q passenger yield (SGD cents per kilometre): FY2012 to FY2016

|

1QFY2012 |

1QFY2013 |

1QFY2014 |

1QFY2015 |

1QFY2016 |

|---|---|---|---|---|

|

11.8 |

11.4 |

11.1 |

10.9 |

10.7 |

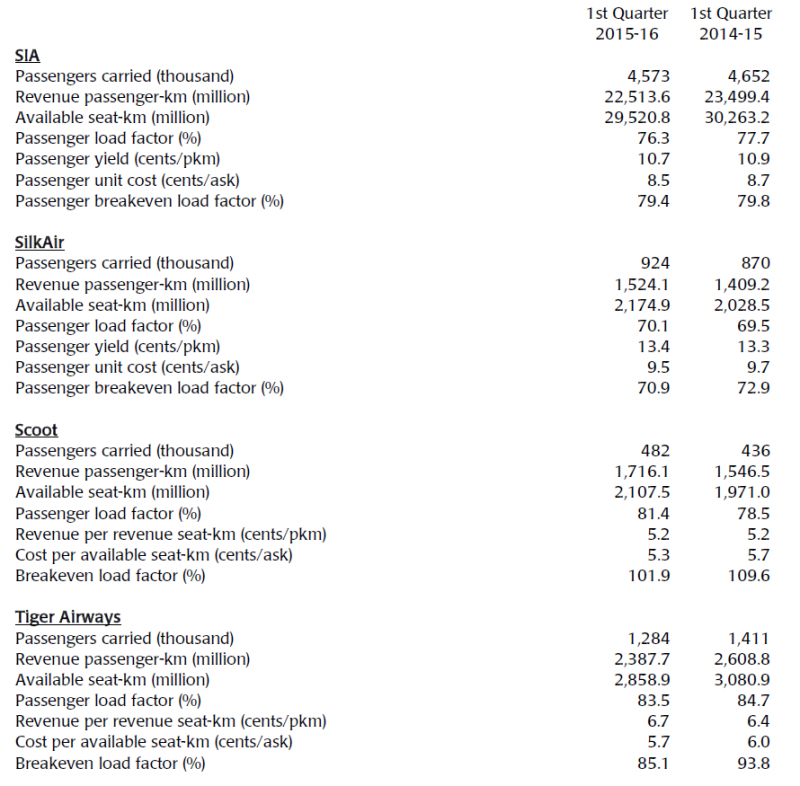

SIA's passenger load factor also dropped by 1.4ppts in 1QFY2016 to 76.3% despite a nearly 3% drop in ASKs.

The parent airline was still able to grow its operating profit despite the discouraging drop in yields and load factor as SIA benefitted from a reduction in fuel expenses and an increase in other revenues driven from the sale of seven A350 delivery slots.

The transaction with Airbus, which was completed during the quarter, reduces SIA's A350 commitment from 70 to 63 aircraft but SIA says it does not impact its fleet or growth plan as it has brought forward deliveries to replace the slots which have been sold. SIA expects to place into service its first A350, which will feature its latest generation cabin products including premium economy, in 4QFY2016.

The improved profit at SilkAir, albeit on a very low base, was driven by a slight improvement in yields and load factor as well as lower fuel costs. The regional carrier's yield improved by 1% and its load factor by 0.6ppts to 70.1% as an 8% growth in RPKs outpaced a 7% growth in capacity.

See related report: Singapore outlook Part 2: SilkAir slows its expansion. Strategic adjustments may be necessary

Premium economy should enable SIA to end the four-year slide in yields

As CAPA has highlighted in multiple previous reports, the SIA Group is seeking to further improve its position in the full service sector by continuing to invest in product enhancements. The latest example of this initiative is premium economy, which is being introduced in early Aug-2015.

SIA will have all 19 of its A380s and 19 of its 777-300ERs configured with premium economy seating by early Jan-2016. As the premium economy cabin is being added at the expense of regular economy rather than business seats, the retrofits will drive a further reduction in mainline capacity for SIA.

Passenger yield should improve as the portion of regular economy seats is reduced, reversing some of the yield declines of the last four years. But SIA is taking a gamble by assuming the yield improvement will outweigh the increase in unit costs that comes with operating its long-haul fleet in a less dense configuration.

See related reports:

- Singapore Airlines outlook brightens as profits, yields improve. New connectivity strategies emerge

- Singapore Airlines: another year of no traffic/profit growth. Betting the farm on premium economy?

