Four ethical shares worth buying

19th June 2015 17:24

by Harriet Mann from interactive investor

Share on

It used to be that so-called "ethical" investment vehicles were the pariahs of the financial world, but responsible investing has flourished in recent years as individuals realise ethics and attractive returns are not mutually exclusive. Of course, just because a company ticks all the green boxes doesn't mean it will generate killer profits. But adding a form of ethical screening to your stock picking process can be fruitful.

Take ; the computer giant is ranked number one of many Socially Responsible Investing (SRI) lists, including Corporate Responsibility's 100 Best Corporate Citizens 2015. Its share price has more than doubled over the last five years and there's a 2.4% dividend yield.

Although ethical investing sounds simple enough, its subjective nature makes it a difficult strategy to adhere to. While the following list can be used as pick and mix, ethical blacklists tend to include those companies involved in, or seen to condone, child labour, human rights abuse, pornography, arms, tobacco, fossil fuels and alcohol.

And while responsible investing used to be associated with lacklustre returns, attitudes to the industry are changing both in the City - with the launch of a Corporate Human Rights Benchmark, for example - and among retail investors.

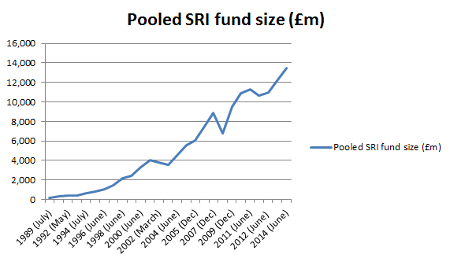

Not only is more money being pumped into responsible retail funds - EIRIS estimates over £13.5 billion in 2014 - but the public's ethical attitudes have become stricter. Now, more investors than ever would avoid investment vehicles known to profit from zero-hour contracts, fracking and tax avoidance, according to ethical investment platform Abundance.

A 2011 study by The Guardian and development charity ActionAid claimed that 98% of FTSE 100 companies used tax havens to avoid paying 100% of their tax. Four years down the line and the statistics are likely to have changed, but given the opaque nature of the issue, non-profit organisation Fair Tax wanted to reward corporations for transparency and fairness. So far, they have awarded utility , bus and train operator and temp work recruiter the Fair Tax Mark. SSE is the first blue-chip to get it.

Source: EIRIS

A fifth of investors would also want to move their money out of fossil fuel investments, according to the Abundance study, with two-thirds believing fossil fuel holdings are becoming riskier. In fact, the momentum for renewable alternatives is gathering such traction that reports this week claimed "clean" energy could overtake coal as a source of electricity supply in just 15 years.

As the European Sustainability Energy Week draws to a close, there is evidence that the force for change is being driven across industries. The recent oil price bear run can only have helped drive innovation and investment in cleaner energy, aided by changing attitudes in the transport and automobile industries and hardening governmental policies across the globe.

There is no doubt that increasing consumer momentum for "green" products has made its way to the forefront of many investors' minds. As policies tighten, attitudes harden and the City responds, it will only become easier to invest in an increasingly transparent industry.

Go Ahead Group

Go-Ahead is nearing the end of its financial year and strong returns are forecast. Broker Nomura reckon return on capital employed (ROCE) will reach 16.7%, growing to 19.6% in 2016. With 37% of 2016's net earnings expected to come from the UK regional bus business, 31% from London buses and 32% from UK rail, they see the group as having the most attractive exposure to the bus and rail sector. They upgraded the stock to 'buy' in April, along with a juicy target price hike to 2,950p from 2,550p.

On Investec's estimates of 153.3p earnings per share (EPS) in 2015, the shares currently trade on 17 times forward earnings after a 13% share price increase since the beginning of April.

Legal & General

Popular with many ethical open-ended vehicles, including the , financial services group is yielding over 4.4%, with tempting double-digit earnings per share (EPS) growth forecast into 2016. Analysts at Deutsche Bank reckon recent price weakness - they're down 14% since March and trading around the 200-day moving average (see chart) - presents an attractive entry point.

The group holds a unique position in the pensions market by offering corporate schemes asset management and de-risking solutions, say analysts at Barclays. The business has successfully grown to manage over $1 trillion of assets, expanding from simply being a UK passive funds provider. Describing the group's business model as "disruptive", Shore Capital analyst Eamonn Flanagan reckons it has much further to run, with significant upside potential.

Staffline

Staffline recruits for logistics, manufacturing, driving and food processing companies, supplying thousands of workers a day to 1,300 clients. Analysts at finnCap expect it to report 54% EPS growth in 2015 after the company confirmed last month that trading was in line with expectations. Its staffing business had a fantastic start to the year and its newly acquired A4E business helped drive performance at the 'welfare to work' division, now rebranded PeoplePlus.

Staffline has experienced massive market growth since 2010 and the shares have jumped by a third this last year. But finnCap thinks there's more in the tank. Their 1,546p target price represents 20% upside to current levels.

Good Energy Group

Supplying renewable energy to homes and businesses in the UK, sources its electricity from owned operations, other renewable generation assets and straight from the market. Nearly a fifth of its electricity is supplied from its 9.2 megawatt (MW) Delabole windfarm in North Yorkshire, contributing to its total wind power installed capacity of 17.4MW. After developing 100MW of solar power, the group decided to sell the majority of this capacity and now has has 6.8MW remaining. It has a group pipeline worth 200MW.

Installed capacity is all well and good, but the electricity provider needs to be attractive enough next to bigger power groups for consumers. It keeps pricing competitive and profitable by owning a portfolio with significant growth potential and through power purchase agreements with small renewable developers. Earnings will likely dip this year following a period of investment , but Cantor Fitzgerald is confident this short-term hiccup masks underlying growth, forecasting EPS growth of over 15%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.