The petroleum ministry has decided against allowing any increase in the price of gas from the Ravva hydrocarbon fields in the Krishna-Godavari basin despite the operator Cairn India clamouring for a hike.

The ministry feels that though the relevant production sharing contract (PSC) provides for a price revision, it doesn’t mandate changing the gas price more than once. Given that the price was once revised (in 2006), the ministry reckons there is no obligation on the government to revise it again and has written to the law ministry for an endorsement of this view.

The ministry’s stance has made matters worse for the Vedanta Group firm, which, as a member of a consortium that consists of state-run ONGC, Videocon Industries and Ravva Oil, operates the Ravva field and adjacent satellite field. The consortium’s plea for an extension of the PSC life for 10 years from the current expiry date (2019-20) was earlier rejected by the upstream regulator Directorate General of Hydrocarbons (DGH), which agreed for only a five-year extension.

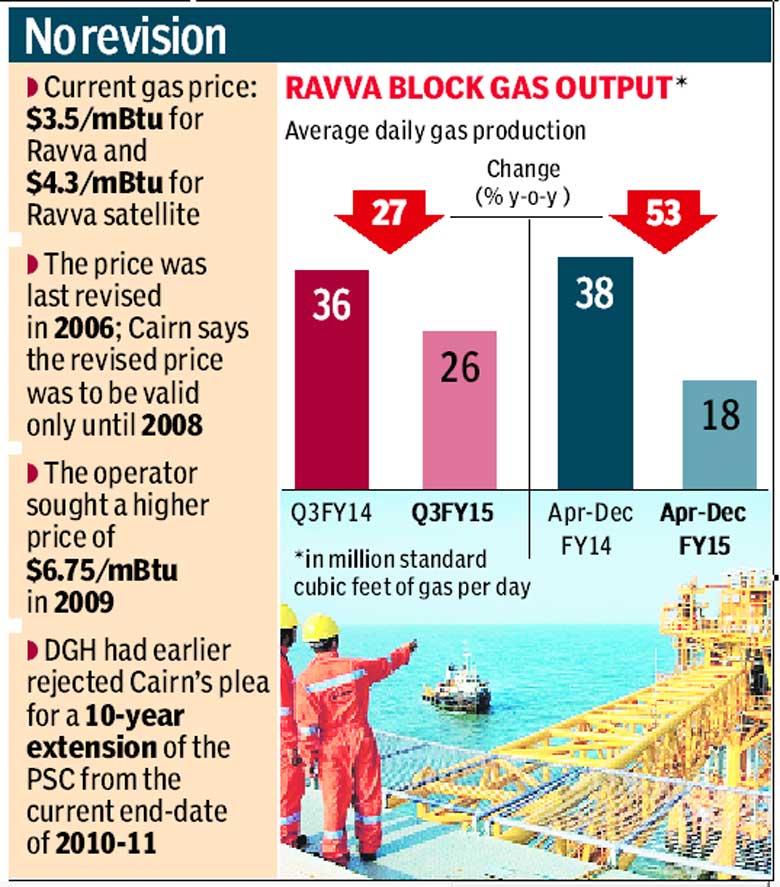

Currently, crude oil production from the Ravva asset hovers around 26,000 barrels per day and gas production is showing early signs of tapering off, with output falling below one million metric standard cubic metres per day (mmscmd). The output declined a huge 53% y-o-y in the first nine months of the last fiscal.

The private explorer is of the view that maximum selling price of $3.5/mBtu for Ravva and $4.3/mBtu for Ravva satellite gas, decided in 2006, was due for revision in 2008. It asked for a price of $6.75/mmBtu in 2009.

“Of course, the PSC says that gas price would be revised but this was already done (in 2006). The contract does not say that the price would be revised more than once,” a senior government official, familiar with the issue, told FE.

Yet, the ministry has sought the law ministry’s view to verify whether its interpretation is correct. “There are some issues and so we are seeking a legal opinion,” the official added.

For Cairn and the consortium members, the price revision and the 10-year extension of the PSC is important as it will accord them certainty over the exploitation of the asset. While the gas fields could dry up by 2019-20, the oil production profile of the asset extends up to 2024-25.

In 2009, GAIL, which buys Ravva gas, had objected to the price of $6.75 per mBtu sought by the Cairn-led consortium.

The Ravva PSC was signed in October 28, 1994, where Cairn India is the operator with a 22.5% stake in the asset. ONGC is the largest stakeholder with 40% followed by Videocon Industries (25%) and Ravva Oil (12.5%).

The Ravva block produced over 335 billion cubic feet of gas since inception in 1994, far greater than the resource estimate made at the time of the PSC award. The 12-well Ravva drilling campaign commenced in March 2014 and 8 of the wells have been successfully completed through Q3 FY15.