Catastrophic EMEA External Storage Market in 1Q15 – IDC

Plunging 6% Y/Y and 13% Q/Q, and all top 5 with lower sales

This is a Press Release edited by StorageNewsletter.com on July 3, 2015 at 2:41 pmThe external disk storage systems market in Europe, the Middle East, and Africa (EMEA) in the first quarter of 201Q15 registered one of its heftiest declines in recent years, dropping 6% year over year to $1.7 billion in user value, according to the IDC Corp.‘s EMEA Quarterly Disk Storage Systems Tracker 1Q15.

Total capacity grew 16% year on year to 2.9EB, with a slowdown in $/GB due to the increasing adoption of flash-powered systems.

However, looking at the impact of the euro on the storage market presents a completely different view of the market, with growth of almost 15% year on year and a value of €1.5 billion.

“Heavy currency swings and uncertain political conditions weighed down the storage systems market in the first quarter, where only new, high-growth segments such as cloud and flash have been spared by the drop in investments,” said Silvia Cosso, senior research analyst, european infrastructure, IDC. “For example, the ODM segment, with its 112% year-on-year growth, has spiked to almost 6% of the total EMEA hardware storage market in the quarter, up from 3% in 1Q14. As a result, the companies focused around one of these high-growth segments have managed to keep afloat as opposed to big, more generalist ones.”

Regional Highlights

“Rapid growth in data volumes is pushing Western European organizations to optimize their storage infrastructures by adding newer storage technologies such as flash arrays into the mix,” said Archana Venkatraman, senior analyst, european storage research, IDC. “The increased acceptability of all-flash arrays, thanks to compelling use cases around sub-millisecond latency and high performances, has kept the technology immune to the slump seen in the other segments of the storage market.”

The number of flash deals is increasing every quarter and adoption of flash will further accelerate in Western Europe as economies of scale come into the picture, IDC believes.

“A continued decline in high-end systems, longer IT purchase cycles, and the gradual move to cloud storage for non-critical data were also key contributors for the storage market decline this quarter,” said Venkatraman.

Meanwhile, the Central and Eastern Europe, Middle East, and Africa (CEMA) external storage market declined 2.2% over 1Q14, accounting for $424.8 million in user value, but increased in terms of capacity, up 42.8% to 566.3 petabytes.

“Capacity in the region surged mostly due to the Middle East and Africa [MEA] region seeing intense investments by government and enterprise segments in high-end and flash-enhanced storage solutions,” said Marina Kostova, storage systems analyst, IDC CEMA.

The Central and Eastern Europe (CEE) market behaved similarly to the Western European market as the region recorded its severest year-on-year decline in U.S. dollars since 2009 (-14.7%). The trend, however, was not seen in all countries but was triggered by the continuing unfavorable conditions in Russia and Ukraine. The usually quieter first quarter of the year maintained momentum from the end of 2014 and turned pipeline projects into actual orders in most CEE countries.

MEA continued on its growth trajectory with 8.8% year-on-year growth in storage spending, accounting for nearly 60% of the total CEMA market. The usual market leaders, Israel and South Africa, were pulled down by weak investments in traditional storage solutions, while Turkey and the Gulf countries performed well and captured half the total regional storage investments.

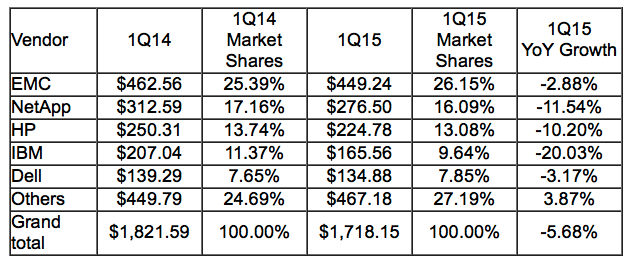

Top 5 Vendors, EMEA External Disk Storage Systems Value

(in $ million)

