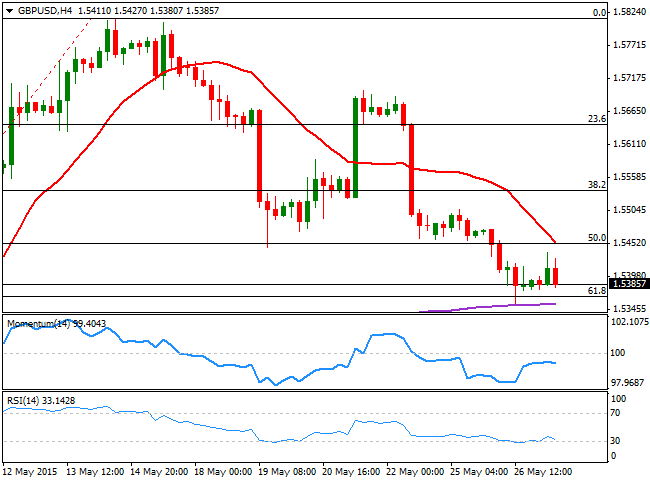

The GBP/USD pair consolidates in between Fibonacci levels and near a 3-week low, stuck around the 1.5400 level. There are no scheduled news in the UK for this Wednesday, and little relevant ahead in the US, which means the pair will probably trade based on sentiment and technical readings today, and therefore, the downside remains favored.

The 4 hours chart shows that the 20 SMA heads sharply lower around the 1.5440/50 region, a few pips above the 50% retracement of the latest bullish run, while the technical indicators have turned back south after a limited correction in negative territory, of oversold readings, all of which supports additional declines. The price has bounced yesterday from its 200 EMA, a few pips below the 61.8% retracement both in the 1.5350 region, so it will take a break below this last to see the pair extending its decline towards the 1.5300 price zone, in route to 1.5260, a strong static support level.

To the upside, 1.5440 continues to be the critical resistance, with a break above it required to change the bias towards the upside, eyeing as the immediate short term target the 1.5480/90 price zone.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.