Friday’s Low Was a Touch on a Potential (But Highly Unlikely) Price Channel Bottom – Suggests Low for Move isn’t In Yet

Friday’s low was an exact touch on the bottom of a potential (but highly unlikely in this spot) price channel for SPY (though not for ES).

Then SPDR S&P 500 (ARCA:SPY) and ES retraced at the close to their 20- and 50-dma’s.

ES has put in a legal falling megaphone bottom (bright blue in chart below) for the move down from Wednesday’s high, but a complete falling megaphone bottom in this spot would imply a limited retrace (green scenario in chart below).

The falling megaphone is also still legal for another wave down (the formation top can still be redrawn). This scenario would require ES to plunge right away at the Sunday night open, and would imply a trip all the way to the bottom of the triangle that ES has been forming since February. But this scenario is unlikely too because of retrace requirements for the blue topping megaphone on the chart.

Falling Megaphone (Bright Blue) vs Megaphone Bottom (Purple Scenario)

There’s also a potential head and shoulders on the ES chart (red neckline in chart above). The scenario with the highest odds in this spot is a volatile megaphone bottom (purple scenario) before one final wave up to the top of the blue megaphone.

Basically ES would return to the top of that blue megaphone roughly 2/3 of the time. And in order to get the price back to the megaphone top the market would typically require enough of a fight here and enough fake-outs to get a lot of traders positioned wrong.

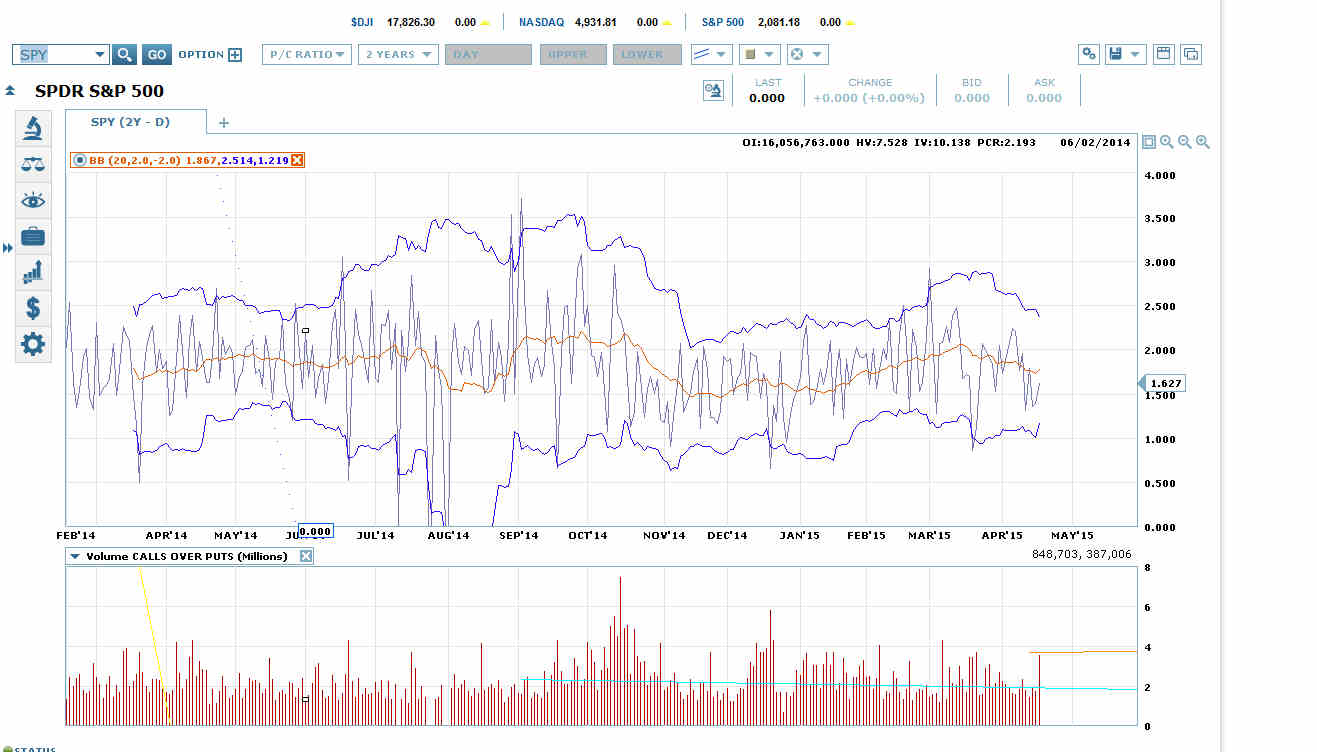

This is especially the case since the SPY put-call ratio shows absolutely no excess bearish sentiment after Friday’s drop. Instead, on yet another rise in open interest, and a huge jump in both put and call volume, the ratio didn’t even make it back to its 20 dma for the close of opex week.

The SPY Put-Call Ratio Ended the Week Still Below its 20 dma on Another Rise in Open Interest and Huge Jump in Both Put and Call Volume

In other words, both bulls and bears continue to dig in as SPY put volume rose more than 100%, while SPY call volume rose a little less than 100%.