Amidst the brouhaha over valuations and billion-dollar fund raising, the stark reality of the Indian start-up ecosystem is: For every success story like Flipkart, there are at least a hundred that are floundering and struggling to even get the first round of funding.

Sahil Baghla, an IIT-Kanpur alumnus and founder of Bluegape.com, says, “It looks all glossy on paper but in reality it is a rollercoaster ride for the entrepreneur. Only one in 1,000 gets seed funding whereas every year 200 frugal start-ups are entering the ecosystem.”

Aaditya Goyal, an IIT-Kharagpur alumnus and founder of hyperlocal grocery app BigZop.com, says he had to write over a hundred mails and make 60-70 pitches before getting his first round.

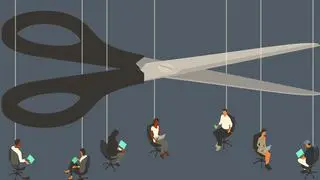

Even if a start-up manages to get the attention of venture capital firms and private equity investors, the next big challenge is how much stake to dilute. Companies, which gave away too much control to investors, have found the going tough. For example, a former co-founder of Yebhi.com told BusinessLine that the company had to change its business model repeatedly to keep investors happy even if the then promoters were not keen to do so.

“The investors in India put money based on just the idea. They are more worried about quick returns and put pressure on entrepreneurs, which sometimes leads to failure. In the US, even a seed round is done after going through things like proof of concept and validation by consumers,” said Rahul Anand, Founder of online kids apparel firm Hopscotch.in.

Valuation gameBusinessLine spoke to a number of start-up founders who say that entrepreneurs are just waking up to these issues. “If the billion-dollar funding raised by Flipkart started a series of big ticket funding in the e-commerce space, events that unfolded at real-estate portal Housing.com reveal the downside,” said a market watcher.

Online comedy channel The Viral Fever in its latest web-series talked about the challenges and difficulties the entrepreneurs are facing to raise the first round.

“Entrepreneurs should not fall into the trap of the valuation game from the beginning. Though angel funding is more easily available now, the terms are usually draconian. Many believe in taking a controlling stake. This leads to the founders being left with a minority single-digit stake after two-three rounds of fund-raising. They don’t have much say in the company,” said Hopscotch’s Anand.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.