Now, in the government’s latest Memorandum of Economic and Financial Policies, Finance Minister Ishaq Dar has assured that any shortfall in tax revenues will be met through additional measures, just falling short of saying that indirect taxes will be imposed and existing rates will be raised — in effect, increasing the tax burden on those who already pay taxes instead of expanding the tax net. This basically amounts to punishing taxpaying citizens for the government’s own incompetence through imposing mini-budgets. In the past, these have hardly ever achieved the desired results, but clearly no lessons have been learnt.

In the budget, the government has tried penalising those who don’t file their tax returns. But this reward-punishment strategy will not work. The fault lies in the manner the tax returns are supposed to be filed and the public’s avoidance of the same. However, this area continues to be ignored and instead there is reliance on mini-budgets to compensate for the shortcomings of the country’s tax machinery. It seems that the only way the authorities might be pushed into instituting substantial tax reforms is if the IMF insists on this being done. It is a pity that there may be no hope of progress in such a vital area of governance otherwise.

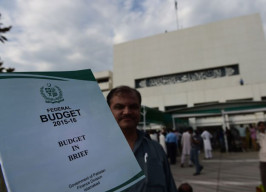

Published in The Express Tribune, July 6th, 2015.

Like Opinion & Editorial on Facebook, follow @ETOpEd on Twitter to receive all updates on all our daily pieces.

1714129906-0/Clint-Eastwood-(1)1714129906-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