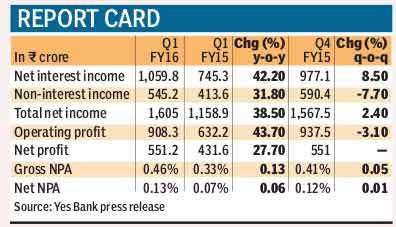

YES Bank on Wednesday reported a 27.7% y-o-y rise in net profit at Rs 551.20 crore, driven by growth in net interest income as well as non-interest income. In the first quarter of FY15, the bank had reported a net profit of Rs 431.60 crore.

Net interest income (NII) saw a considerable growth at 42.2% at Rs 1,059.80 crore on a y-o-y basis where as non-interest income surged 31.8% to Rs 545.20 crore compared to a year ago.

Total income saw a growth of 38.5% to Rs 1,605 crore. Net interest margins (NIMs) saw a marginal rise by one basis point to 3.3% compared with the previous quarter, while on a y-o-y basis, it rose 3 basis points. The lender saw a rise in operating profit of 43.7% to Rs 908.30 crore.

Rajat Monga, chief financial officer, YES Bank, said cost of funds came down to 7.6% in the first quarter compared with 7.8% in the previous quarter. Asset quality saw a dip with the gross non-performing assets (GNPAs) as a percentage of gross advances rising 13 basis points to 0.46% on a y-o-y basis, while net non-performing assets as a percentage of net advances rose six basis points to 0.13%.

On a sequential basis, GNPAs rose five basis points and NNPAs rose a marginal one basis point. Provisions rose 312.60% to Rs98 crore on a y-o-y basis, while they saw a drop of 22.5% compared to the previous quarter.

Total restructured advances stood at Rs567.10 crore as on June 30, 2015, representing 0.71% of gross advances, the bank said in its release, adding that there was no sale to asset reconstruction companies during the quarter.

Total advances grew 35.1% to Rs79,665.60 crore as on June 30 with corporate banking accounting for 67.8% of the advances portfolio. The bank’s Tier-I capital stood at 10.9%. YES bank has received approval from the Reserve Bank of India for setting up of an IFSC Banking Unit (IBU) in GIFT City Gujarat. The bank is planning to raise funds for its IBU operations that are expected to commence in the second quarter. “In the next three to six months — sooner not later — you should expect between $300million and $500 million of issuance,” said Monga.

In the domestic market, the lender is planning to raise capital through Basel-III-compliant Tier-II bonds. “We should be looking at another Rs700-800 crore capital through Basel-III-compliant tier-II bonds, mostly in the second quarter of this fiscal; may be with a possibility of a spillover to the third quarter,” Monga added.

YES Bank’s stock closed up 2.65% at Rs815.70 on Wednesday on BSE.