Good results; remain positive. Reliance Industries Ltd (RIL) reported 20% quarter-on-quarter increase in standalone Ebitda (earnings before interest taxes depreciation and amortisation) to R86.3 bn, led by higher refining margins and 23% q-o-q increase in net income to R62.4 bn, boosted by lower interest cost. FY15 standalone earnings per share increased 3% to R70 and consolidated EPS increased 5% to R80 (adjusted for treasury shares). Potential value erosion from non-core businesses remains a concern, although we believe RIL (Buy, target price R1,040) can outperform broader markets given its relatively inexpensive valuations.

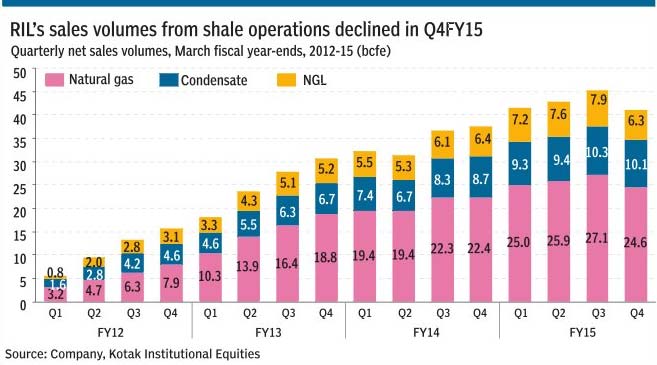

Robust Ebitda; net income boosted by lower interest cost: RIL reported 20% q-o-q increase in standalone Ebitda, 1.5% below our estimate. Lower interest cost aided net income, which increased 23% q-o-q, 4.6% ahead of our estimates. Consolidated Ebitda increased 14% q-o-q to R98.7 bn, partially impacted by lower profitability of the shale business. Consolidated net income increased 21% q-o-q to R63.8 bn, benefiting from lower interest and DD&A (depletion, depreciation and amortisation) expenses.

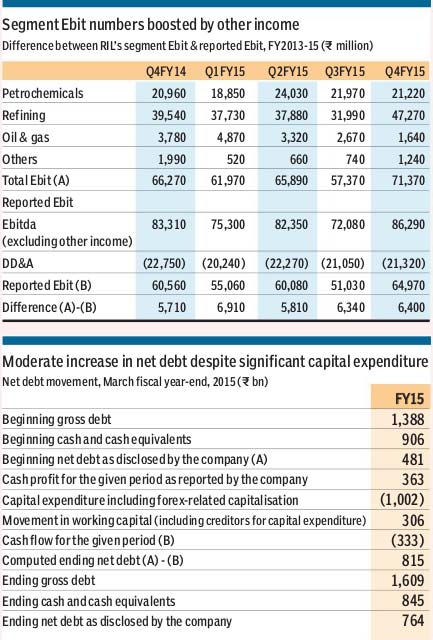

Sharp increase in refining Ebit; steady petchem Ebit: Refining segment Ebit increased 48% q-o-q to R47.3 bn despite lower crude throughput at 16.2 mt (-8.5% q-o-q) due to shutdown, reflecting higher refining margins (+$2.8/bbl q-o-q). Petchem segment Ebit declined by a modest 3.4% q-o-q to R21.2 bn in Q4FY15, reflecting (i) lower production volumes and (ii) lower realised margins during the quarter.

E&P (exploration & production) segment Ebit declined to R1.6 bn in Q4FY15 from R2.7 bn in Q3FY15, reflecting lower crude oil realisations and decline in production volumes. Retail business Ebit declined to R1.04 bn in Q4FY15 from R1.3 bn in Q3FY15 despite 2% growth in revenues to R48 bn. Shale business Ebit declined to R3.4 bn in Q4CY14 from R5.7 bn in Q3CY14, led by lower crude and gas realisations.

Moderate increase in net debt despite capex: Consolidated net debt (net of liquid investments) increased to $12.2 bn as of March 31, 2015 from $8 bn as of March 31, 2014, as a significant portion of FY15 capital expenditure of $16 bn (including forex-related capitalisation) was funded by $6 bn of cash profits and $5 bn of working capital savings, including creditors for capital expenditure.

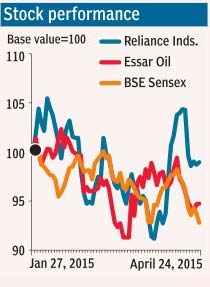

Fine-tune estimates: We revise our FY16-18e EPS estimates (standalone) for RIL to R75.8 (+2.2%), R87.9 (+2.7%) and R92.8 (+0.9%) to reflect (i) details from FY15 results, (ii) higher other income and (iii) other minor changes. We retain our Buy rating on the RIL stock with an unchanged SOTP(sum-of-the-parts)-based target price of R1,040, noting (i) inexpensive valuations at 11.1x FY16e adjusted EPS versus BSE-30 Index at 17.6x and (ii) strong earnings growth led by core business projects. Our reverse valuation exercise shows the RIL stock is ascribing 5.4x FY17e EV(enterprise value) /Ebitda to its core businesses, while factoring in nil equity value from the non-core businesses (telecom/shale).

Key highlights of Q4 consolidated results

* Steady performance of retail business. RIL’s retail business has reported higher revenues of R48 bn but lower Ebit of R1.04 bn in Q4FY15 versus R47 bn and R1.3 bn in Q3. RIL has added 336 stores in Q4, increasing the overall store count to 2,621.

* Weak performance of US shale business. RIL’s shale business reported 33% q-o-q decline in revenues to $138m and 48% decline in Ebitda to $91m in Q4CY14, reflecting 5% decline in production volumes to 49.4 bcfe (billions of cubic feet equivalent) and lower realisations on both oil and gas. RIL has consolidated sequentially lower revenues of R1.3 bn (-14% q-o-q) and lower Ebit at R3.4 bn (-41% q-o-q) pertaining to Q4CY14 in Q4FY15 financials. The company invested $234m in Q1CY15; cumulative investments across US shale JVs stand at $8.1 bn as of March 31, 2015.

* Sharp increase in net fixed assets. RIL’s net fixed assets have increased to R3.18 tn as of March 31, 2015 from R2.33 tn as of March 31, 2014, reflecting an addition of R972 bn to gross fixed assets, which includes (i) capitalisation due to difference in exchange rate and (ii) capex in ongoing core-business projects and incremental investments in non-core businesses of shale and telecom.

* Increase in gross debt; decline in cash and liquid investments. RIL’s gross debt has increased to R1.61 tn in FY15 from R1.39 tn in FY14, while its cash and liquid investments have declined to R845 bn from R906 bn.

* Moderate increase in net debt. Consolidated net debt (net of liquid investments) increased rather moderately to $12.2 bn from $8 bn, as a significant portion of FY15 capex of $16 bn was funded by $6 bn of cash profits and $5 bn of working capital savings.

* Increase in capital employed of telecom business. The capital employed in telecom business increased to R524 bn in FY15 as compared to R378 bn in FY14. We note that the capital employed excludes R150 bn of deferred payment pertaining to the bandwidth acquired in 800/1800 MHz spectrum in February 2014 and March 2015.

For Updates Check Market News; follow us on Facebook and Twitter