- Singapore Aviation Part 2: Emirates & Qatar expand. SIA drops Europe capacity, adds premium economy

- Singapore Airlines incurs 4QFY2014 operating loss, adds premium economy as latest strategic response

The more dynamic area and faster growing area of the SIA Group portfolio is the budget end, where SIA is investing heavily in expansion at Scoot and through its increased stake in Tigerair. The rest of this report will focus on the performance and outlook for Scoot.

Scoot's load factor exceeded 80% in 1QFY2016

Scoot carried 482,000 passengers in 1QFY2016, an increase of 11% compared to 1QFY2015. RPKs were also up 11%, outstripping a 7% increase in ASKs and driving an encouraging 2.9ppts increase in load factor to 81.4%

Scoot accounted for 7% of the SIA Group's total passengers in 1QFY2016 and 6% of the group's RPKs. Scoot already has more ASKs than SilkAir and has about 25% fewer ASKs than Tigerair. Scoot should surpass Tigerair in this category by the end of FY2016 given the recent capacity cuts at Tigerair and the planned rapid expansion at Scoot.

In terms of passenger numbers SilkAir is still twice as large and Tigerair is about two and half times larger (see background information).

Scoot's unit costs or CASK for the quarter was SGD5.3 cents (USD3.95 cents), or only about 7% less than Tigerair despite Scoot having a much longer average trip length. Scoot's average stage length is 3,560km while Tigerair's average stage length is 1,860km.

Scoot's CASK is about 10% higher than AirAsia X

The global CASK leader is rival medium/long-haul LCC AirAsia X, which for the quarter ending 31-Mar-2015 reported CASK of USD3.5cents. But AirAsia X, which has not yet reported results for the June quarter, has a longer average stage length of 4,635km.

AirAsia X's arrangement with sister short-haul carrier AirAsia prevents it from operating any routes under four hours while Scoot has five routes under four hours - Singapore-Bangkok, Singapore-Hong Kong, Kaohsiung-Osaka, Taipei-Seoul and Taipei-Tokyo Narita. Scoot should be able to reduce its CASK as it completes the transitions to a more efficient 787 fleet and expands its operation.

Scoot will also benefit over the next few quarters from a lower fuel costs as the average hedge price for the SIA Group gradually reduces. The SIA Group, including Scoot but excluding Tigerair, hedged 58.5% of its fuel in 1QFY2016 at USD110 per barrel but this reduces to 55.4% of fuel at USD104 per barrel in 2QFY2016.

Scoot began 1QFY2016 with one 787-9 and during the quarter placed into service three more 787-9s, giving it a fleet of four 787-9s and two 777-200s as of 30-Jun-2015. In July-2015 it has placed into service two more 787s, including a fifth 787-9 and its first 787-8. The fifth 787-9 was a growth aircraft while the first 787-8 replaced the second to last 777-200. A second 787-8 is slated to be delivered in Aug-2015, enabling Scoot to phase out its last 777 in late Aug-2015.

Scoot was already able to reduce CASK by 7% in 1QFY2016 compared to 1QFY2015, driven by lower fuel costs and the efficiencies generated by the 787. A larger CASK reduction should be achieved in 2QFY2016 as more 787s are added and again in 3QFY2016, which will mark the first entire quarter Scoot operates an all 787-fleet.

But it is unlikely Scoot will be able to match the CASK of AirAsia X given that the Malaysian carrier has a longer average stage length and a much larger fleet overall, which it enables it to enjoy greater economies of scale. AirAsia X also benefits from being based in a country with significantly lower labour costs.

Both AirAsia X and Scoot now benefit from joint purchasing with sister carriers. But there could be potential further upside for Scoot as Tigerair gradually starts to participate in some of the joint contracts that already include Scoot, SIA and SilkAir. There could also possibly be some new joint contracts between Scoot and Tigerair.

For example, Tigerair and Scoot now use the same reservation systems supplier but have separate contracts and Tigerair has not yet completed a transition to the version used by Scoot.

The Singapore Airlines Group brand matrix

Scoot to enjoy greater economies of scale as it accelerates its expansion

Scoot also plans significant expansion of its fleet and network in 2HFY2016, enabling it to enjoy greater economies of scale and further reduce its unit costs although there will be some additional one-time costs associated with starting new routes.

As CAPA has previously highlighted, Scoot is slated to take a total of six 787-8s in FY2016, which will give it a fleet of six 335-seat 787-8s and five 365-seat 787-9s at the end of Mar-2016. The 11 aircraft at the end of FY2016 compares to a fleet of only six aircraft at the end of FY2015.

