Upbeat Indian auto component industry targets 8-10% growth in FY16

In what marks a positive trend for the current fiscal, the Indian auto component industry has driven past its projected growth of 8-10% for fiscal 2014-15.

In what marks a positive trend for the current fiscal, the Indian auto component industry has driven past its projected growth of 8-10% for fiscal 2014-15. The industry has notched growth of 11.1% percent over 2013-14, posting a CAGR of 11 percent for the past 6 years.

As a result, the industry is optimistic of posting good numbers in the current fiscal 2015-16. “We expect the component sector to grow at a minimum of 8-10% this fiscal. The ‘Make in India’ programme will be a success in the auto parts industry with the support extended by the Union government,” said Ramesh Suri, president of ACMA (seen below with ACMA director general Vinnie Mehta), while announcing the sector’s results for 2014-15 today in New Delhi.

Adding weight to his comments is the gradual recovery witnessed in the Medium and Heavy Commercial Vehicle (M&HCV) industry which currently accounts for a 13% percent share of domestic components supply. Along with LCVs (4%), SCVs (1%), the domestic CV industry sources 18% of the total parts supply. ACMA says the largest consumer of components is the passenger vehicle segment at 45%.

In FY2014-15, the Indian auto parts sector’s turnover stood at Rs 2,348 crore emanating from the supply chain which caters to both on-road and off-road automakers, the aftermarket in India and overseas players, captive suppliers to OEMs and unorganised and small players.

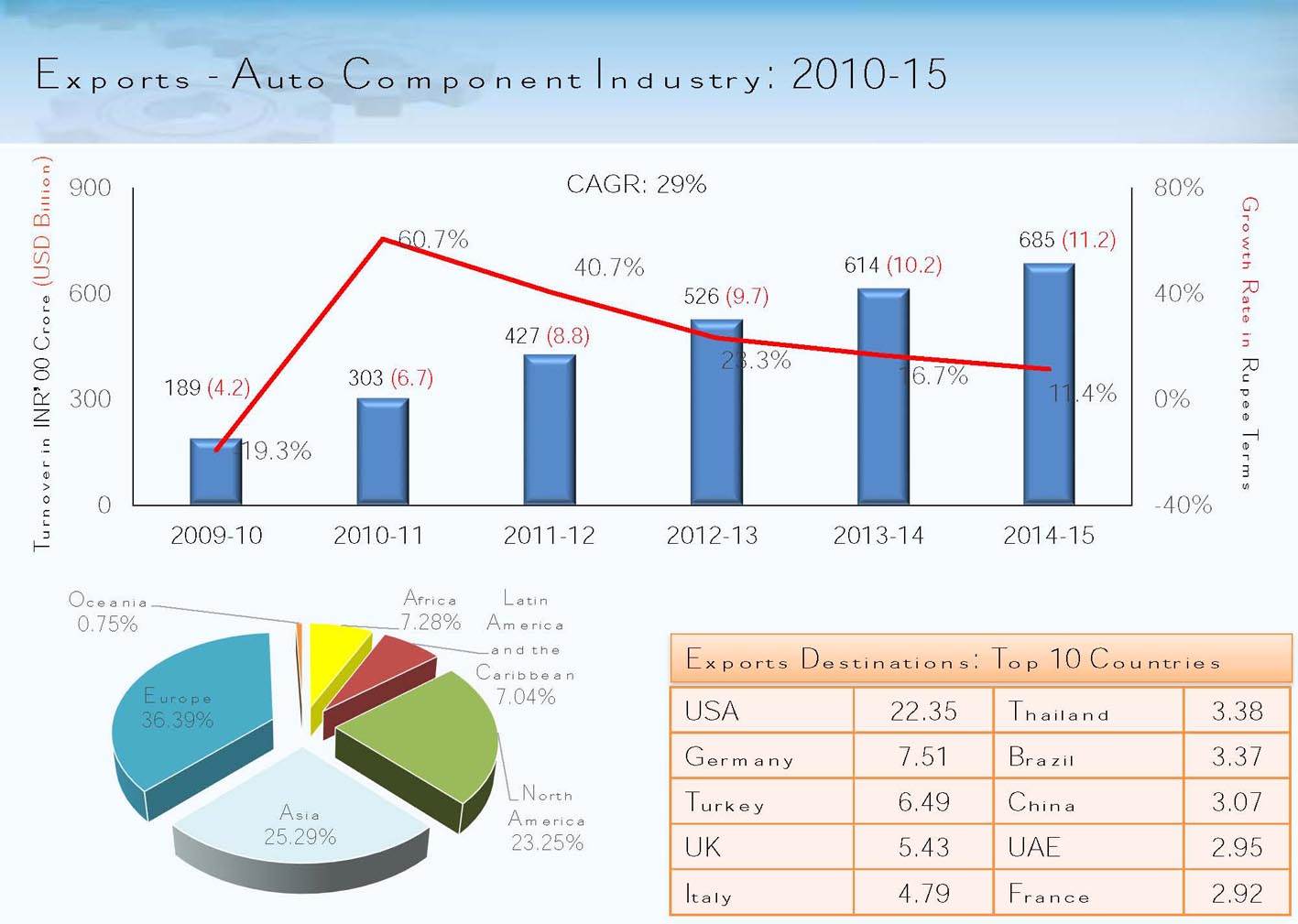

While imports continued to maintain an edge over exports, exports grew by 11.4% to Rs 68,500 crore from Rs 61,400 crore in 2013-14, recording a CAGR of 29% for the 2010-2015 period.

