How the Indian commuter bike industry performed in Q1 FY2016

For Q1 FY2016, of the five sub-categories, only the 150cc-200cc space has seen growth year-on-year. This is thanks to two new motorcycles – Honda’s all-new CB Unicorn 160 and Suzuki Motorcycle’s 155cc Gixxer models.

Hero No. 1 in 75cc-110cc, Honda No. 1 in 111cc-125cc bike segments

The commuter motorcycle segment or precisely the small bike market in India is, according to apex industry body SIAM’s split, is roughly fragmented into five sub-categories across the engine displacements of more than 75cc to less than equal to 250cc, has seen dynamic changes across the recent quarters.

For Q1 FY2016 (April-June 2015), of the five sub-categories, which are split in the form of 75cc-110cc, 110cc-125cc, 125cc-150cc, 150cc-200cc and 200cc-250cc engine displacements, only the 150cc-200cc space has seen growth year-on-year. This has primarily come on the back of two new motorcycles – Honda’s all-new CB Unicorn 160, which now comes with a reworked, single-cylinder, 162.7cc engine, and Suzuki Motorcycle’s single-cylinder, 155cc Gixxer models.

Notching impressive sales numbers, both these models have not only provided good traction to their companies (HMSI and Suzuki Motorcycle) but have also helped them to mark their presence in one of the most competitive sub-categories (premium commuter) of the Indian commuter bike market. Domestic sales-wise, Honda’s CB Unicorn 160 has sold more than 100,000 units since its launch in December 2014 and Suzuki’s Gixxer has fetched sales of easily more than 60,000 units since it was first launched in September last year. Its faired variant, the GIxxer SF, was launched in April 2015.

Spokespersons from both the companies, Honda and Suzuki, have commented about their focus on the premium commuter motorcycle segment.

“The CB Unicorn 160 has given us good traction in its class. Our strategy of having a clear focus on urban youth and ensuring that our network in the top 35 cities, where we are the No. 1 two-wheeler player, have the right products, right inventory and at the right time is delivering impressive results,” YS Guleria, senior vice-president (sales & marketing), HMI told Autocar Professional recently.

Atul Gupta, executive vice-president, Suzuki Motorcycle India (SMIL) also had clarified his company’s stance to Autocar Professional during the launch of Gixxer SF in Delhi earlier this year. “We will focus on the niche segment which includes the 150cc and above motorcycle category in the A- and B-class cities in India. Young India is driving growth in this category,” he said.

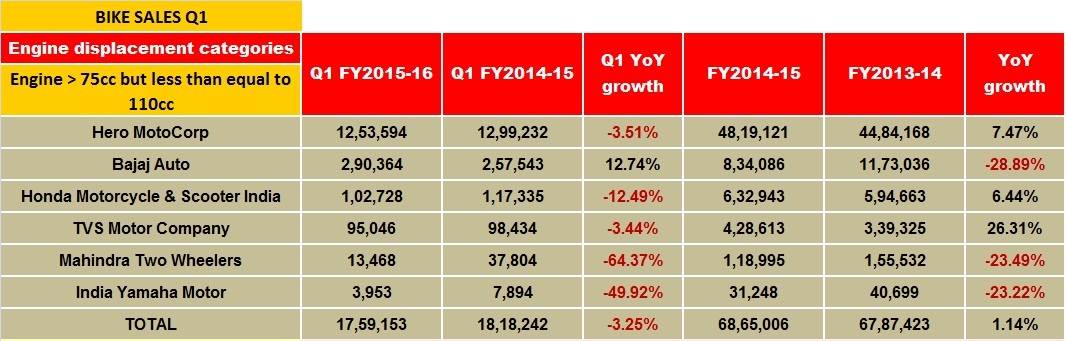

However, Q1 FY 2016 sales data of the overall small motorcycle segment (assumed to be 75cc-250cc) indicate a downfall of 3.25 percent. The small bike categories put together registered total sales of 2,604,842 units in the Q1 FY2016 as compared to the sales of 2,692,361 units recorded in Q1 FY2015.

Leading the small motorcycle market is the mass commuter segment (75cc-110cc), which is not only the largest in terms of volumes (1,759,153 units) but also represented a dominating 67.53 percent market share during Q1 FY2016.

Hero MotoCorp commands 71% of 75cc-110cc commuter bike segment in India

India’s largest motorcycle manufacturer, Hero MotoCorp is keeping its leadership position strongly in the biggest two-wheeler category by volumes, the 75cc-110cc mass commuter motorcycle segment.

The company commanded 71.26 percent of this segment alone in Q1 FY2016, as per SIAM industry sales data. Hero MotoCorp sold a total of 12,53,594 units during Q1 of this fiscal as against 12,99,232 units sold in Q1 FY2015, reporting a Q1 YoY fall of 3.51 percent.

This can be attributed to the slowdown in demand in the rural markets, thereby affecting the sales of entry level motorcycles which include models under Hero’s widely popular Passion and Splendor brands. The models under the Splendor brand recorded domestic sales of 633,420 units followed by sales of 348,008 units contributed by the models sold under the Passion brand.

The company’s inventory for Q1 this fiscal stood at six weeks as against the industry average of 4-5 weeks.

For FY2014-15, with total sales of 48,19,121 units in this category alone, Hero’s market share stood at 70.20 percent. For the same year, the domestic market size of the 75cc-110cc motorcycle category stood at 68,65,006 units. This clearly shows that despite the fall in the overall category, the company continues to command with its dominating market share.

Bajaj Auto, which posted YoY declining numbers in April and May 2015 but a sharp growth in June 2015, turns out to be the only two-wheeler manufacturer in this category with positive Q1 YoY growth of 12.74 percent in Q1 FY2016. Backed by a sharp uptick in the demand for its 100cc mass commuter models – the CT100 and Platina ES – the company has posted sales of 290,364 units during Q1 FY2016 under this category.

Interestingly, the CT 100, which has sold close to 1,74,000 units during Q1 this fiscal, along with the Platina (with sales of 76,477 units) has contributed to company’s sales in 75cc-110cc category by more than 2,50,000 units during the said period.

Honda No. 1 player in 111cc-125cc executive commuter class

Honda Motorcycle & Scooter India (HMSI), which stands as the top player in the executive commuter motorcycle segment (111cc-125cc), now has an impressive 49.53 percent in this category in Q1 FY2016. While the company sold 218,354 units, the market size of this category stood at 440,821 units during Q1. The category best-seller, Honda’s CB Shine raked in total sales of close to 217,000 units in Q1 FY2016.

A closer look at this category underlines that though the overall volumes fell by 3.15 percent YoY, Bajaj Auto’s decline of 76.99 percent in this category (due to a fall in sales of Discover models) has directly benefited by the two leaders – HMSI and Hero MotoCorp.

Selling 173,731 units during Q1 FY2016, Hero sold 33,708 units more than its Q1 FY2015 sales of 140,023 units, thereby recording a YoY growth of 24 percent. Hero’s 124.7cc Glamour model dominated this chunk by registering total domestic sales of 1,67,740 units during the period.

Bajaj Auto, Yamaha dominate the 126cc-150cc class

The 126cc-150cc category of motorcycles has reported domestic sales of 208,964 units during Q1 FY2016, substantially down by 33.64 percent from Q1 FY2015’s sales of 314,880 units. A significant part of this drop can be attributed to HMSI, which discontinued its CB Unicorn 150 model in January-February 2015 after launching its CB Unicorn 160 in the domestic markets.

Bajaj Auto, the market leader in this category, posted marginal YoY growth of 1.25 percent in its domestic Q1 sales of 125,504 units in this fiscal. The growth has come on the back of its new 144.8cc Discover 150F that the company had rolled out in the second half of CY 2014. It sold close to 10,000 units of this model in Q1 FY2016. However, the Pulsar brand continues to be the segment leader with total sales of 115,537 units in the same period.

