- News

- Business News

- India Business News

- Sun-Ranbaxy integration: Entity to corner 9% of desi market

Trending

This story is from March 26, 2015

Sun-Ranbaxy integration: Entity to corner 9% of desi market

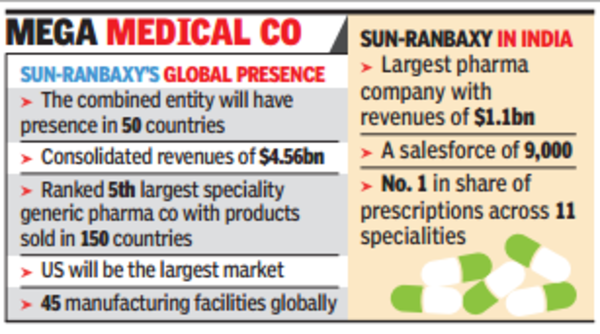

Following the successful closure of the $3.2 billion merger with troubled drug maker Ranbaxy, Dilip Shanghvi-led Sun Pharma said on Wednesday that the company is initiating the integration of the business, which will make the combined entity the fifth-largest speciality generic company in the world, with consolidated revenues of over $4.5 billion.

MUMBAI: Following the successful closure of the $3.2 billion merger with troubled drug maker Ranbaxy, Dilip Shanghvi-led Sun Pharma said on Wednesday that the company is initiating the integration of the business, which will make the combined entity the fifth-largest speciality generic company in the world, with consolidated revenues of over $4.5 billion.

The integrated entity -- with India revenues at $1.1 billion-- will corner a 9.1% share in the Rs 85,000 crore domestic pharma retail market. Post- transaction announced in April 2014 and completed on March 24 this year, Ranbaxy will be delisted from the stock exchanges after April 7, while the Ranbaxy brand will cease to exist on the country's retail shelves. According to the agreement, Ranbaxy shareholders will receive eight shares of Sun Pharma for every 10 shares of Ranbaxy.

Announcing an operational blueprint to achieve synergies through value-creation across various regions and functions, Sun Pharma MD Dilip Shanghvi said here on Wednesday that the integrated company will focus on five important businesses --US, India, emerging markets, consumer healthcare and APIs (active pharmaceutical ingredients or key raw materials), and grow in each of these, faster than the market.

The "most important focus” would be to "build a business on values, integrity, passion for success”, with the "objective is to become a better company, which the country can be proud of”, Shanghvi said, adding the company will "use and nurture the talent’’ of Ranbaxy.

The company is not considering any job cuts, he said. The people reporting directly to him have already been identified, and others could be accommodated in new roles, he said, without specifically mentioning the top leadership of Ranbaxy including its CEO and MD, Arun Sawhney.

In April last year, Sun Pharma had announced the deal to buy Ranbaxy for $3.2 billion in stock, in addition to $800 million debt. At today’s valuation, the deal is estimated around $5.5 billion.

Post merger, the Japanese parent of Ranbaxy, Daiichi Sankyo will become the second-largest shareholder in Sun Pharma, with an equity stake of around 9%. “We will engage with them as part of the ongoing relationship”, he said.

Talking about the problems that Ranbaxy went through with the US FDA due to lapses in manufacturing quality at some of its plants, Shanghvi said that his focus will be on winning the confidence of regulators. “We will do whatever it takes to build that confidence and trust (with the regulators)'' he said.

Ranbaxy had been filing 25-30 products annually earlier, but this has slowed down over the lat few years. “'We will understand why this has happened, and launch not only more generics, but differentiated products too,” he said.

Sun Pharma will offer a large basket of specialty and generic products, encompassing a broad range of chronic and acute prescription drugs as well as a ready foray into the global consumer healthcare market. Synergies from the merger estimated at $250 million, which will be achieved over a period of three years.

The company will invest over $300 million (over Rs 1,800 crore) in research and development in 2015-2016, which would be 6-7% of the combined revenue.

The acquisition of Ranbaxy would also not restrict the combined entity from making further large acquisitions, Shanghvi said, adding the idea is to be a low cost producer with high credibility in all markets.

Says Sarabjit Kour Nangra VP research - pharma, Angel Broking “On the profitability front, the company is estimated at OPM of 31.6%, which is still very healthy, given that Ranbaxy is currently operating at a low OPM. The company is confident of turning around the same, given its history of turning around its acquisitions (Caraco, Taro, DUSA and URL) in the past”.

The integrated entity -- with India revenues at $1.1 billion-- will corner a 9.1% share in the Rs 85,000 crore domestic pharma retail market. Post- transaction announced in April 2014 and completed on March 24 this year, Ranbaxy will be delisted from the stock exchanges after April 7, while the Ranbaxy brand will cease to exist on the country's retail shelves. According to the agreement, Ranbaxy shareholders will receive eight shares of Sun Pharma for every 10 shares of Ranbaxy.

Announcing an operational blueprint to achieve synergies through value-creation across various regions and functions, Sun Pharma MD Dilip Shanghvi said here on Wednesday that the integrated company will focus on five important businesses --US, India, emerging markets, consumer healthcare and APIs (active pharmaceutical ingredients or key raw materials), and grow in each of these, faster than the market.

The "most important focus” would be to "build a business on values, integrity, passion for success”, with the "objective is to become a better company, which the country can be proud of”, Shanghvi said, adding the company will "use and nurture the talent’’ of Ranbaxy.

The company is not considering any job cuts, he said. The people reporting directly to him have already been identified, and others could be accommodated in new roles, he said, without specifically mentioning the top leadership of Ranbaxy including its CEO and MD, Arun Sawhney.

In April last year, Sun Pharma had announced the deal to buy Ranbaxy for $3.2 billion in stock, in addition to $800 million debt. At today’s valuation, the deal is estimated around $5.5 billion.

Post merger, the Japanese parent of Ranbaxy, Daiichi Sankyo will become the second-largest shareholder in Sun Pharma, with an equity stake of around 9%. “We will engage with them as part of the ongoing relationship”, he said.

Talking about the problems that Ranbaxy went through with the US FDA due to lapses in manufacturing quality at some of its plants, Shanghvi said that his focus will be on winning the confidence of regulators. “We will do whatever it takes to build that confidence and trust (with the regulators)'' he said.

Ranbaxy had been filing 25-30 products annually earlier, but this has slowed down over the lat few years. “'We will understand why this has happened, and launch not only more generics, but differentiated products too,” he said.

Sun Pharma will offer a large basket of specialty and generic products, encompassing a broad range of chronic and acute prescription drugs as well as a ready foray into the global consumer healthcare market. Synergies from the merger estimated at $250 million, which will be achieved over a period of three years.

The company will invest over $300 million (over Rs 1,800 crore) in research and development in 2015-2016, which would be 6-7% of the combined revenue.

The acquisition of Ranbaxy would also not restrict the combined entity from making further large acquisitions, Shanghvi said, adding the idea is to be a low cost producer with high credibility in all markets.

Says Sarabjit Kour Nangra VP research - pharma, Angel Broking “On the profitability front, the company is estimated at OPM of 31.6%, which is still very healthy, given that Ranbaxy is currently operating at a low OPM. The company is confident of turning around the same, given its history of turning around its acquisitions (Caraco, Taro, DUSA and URL) in the past”.

End of Article

FOLLOW US ON SOCIAL MEDIA