According to ACMA’s Industry Performance Review 2014-15, Europe accounted for 36.9% of total exports followed by Asia (25.2%) and North America (23.2%). Exports to Africa, Latin America and North America rose by 12.6%, 4.6% and 18.9% over the previous fiscal with key exports comprising engine and transmission parts, brake systems and components, body parts, exhaust systems, turbochargers. During 2010-15, USA was the top export market (22.35%), followed by Germany (7.51%) and Turkey (6.49%).

In comparison, imports grew by a slower 7.5% to Rs 82,900 crore in FY’15 from Rs 77,160 crore in FY’14. Asia and Europe accounted for 57.9% and 32.4% percent of total imports respectively. Within Asia, China is the leading importer (23.94%), followed by Germany (14.57%) and Japan (11.53%) for the 2010-15 period.

CONSISTENTLY IMPROVING PRODUCT QUALITY

With new products and advanced technologies entering India through joint ventures and technology partnerships or even acquisitions, Indian auto components are steadily improving in terms of quality and cost competitiveness.

“Tier 1s are doing well and are fully equipped to absorb technologies. They have product development capability and are able to meet both present and future requirements of customers,” said Suri.

Citing the example of Daimler India Commercial Vehicles’ BharatBenz trucks, he pointed out that along with BMW, it had begun large scale localisation of parts to make its products cost competitive. BMW has increased the level of localisation in its cars assembled at the Chennai plant by up to 50 percent, and has inked partnerships with seven leading Indian suppliers for sourcing of components. Hyundai Motors India is also fast driving up its localisation levels, which will give a further impetus to the domestic parts industry.

The two-wheeler industry, which is currently seeing flat growth, is expected to bounce back and with leading players like hero MotoCorp and Honda Motorcycles & Scooters India planning new plants, the parts industry should be able to optimise its capacity utilization in the near future.

BUT CHALLENGES REMAIN. . .

However, not all is hunky dory. Challenges remain in terms of MSMEs which constitute 80 percent of the component industry. Some hand- holding and partnerships between Tier 1s and Tier 2s is the need of the hour if the industry has to achieve its projected turnover of $100 billion by 2020, of which exports will contribute $35-40 billion with $20-22 billion revenue coming from overseas assets.

Lower interest rates besides support in R&D initiatives as well as increased penetration in export markets will make the Tier 2s and 3 companies more self-sufficient. At present, the component industry’s total spend on R&D is less than a meagre 0.5 percent.

Current capacity utilisation in the components industry stands at 60-70% percent as a result of the slow offtake in the past two years. This means there will not be any major capacity addition in the current fiscal, according to Vinnie Mehta, director general, ACMA.

However counterfeits continue to remain a problem flooding the Indian aftermarket that is worth Rs 39,875 crore. Counterfeits and fakes account for a third of this market with the largest chunk of these products coming from China. This scenario has not seen any abatement. With increasing vehicle parc in the country, the aftermarket grew by 12 percent in FY’15.

The menace of counterfeit parts continues to remain a problem area, flooding the Indian aftermarket that is worth Rs 39,875 crore and grew by 12% in 2014-15. Counterfeits and fakes account for a third of this market with the largest chunk of these products, believed to be originating from China.

OPPORTUNITIES TO BE HAD

ACMA is confident that Indian companies can offer themselves as an alternate base to produce parts like castings and forgings, which are much sought after in Europe and USA. Importantly, the industry has taken the government’s zero defect policy in manufacturing very seriously and is working in close sync with vehicle manufacturers to keep a strict tab on product quality through regular meetings and checks on components at various stages of manufacturing. Vehicle OEMs are also conducting audits of the supply chain and assembly lines.

The component industry is optimistic that the enforcement of GST from 1 April 2016 will be a boon for the auto sector as will some more incentives in terms of lower interest rates for accessing finance and removal of customs duties on import of select raw materials.

“We have been asking for some aluminium alloys, certain grades of steel as well as aluminium and steel scrap that is used for making ingots to have nil duty,” says Mehta. This would make production more cost effective.

Captains of the Indian components industry, however, are silent on the expected investments in the current fiscal. Capital investments are estimated to have been around Rs 1,980-Rs 2,767 crore in FY15. Due to moderation in vehicle sales and depressed market sentiment, investment declined compared to Rs 3,200-Rs 4,400 crore in FY2013-14.

Nevertheless, the overall mood in the industry is buoyant and driven by the uptick in passenger car and M&HCV sales. ACMA says the industry is driving towards its overarching goal in the year 2020, with a target of crossing the US$ 100 billion mark including exports of US$ 30-40 billion.

RELATED ARTICLES

Maruti Suzuki’s SUV and MPV production jumps 100% to 58,226 units in January 2024

Utility vehicle market leader’s two plants in Haryana along with Suzuki Motor Gujarat’s facility hit a record monthly hi...

Car and SUV users in Bengaluru and Pune took over 27 minutes to travel 10km in CY2023

Traffic remains a challenge worldwide as life returns to pre-pandemic levels. Four Indian cities are among the 80 cities...

Indian car and 2W OEMs recall 284,906 vehicles in 2023 and 5.35 million since 2012

CY2023 saw three two-wheeler manufacturers proactively recall 122,068 motorcycles and five car and SUV producers recall ...

By Shobha Mathur

By Shobha Mathur

30 Jun 2015

30 Jun 2015

9875 Views

9875 Views