Second in order is Yamaha’s FZ series that sold 46,708 units in the domestic market during Q1 FY2016. The SZ and R-15 models added another chunk of 11,000 units to Yamaha’s Q1 sales performance.

Hero’s YoY quarterly sales decline in this category can be attributed to the fall in the sales of its 149.2cc Xtreme model, which sold only 12,305 units in Q1 FY2016 when compared to the sales of 38,262 units in Q1 FY2015. The company’s attempt to boost the falling sales of this model can be understood in the form of the roll out of new cosmetically upgraded Hero Xtreme in Hyderabad on July 16.

Honda inching closer to TVS’ supremacy in 151cc-200cc class

151cc-200cc is one category of motorcycles that had only TVS Motor Company (Apache 160 and Apache 180) and Bajaj Auto (Pulsar 180 DTS-i, 200NS, KTM 200 Duke, RS 200, AS 200) rivalling with their performance-oriented commuters all this while. Although TVS Motor continued to command the top position in this category, it did not add new products to its Apache portfolio. Bajaj Auto, on the other hand, added a slew of new products to gain market share over the last 36-42 months.

TVS Motor’s market share, which stood at 53 percent in the domestic volumes of this category in FY2014-15, now has been reduced to 38.27 percent, all thanks to its new rival – Honda’s CB Unicorn 160.

A close look at the Q1 FY2016 numbers point out that HMSI is inching towards TVS Motor’s volume. Reporting an impressive YoY growth in Q1 FY2016, TVS Motor sold 64,848 Apache bikes as compared to 45,278 units sold in Q1 FY2015. Following the South Indian company is Honda, which has sold only 8,422 units less despite being a new entrant.

Rolling out new models has worked in favour of Bajaj Auto, which has sold 31,375 units in the same period, posting a YoY growth of 26.96 percent. Models positioned under the Pulsar brand have sold a total of 25,991 units in Q1 FY2016 as against 22,150 units sold in Q1 FY2015.

Additionally, the sales of KTM models (200 Duke, RC 200) have doubled to 5,384 units during the same period. KTM sold 2,563 units in Q1 FY2015.

Suzuki’s Gixxer, as mentioned above, is another success story in this category.

Pulsar 220, Avenger stars of 201cc-250cc class, Hero Karizma loses sheen

Bajaj Auto’s oil-cooled, single-cylinder, 220cc Pulsar 220F (as on the manufacturer’s website) and air-cooled, single-cylinder, 219.89cc cruiser, Avenger 220 are the two undisputed stars of this category, which has an annual market size of close to 1,50,000 units (FY2014-15 data). Q1 FY2016 saw Bajaj Auto reporting sales of 13,888 units of the Pulsars and 9,859 units of the Avengers. Both the models, however, saw marginal fall in their YoY quarterly sales.

Hero MotoCorp’s Karizma models (Karizma ZMR and Karizma), which are powered by the air-cooled, single-cylinder, 223cc engine, have declined in their sales numbers. The models that sold 36,451 units in FY2013-14 reported sales of 25,752 units in FY2014-15. They continue to chart a similar story in the Q1 FY2016. The company reported sales of 1,748 units of the two models together as against 6,887 units sold in Q1 FY2015, down by 74.62 percent.

On the other hand, Honda’s CBR250R has picked up in the previous quarter. The CBR250R model sold 954 units in Q1 this fiscal as against 497 units sold in Q1 FY2015.

The automakers and the industry analysts say that conventionally Q2 of any financial year is always better than the Q1 and the business done in the second half of any calendar year is mostly better than that of the first half. Going by that it is understood that the upcoming quarters will fetch better results to the companies.

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

By Amit Panday

By Amit Panday

30 Jul 2015

30 Jul 2015

16633 Views

16633 Views