See related reports:

- Scoot plans Kaohsiung-Osaka & Bangkok-Sapporo as long-haul LCCs focus on fifth freedom opportunities

- Scoot begins new chapter as Singapore Airlines long-haul LCC subsidiary takes first 787

- Scoot outlook improves as Singapore Airlines long-haul LCC subsidiary prepares for 375-seat 787-9

Scoot has so far only taken one of the five growth aircraft in the FY2016 fleet plan; this enabled the 8-Jul-2015 launch of Osaka, which is being served six times per week with three frequencies via Bangkok and three via Kaohsiung in Taiwan. This marked the first growth aircraft and first new destinations for Scoot in 20 months. The addition of Osaka and Kaohsiung gives Scoot a network of 15 destinations including Singapore.

Of the other four additional growth aircraft for FY2016 Scoot has so far only announced the deployment plans for one aircraft, which will be used to serve Melbourne with five weekly flights from 1-Nov-2015. Scoot is expected to allocate most of the capacity from the other three growth aircraft to China but has not yet announced any new routes to China. As CAPA stated in a Dec-2014 report:

New routes to mainland China are expected to account for most of the capacity Scoot is adding in 2015. Scoot currently serves four destinations in mainland China with 11 weekly flights. This includes four weekly flights to Nanjing, four weekly flights to Qingdao and three weekly flights to Tianjin. Two of the four Qingdao frequencies continue onto Shenyang.

Scoot is looking to add up to four new destinations in China in 2015 while adding frequencies to its existing four destinations. The 787-8 is seen as an ideal aircraft for China, enabling more frequencies and new routes. Scoot eventually also plans to decouple Qingdao and Shenyang although non-stop flights to Shenyang are not part of the plan for 2015. Scoot's preference it to operate non-stops and none of its new Chinese destinations for 2015 will be tagged. Scoot has been looking at several potential new Chinese destinations.

See related report: Long haul LCC Scoot's 2015 outlook: transition to 787s and strategic growth, including Melbourne

Scoot needs to boost yields

Scoot could face challenges on the revenue and yield side as it accelerates expansion. Scoot's yields are already very low as prices have remained consistently at promotional levels since its mid-2012 launch. While Scoot may be able to improve yields on some of its initial routes this will likely be offset by lower yields during the spool-up phase of its new routes.

Scoot reported unit revenues (RPKM) of SGD5.3 cents (USD3.95 cents) for 1QFY2016, matching its unit revenues from 1QFY2015. As its CASK figure was slightly higher, Scoot had a clearly unsustainable break-even load factor of 101.9% in the most recent quarter (see background information below).

Lower CASK should enable Scoot to continue reducing its break-even load factor, which had stood at 109.6% in 1QFY2015. But Scoot will also need to see improvements in unit revenues and yield if it is to become profitable.

A closer partnership with Tigerair will be a key driver for such improvements. Scoot and Tigerair have already seen a doubling of transfer traffic over the last year but on an extremely low base. Scoot is banking on significantly more feed from Tigerair, which should result in higher load factors and potentially higher yields as it will be able to rely less on trying to stimulate local traffic through steep discounting.

Yields should also continue improving on the two routes Scoot and Tigerair have been operating jointly with anti-trust immunity since Jan-2015 - Singapore-Bangkok and Singapore-Hong Kong. Extension of the joint venture on more routes such as Singapore-Taipei and increased coordination on scheduling as well as on network development could provide further benefits on the revenue side for both LCCs.

Scoot should also be able to improve yields as SIA begins selling Scoot-operated flights in the current quarter. Scoot's codeshare with SIA and SilkAir has until now been limited to Scoot selling on its two full service sisters.

Leveraging SIA sales channels could particularly help in mainland China, where Scoot has focused on secondary destinations that are not served by SIA or SilkAir. Scoot is considered the preferred brand within the SIA Group to expand in secondary Chinese markets, which could potentially offer higher yields than more competitive markets such as Australia.

SIA Group's future outlook hinges on Scoot and Tigerair

Scoot is facing a critical juncture as it completes the transition to an all 787 fleet, pursues greater synergies with Tigerair and accelerates expansion.

Scoot was never expected to be profitable in its first three or four years.

But Scoot should start to narrow losses in 2HFY2016 and could be break-even - or potentially even profitable - as early as FY2017.

Tigerair will also likely again be at least at break-even in FY2016, boosting the SIA Group's position in the budget end of the market.

Scoot and Tigerair are critical components to the overall SIA Group strategy and could eventually merge; they will at least grow closer. An improved outlook for the two LCCs will brighten the overall outlook for SIA as the group continues to fine tune its multi-brand strategy.

Background information

Operating highlights for SIA Group's four airline brands: 1QFY2016 vs 1QFY2015