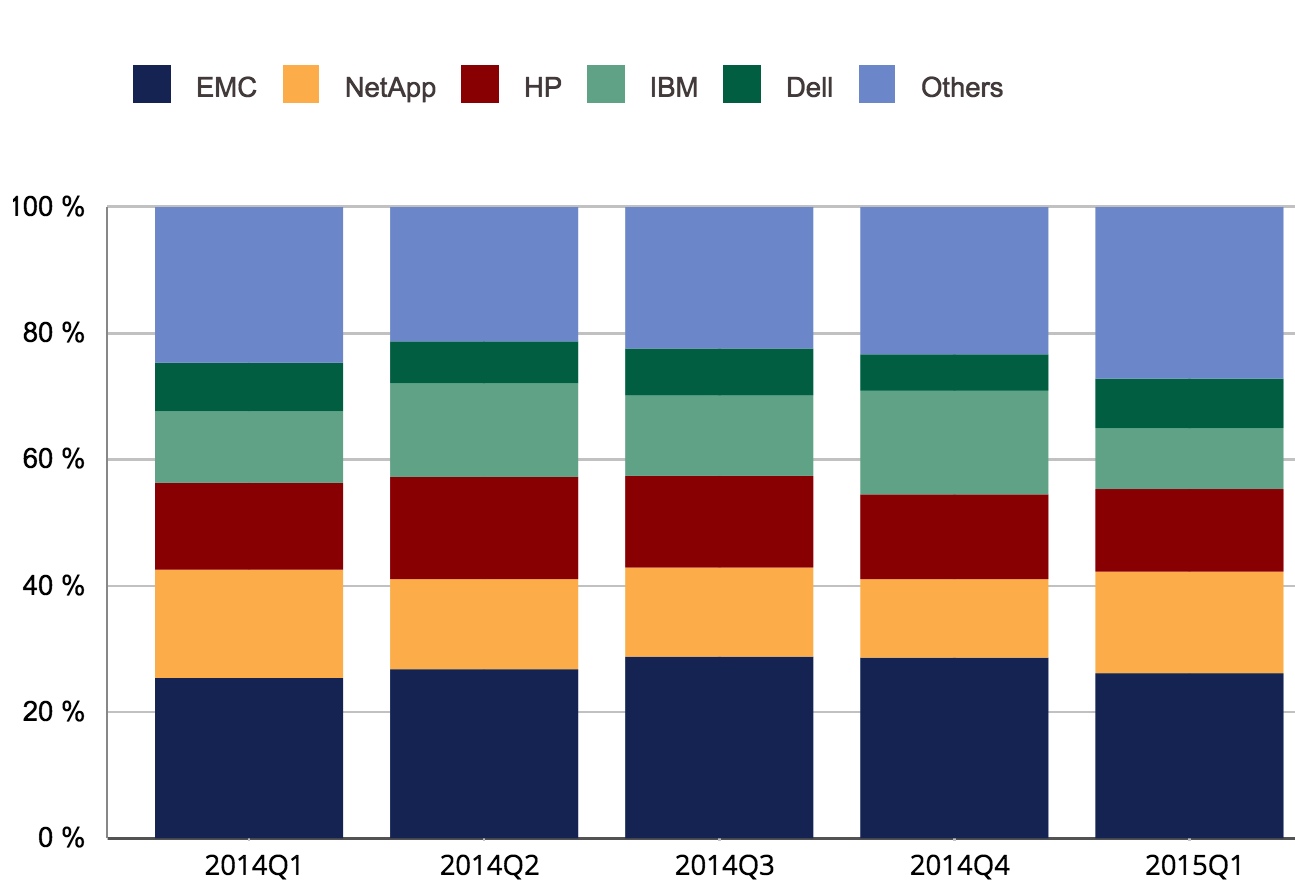

Top 5 Vendors, EMEA External Disk Storage Systems, 1Q15

(value market share) (Source: IDC EMEA Quarterly Disk Storage Systems Tracker, 2015)

(Source: IDC EMEA Quarterly Disk Storage Systems Tracker, 2015)

Read also:

EMEA External Storage Market Up Just 1.4% in 4Q14 From 4Q13 – IDC

Hitachi +18%, IBM +6%, NetApp -6%, HP -9%

2015.03.16 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter