Logistics and transport service company, VRL Logistics received an astounding response to its three-day public issue that closed on Friday, with bids valued at close to R33,500 crore – higher than Coal India’s recently concluded offer for sale (OFS) worth R23,000 crore. The initial public offering (IPO) was subscribed more than 74 times – an eight-year high – as on 7 pm , stock exchange data showed.

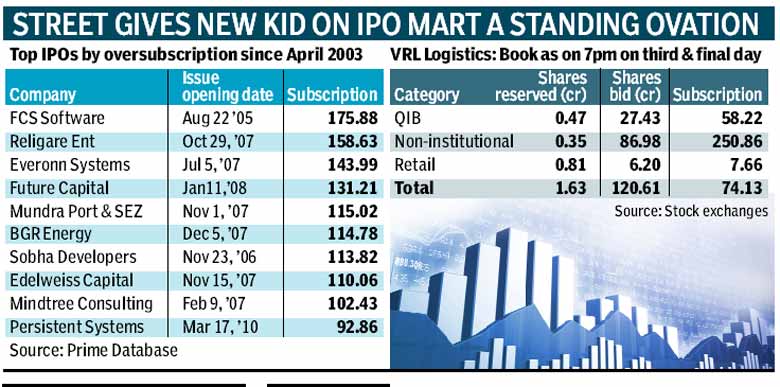

Reliance Power’s IPO was subscribed 73 times in January 2008, while the Power Finance Corp (PFC) IPO in January 2007 was oversubscribed 77.24 times. Delhi-based IT services company, FCS Software Solutions’ IPO too saw record participation in 2005. Its issue was subscribed 175.88 times, data shows.

VRL had aimed to raise R451 crore at the lower price band of R195 per share. At the upper price band of R205, the company was targetting R468 crore from public investors. The non-institutional book, comprising high net-worth individuals (HNIs), was subscribed 250.86 times.

More than 86.98 crore shares were bid against 34.67 lakh shares reserved for this category, stock exchange data showed.

Retail investors, whose investment should not exceed a total R2 lakh as per Sebi rules, hailed the issue, citing valuations. Small-time investors flocked in large numbers even as the company opted not to offer any discount. The retail book was subscribed 7.66 times on Friday. The retail category was subscribed 2.38 times on Thursday vis-a-vis 0.59 times on Wednesday.

The Qualified Institutional Buyers (QIB) book was subscribed 58.22 times compared with 1.27 times on Thursday and 0.36 times on Wednesday. Institutions applied for 27.43 crore shares against 47.11 lakh shares on offer, data showed.

In the grey market, VRL’s shares were quoting at a premium of R80-90 on the final day of bidding. Grey market is a pseudo over the counter market where IPO shares are bought and sold before officially listing on a stock exchange.

The company raised R140.36 crore by issuing 68.46 lakh shares to anchor investors in a pre-IPO placement. The allotment was made at R205 per share.

Post the IPO, the promoters’ stake will decline to 69.5%, 25% will be held by public and remaining 5% would be held by investors. HSBC Securities and Capital Markets and ICICI Securities are financial advisors to the issue.

This is the company’s second attempt to enter the capital markets. In December 2010, the Karnataka-based company had filed draft documents with Sebi for an IPO of 2.35 crore equity shares.

VRL is the fourth public issue on the main board this calendar. So far, three companies — Ortel Communications, Adlabs Entertainment and Inox Wind — have tapped primary markets, cumulatively raising an upward of R1,500 crore.