Essar Power’s Rs 8,000-crore thermal power plant in Tori, Jharkhand, is on hold with bankers reluctant to lend to the project, a highly placed company official told FE. Lenders want the project to get reliable coal linkage and be assured of the project’s viability within a definitive time. Sushil Maroo, managing director and CEO, Essar Power, said that the power producer has so far invested R3,500 crore in the project. Maroo said it would take 20 months to reach date of commencement of commercial operations, provided funds were available.

The 2014 annual report of Essar Power Jharkand, the subsidiary that houses the project, notes delays in implementation and a change in technology resulted in a cost escalation of 46% from the original R5,700 crore to R8,308 crore. The overrun was expected to be financed in a debt-equity ratio of 3:1.

Auditors to Essar Power Jharkand have pointed out that owing to the cancellation of the coal blocks, the company may need to record an impairment charge. The company’s response is that in the event of the coal blocks coming up for reallocation, it will have the first right of refusal.

Moreover, it says the power purchase agreement can be exited without penalty, which is why it has not provided for an impairment in the value of the carrying amount of fixed assets of Rs 3,387 crore.

“Auditors have sought impairment charges on Tori. Our point is that if it’s a permanent loss you treat it as a permanent loss, if its temporary loss treat it as temporary and if there is a chance of recouping it you treat it like that. It is only the coal which is not there,” Maroo said.

“The Tori power project was under execution and we spent a lot of money but the two mines were cancelled . Now, the banks are not disbursing money because there is no coal. We are waiting for the next round of auctions,” Maroo told FE. He added that while the Chakla mine is present in the list of government mines to be auctioned soon, another allotted to it, Ashok Karkata, isn’t.

While the first phase of the project, for 1,200MW, is estimated at 8,308 crore, FE could not verify the cost for the second phase for 600 MW.

The Mumbai-headquartered company, part of the $35-billion Essar Group, had the Chakla and Ashok Karkata mines allocated to it in 2007 for the 1,800 MW power project. It lost the mines in August 2014 when the Supreme Court declared that 214 of 218 coal blocks allocated since 1993 were illegal.

Essar Power acquired the rights to the Tokisud North coal block in Jharkhand in March. However, the block will be utilised for the 1,200 MW coal-based power plant located in Mahan in Madhya Pradesh, despite the Tori project being closer than Mahan. Maroo explained that the coal from Tokisud cannot be used for the Tori plant was because the mine was allocated to the company for the purposes of the Mahan project only. Also, the mine has only 50 million tonnes of reserves, which is not enough to serve both plants. “We are making Tokisud operational in two to three months. As soon as this become operational, the 1,200 MW Mahan plant will become functional,” Maroo said.

The CEO said that the company can import coal but that was a costly option given that the government insists imports must be brought in from the western part of the country. That would entail moving the coal thousands of kilometres to reach the power project site.

Essar Power Jharkhand’s 2014 annual report notes that the Tori Project is being implemented in two phases of 1,200 MW (Tori I) and 600 MW (Tori II). The company has signed 3 PPAs — two with Bihar State Electricity Board and one with Noida Power — aggregating 990 MW. These PPAs were scheduled to be operational between April 2014 and October 2015 but the company said it has sought for an extension due to regulatory delays and de-allocation of the coal blocks.

As at the end of March 2014, 43% of the construction at Tori I was complete, while at Tori II, 17% had been completed.

Maroo said using e-auction coal was not an option since prices were too high. “No plant can run purely on e-auction coal, just 5% or so of the capacity can be run this way. Cement and steel companies can pay more than utilities because the cost of coal in the overall product is small,” he explained.

The company’s flagship project, the 515 MW multi-fuel plant in Hazira, Gujarat, is stranded for want of fuel. Apart from that, expansions to Salaya in Gujarat (Salaya II and Salaya III), a greenfield coal-fired project named Navabharat I, totalling 2,970 MW, have also been put on hold. The total investment cost of the three projects was pegged at Rs 15,240 crore.

“Nobody is looking at any expansions right now. Projects like Navabharat, Salaya 2 and 3 are on hold. All our power expansions are on hold till we make these projects viable and sellable and are able to stabilise them,” Maroo said.

Essar Power had bought Navabharat Power in two tranches in July 2010 and April 2011 for around Rs 230 crore.

Following the acquisition, Essar Power had invested more than Rs 500 crore in developing the project and has also achieved financial closure, with ICICI Bank having underwritten debt financing of more than Rs 3,720 crore, according to a press release dated September 5, 2012. The project was awaiting further government approvals at the time. Navabharat had a coal mine allocated to it, Rampia in Odisha, whose licence was cancelled with the others in September 2014.

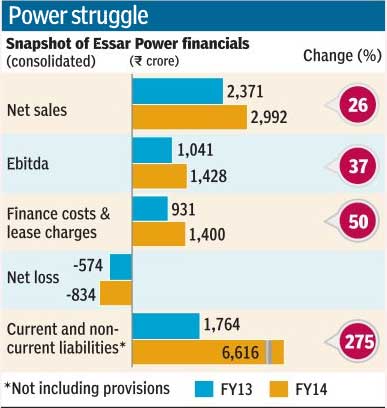

Essar Power’s FY14 consolidated borrowings, which include long-term and short-term and current liabilities, trade payables grew almost four times from its fiscal 2013 number to Rs 6,616 crore. Finance costs and lease charges for the same period doubled from Rs 931 crore at the end of FY13 to Rs 1,400 crore in FY14.

Comparatively, consolidated net sales rose 26% to Rs 2,992 crore while net loss widened from Rs 512 crore at the end of FY13 to Rs 793 crore in FY14.