Good Morning Traders,

As of this writing 4:30 AM EST, here’s what we see:

US Dollar: Up at 96.350, the US Dollar is up 60 ticks and trading at 96.350.

Energies: August Crude is down at 55.09.

Financials: The Sept 30 year bond is up 25 ticks and trading at 150.31.

Indices: The Sept S&P 500 emini ES contract is down 45 ticks and trading at 2055.75.

Gold: The August gold contract is trading down at 1163.90 Gold is 39 ticks lower than its close.

Initial Conclusion

This is not a correlated market. The dollar is up+ and oil is down- which is normal and the 30 year bond is trading lower. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are down and Crude is trading down which is not correlated. Gold is trading down which is correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

All of Asia traded lower with the exception of the Shanghai exchange which traded higher. As of this writing all of Europe is trading lower.

Possible Challenges To Traders Today

- Final Services PMI is out at 9:45 AM EST. This is major.

- ISM Non-Manufacturing PMI is out at 10 AM EST. This is major.

- Labor Market Conditions Index m/m is out at 10 AM EST. This is not major.

Currencies

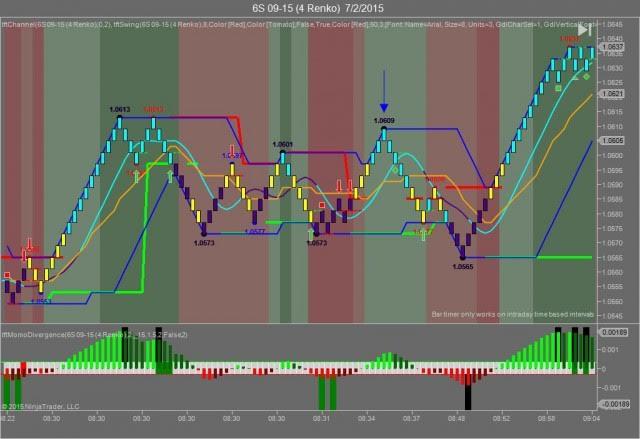

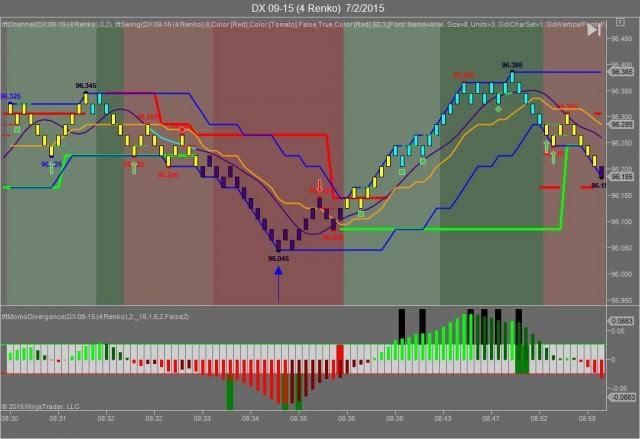

Last Thursday the Swiss Franc made it’s move at around 8:35 AM EST immediately after the Non-Farm Payroll numbers was released. The USD hit a low at around that time and the Swiss Franc hit a high. If you look at the charts below the USD gave a signal at around 8:35 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at around 8:35 AM EST and the Swiss Franc hit a high. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted 20 plus ticks on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

On Thursday we said our bias was neutral as it was a Non-Farm Payrolls day and the markets historically have never shown any sense of normalcy on this day. The markets initially shot up but after 11 AM EST declined and went into negative territory and remained there for the rest of the session. The Dow closed down 28 points and the other indices lost ground as well. Today we aren’t dealing with a correlated and our bias is to the downside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Another monthly jobs report and whereas the US economy showed a gain of 223,000 jobs, guess what? It still didn’t meet the expectation of a net gain of 231,000. Additionally Unemployment Claims rose to 281,000 versus an estimate of 270,000. This did not bode well with traders just prior to a major holiday weekend. On the plus side the Unemployment Rate fell to 5.3%. Please keep in mind that this is the “official” rate and doesn’t take into consideration the long term unemployed or those seeking full time work. That rate stands at 10.5% or nearly double the official rate. No sooner was this news released when the analysts and pundits claimed that the Fed was on target for a September rate hike. Not so fast. The Fed has a dual mandate: low unemployment and battling inflation above 2%. The unemployment rate may be dropping but inflation is basically benign in the United States currently. Chair Yellen also looks at the U6 and that isn’t dropping fast enough. Chair Yellen stated repeatedly at the last FOMC Meeting that a rate hike would be in tandem with economic news that justifies it. I don’t think we’re there yet. Now the Fed may raise rates in September but I think that given their past mindset; they may wait until 2016. But of course, time will tell if this occurs.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.