India Storage Market Expected to Revive in 2015 – IDC

Following last year's decline

This is a Press Release edited by StorageNewsletter.com on April 14, 2015 at 2:47 pmAccording to IDC India, the external storage systems market saw a marginal year-on-year decline in vendor revenue and stood at $60.85 million for Q4 2014.

However, storage capacity sold continues to grow irrespective of the revenue decline and witnessed a double-digit year-on-year growth in Q4 2014 due to a decrease in the cost per gigabyte depicting the ever-increasing storage demand.

According to IDC’s AsiaPac Quarterly Enterprise Storage Tracker, the marginal decline in CY 2014 is attributed to a combination of reasons owing to adoption of technologies like virtualization and compression that are pushing the capacity demand to decrease from its traditional trajectory, growing acceptability of cloud-based storage and services and pending investments across verticals that were expected in 2014.

A combination of infrastructure refresh across verticals, government projects and announcements (taking some shape and form of implementation), and investments from new age organizations in verticals like e-commerce are expected to boost storage demand in CY 2015.

Consolidation needs coupled with optimization of storage infrastructure due to a sudden increase in both structured and unstructured data is driving organizations to consider solutions and products beyond the traditional route. High priority on backup and DR solutions across organizations due to reasons like compliance/regulations is also expected to generate demand for disk storage solutions. The need for high IO/s for workloads like OLTP, VDI and BI are driving the growth of flash storage across organizations in all verticals and segments.

Banking, manufacturing, communications & media and professional services continued to be the dominant verticals in Q4 2014 though a marginal decline was witnessed in banking and communication & media verticals when compared to Q3 2014. Healthcare and transportation emerged as the fastest growing verticals in Q4 2014 and are expected to contribute in CY 2015 as well.

According to Dileep Nadimpalli, senior market analyst, storage, IDC India, “Cloud-based storage is gaining traction particularly in the SMB segment, as well as among new start-ups and enterprises for their non-critical business data. All the storage vendors are positioning their cloud offerings accordingly to capture the incremental growth in SMB segment.”

Gaurav Sharma, research manager, enterprise infrastructure, IDC India, says: “Digitization drives across verticals and key segments are generating unprecedented levels of content and data that are expected to boost storage demand in CY 2015, though organizations may choose to route some of this storage to the ‘non-traditional’ cloud- and software-based solutions as well. Mid-range systems will continue to garner more interest and investments as they inch closer to enterprise capabilities and scalability. Emerging verticals and players across segments will play a significant role in providing a noticeable mindset shift from traditional storage planning, evaluation, and buying patterns in CY 2015.“

Major Vendors Analysis

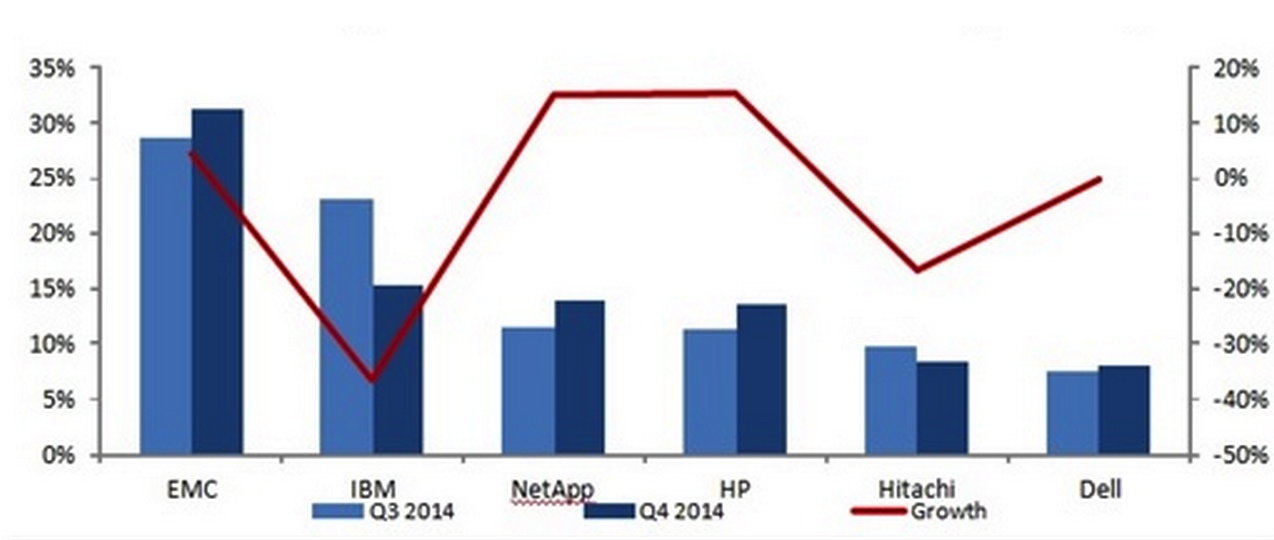

EMC continued to lead the market and increased its share to 31% from 29% in Q4 2014 with their stock and sell business model also starting to contribute. IBM held the 2nd spot with 15% market share but witnessed a sharp de-growth. Netapp and HP increased their share in Q4 2014 (quarter-on-quarter).

India External Storage marker – Vendor Revenue Share and Growth – Q3 2014 Vs. Q4 2014

(Source: IDC APeJ External Storage Tracker Q4 2014)

IDC India Forecast

The external enterprise storage systems market is expected to witness a year-on-year growth in 2015. Investments in refresh/upgrade, data centre expansions and management of storage needs owing to 3rd Platform technologies and workloads are expected to drive the storage demand in CY 2015.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter