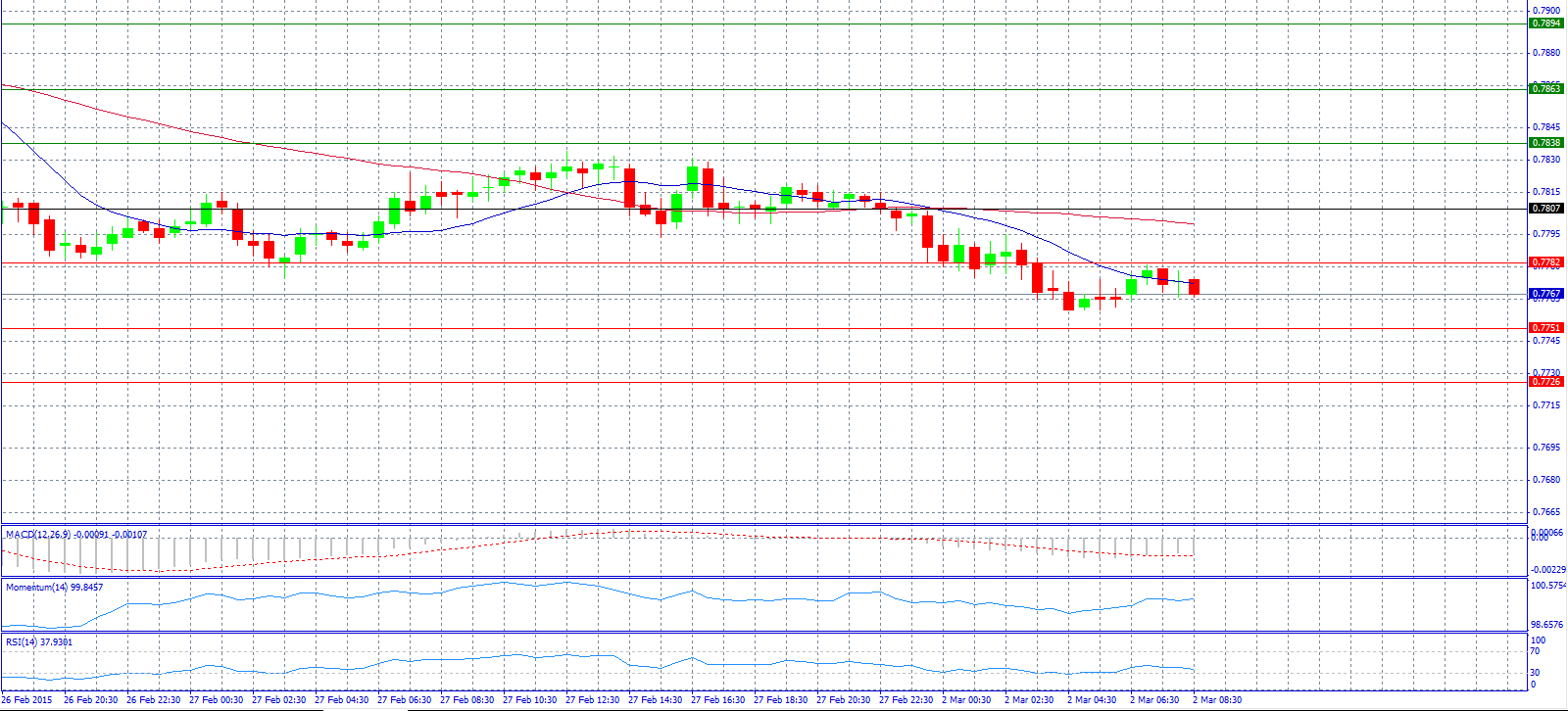

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7807 with target @ 0.7863.

Market Scenario 2: Short positions below 0.7807 with target @ 0.7726.

Comment: Australian dollar suffered losses against the US dollar after the release of Australian AIG performance of the Mfg. Index by the Australian Industry Group.

Supports and Resistances:

R3 0.7894

R2 0.7863

R1 0.7838

PP 0.7807

S1 0.7782

S2 0.7751

S3 0.7726

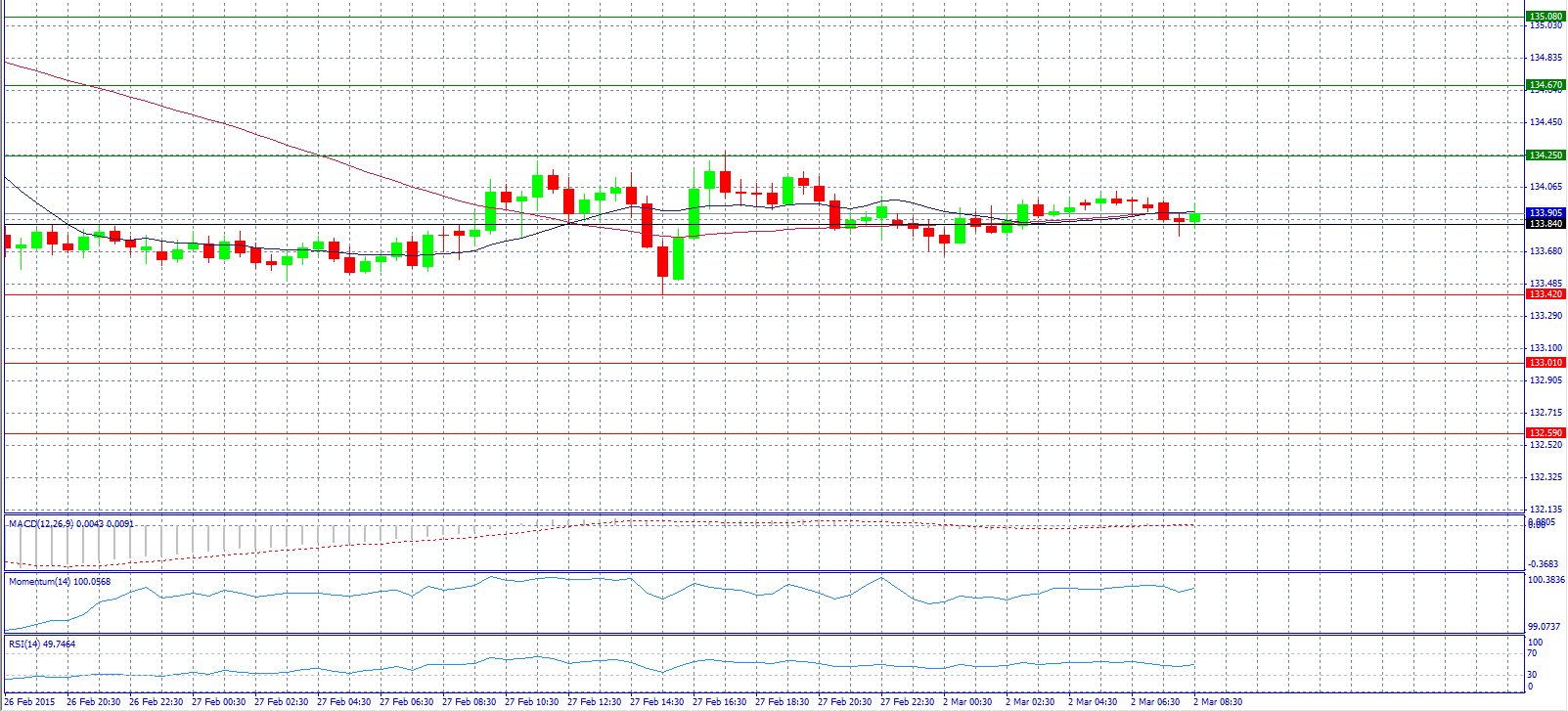

Market Scenario 1: Long positions above 133.84 with target @ 134.25.

Market Scenario 2: Short positions below 133.84 with target @ 133.42.

Comment: The pair reached 134.00 level in the morning session which was unexpected from the moment that euro is falling against the US dollar.

Supports and Resistances:

R3 135.08

R2 134.67

R1 134.25

PP 133.84

S1 133.42

S2 133.01

S3 132.59

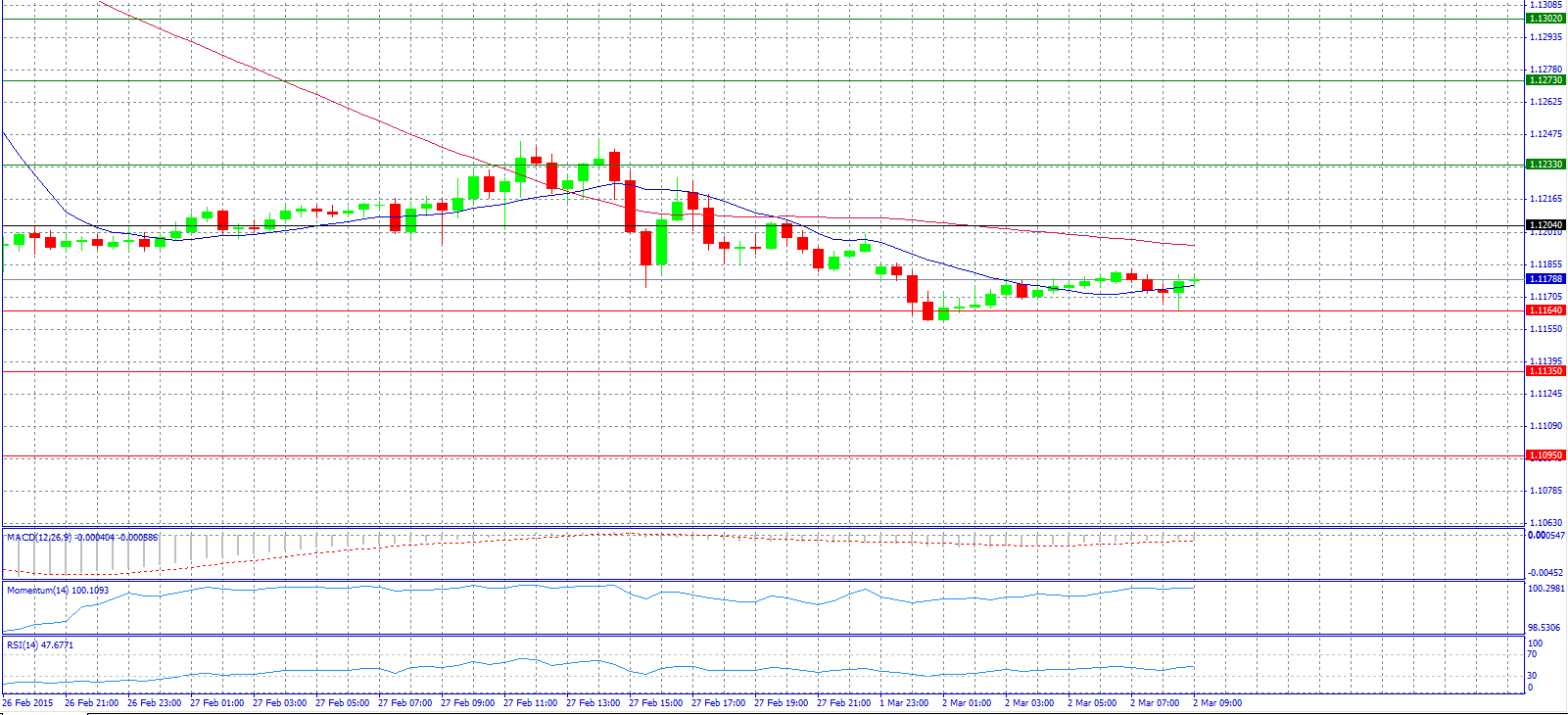

Market Scenario 1: Long positions above 1.1204 with target @ 1.1233.

Market Scenario 2: Short positions below 1.1204 with target @ 1.1164.

Comment: The pair awaits EMU’s CPI, ECB while the outlook of it still remains negative.

Supports and Resistances:

R3 1.1302

R2 1.1273

R1 1.1233

PP 1.1204

S1 1.1164

S2 1.1135

S3 1.1095

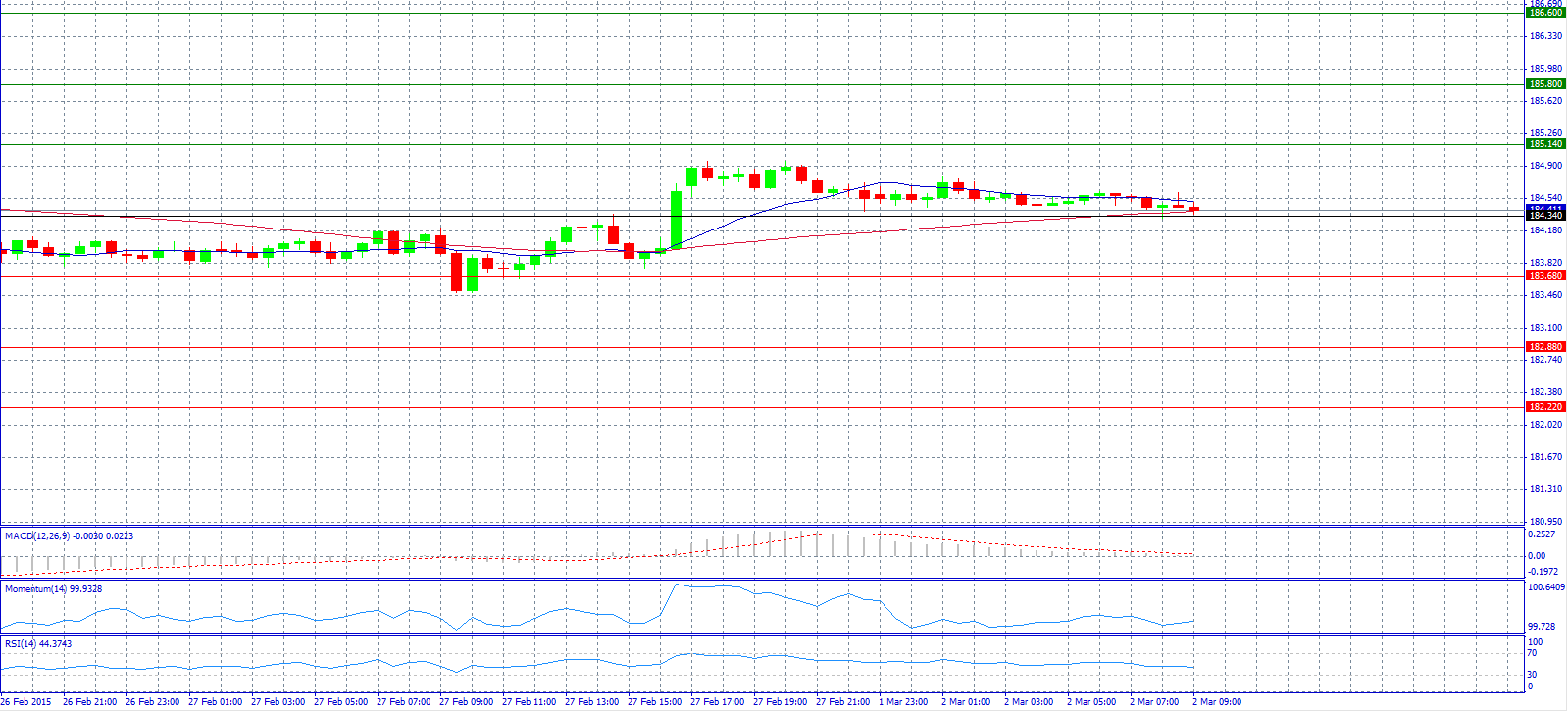

Market Scenario 1: Long positions above 184.34 with target @ 185.14.

Market Scenario 2: Short positions below 184.34 with target @ 183.68.

Comment: The pair shows weakness as it awaits UK PMI data.

Supports and Resistances:

R3 186.60

R2 185.80

R1 185.14

PP 184.34

S1 183.68

S2 182.88

S3 182.22

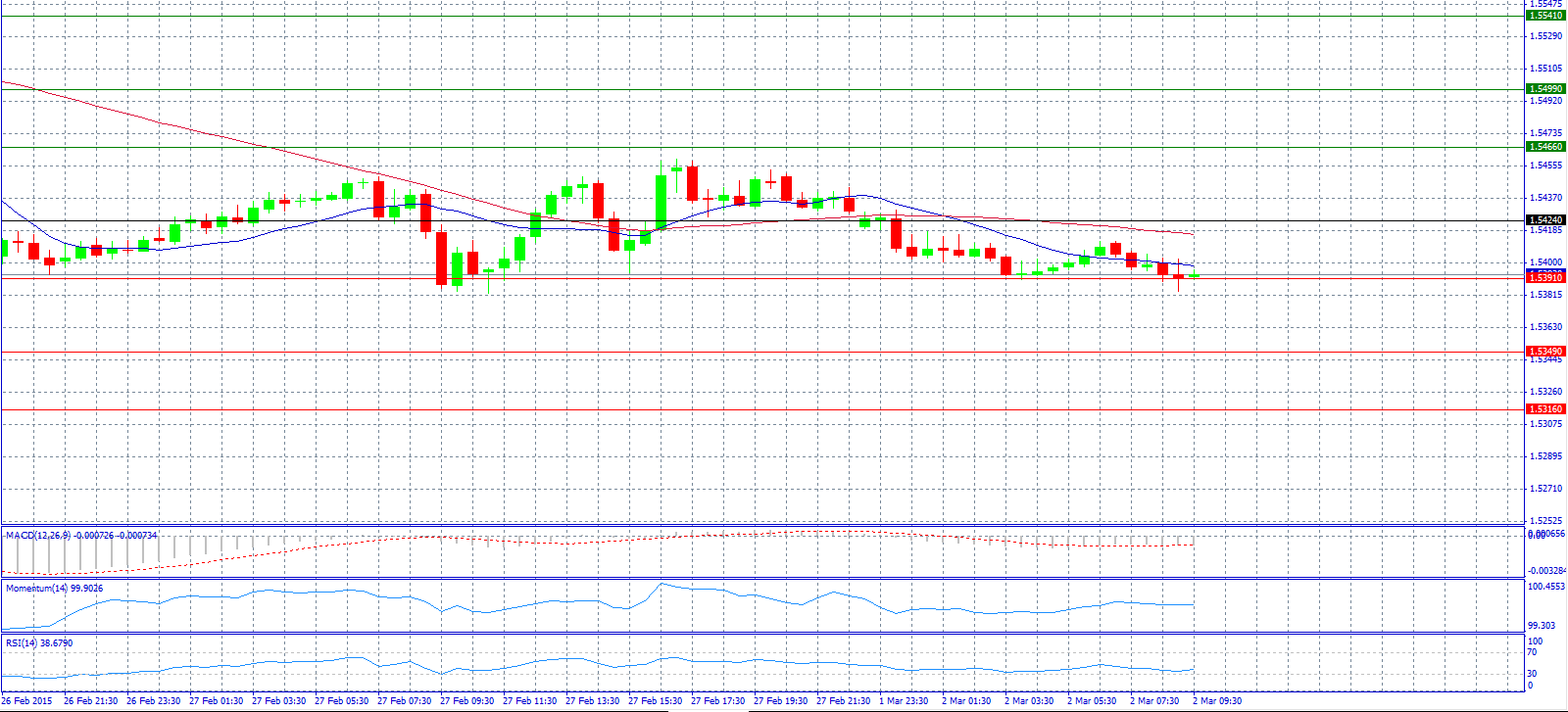

Market Scenario 1: Long positions above 1.5424 with target @ 1.5466.

Market Scenario 2: Short positions below 1.5424 with target @ 1.5349.

Comment: The pair is trading near 1.5400 level.

Supports and Resistances:

R3 1.5541

R2 1.5499

R1 1.5466

PP 1.5424

S1 1.5391

S2 1.5349

S3 1.5316

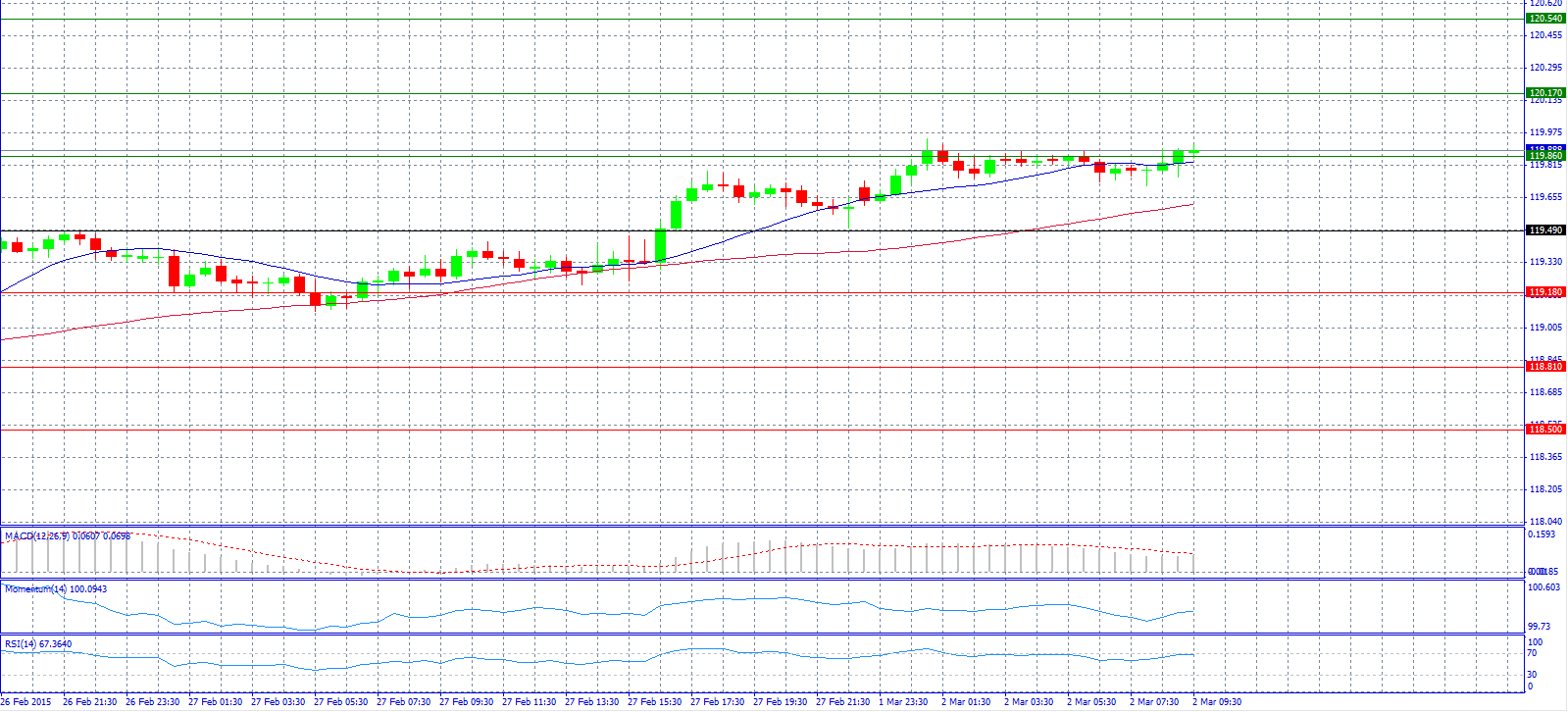

Market Scenario 1: Long positions above 119.49 with target @ 120.17.

Market Scenario 2: Short positions below 119.49 with target @ 119.18.

Comment: The pair is heading for 120.00 level with the Tokyo’s demand extending the rally on the basis of a strong dollar.

Supports and Resistances:

R3 120.54

R2 120.17

R1 119.86

PP 119.49

S1 118.18

S2 118.81

S3 118.50

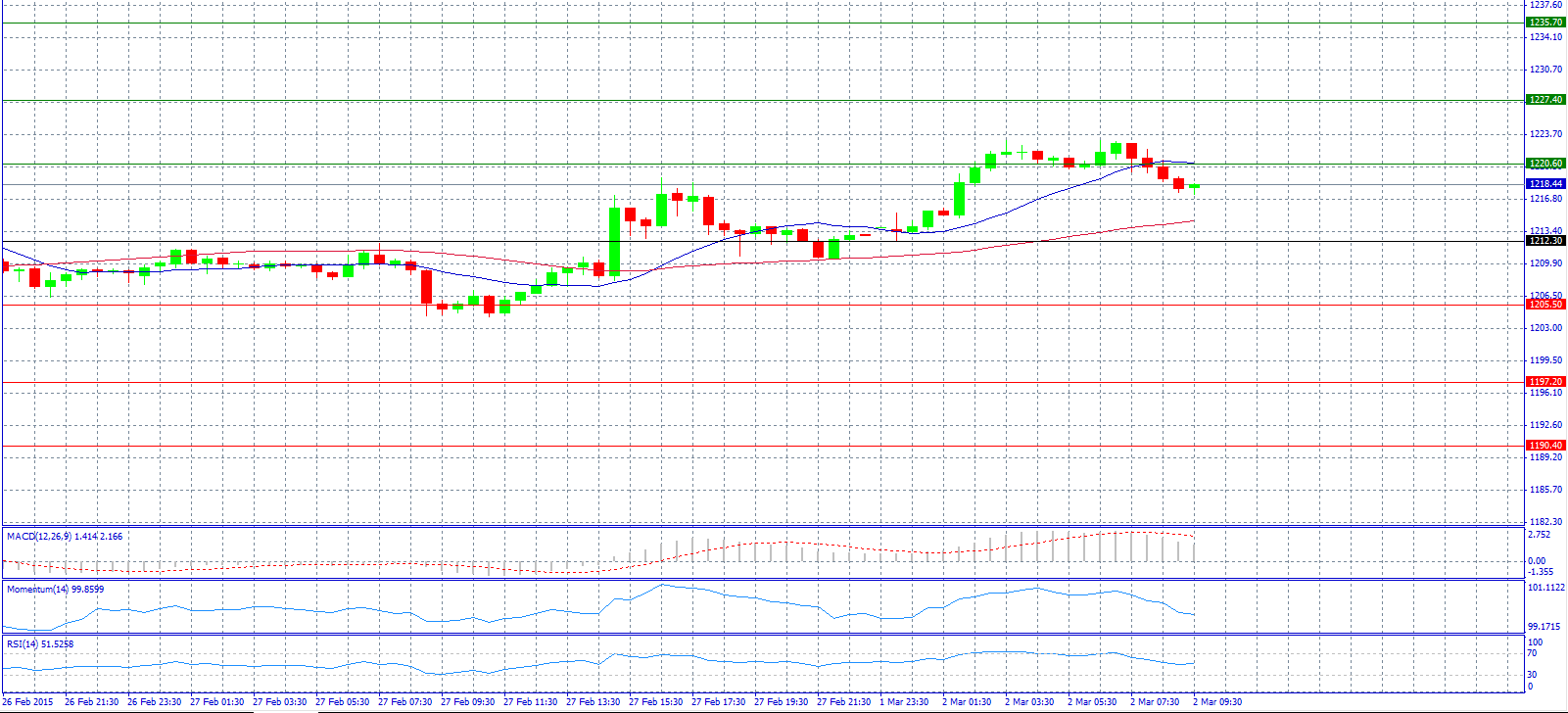

Market Scenario 1: Long positions above 1212.30 with target @ 1227.40.

Market Scenario 2: Short positions below 1212.30 with target @ 1205.50.

Comment: Gold prices advanced to the highest level of the last 2 weeks after China announced a second interest-rate cut in three months and the US reported a slower pace of economic expansion than estimated.

Supports and Resistances:

R3 1235.70

R2 1227.40

R1 1220.60

PP 1212.30

S1 1205.50

S2 1197.20

S3 1190.40

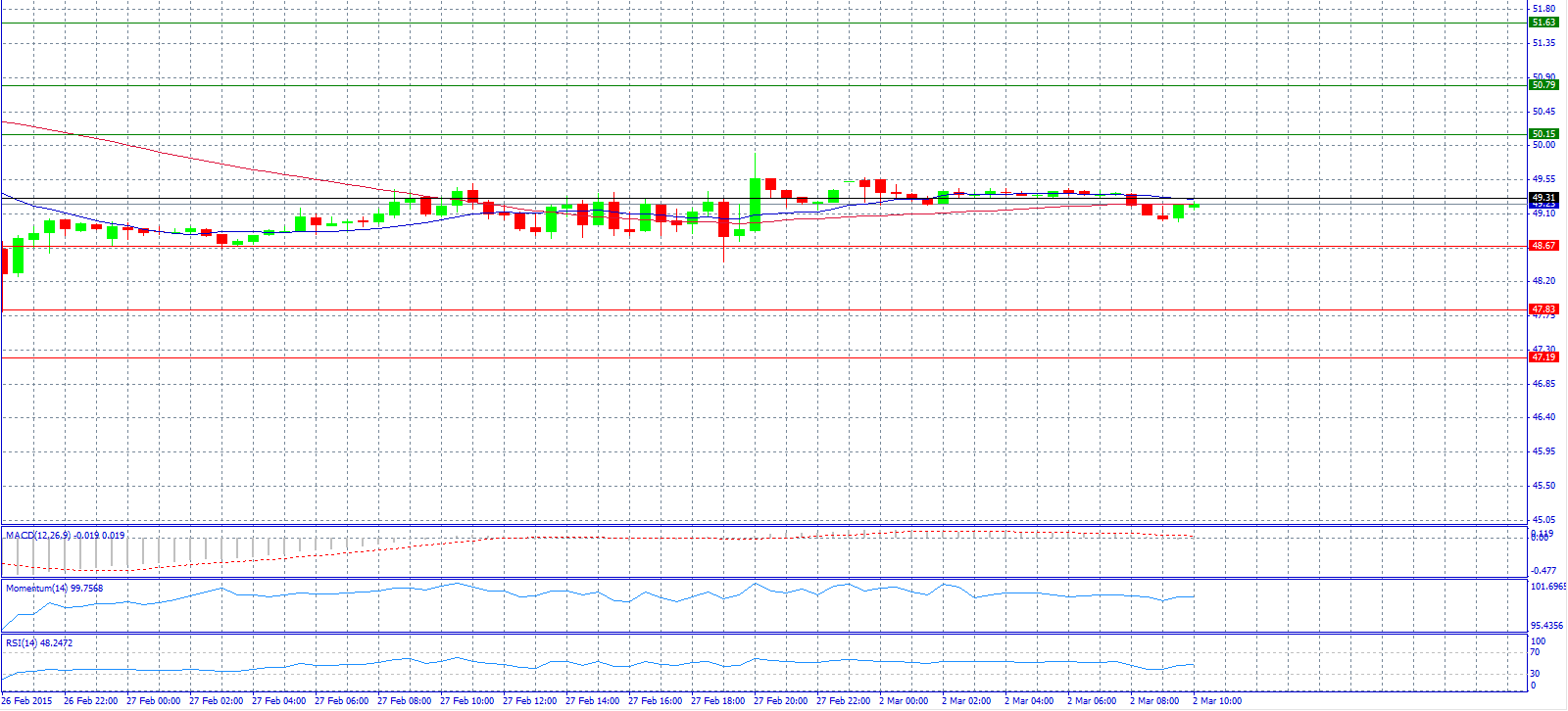

Market Scenario 1: Long positions above 49.31 with target @ 50.15.

Market Scenario 2: Short positions below 49.31 with target @ 48.67.

Comment: Crude oil prices trade steady after recent sharp gains.

Supports and Resistances:

R3 51.63

R2 50.79

R1 50.15

PP 49.31

S1 48.67

S2 47.83

S3 47.19

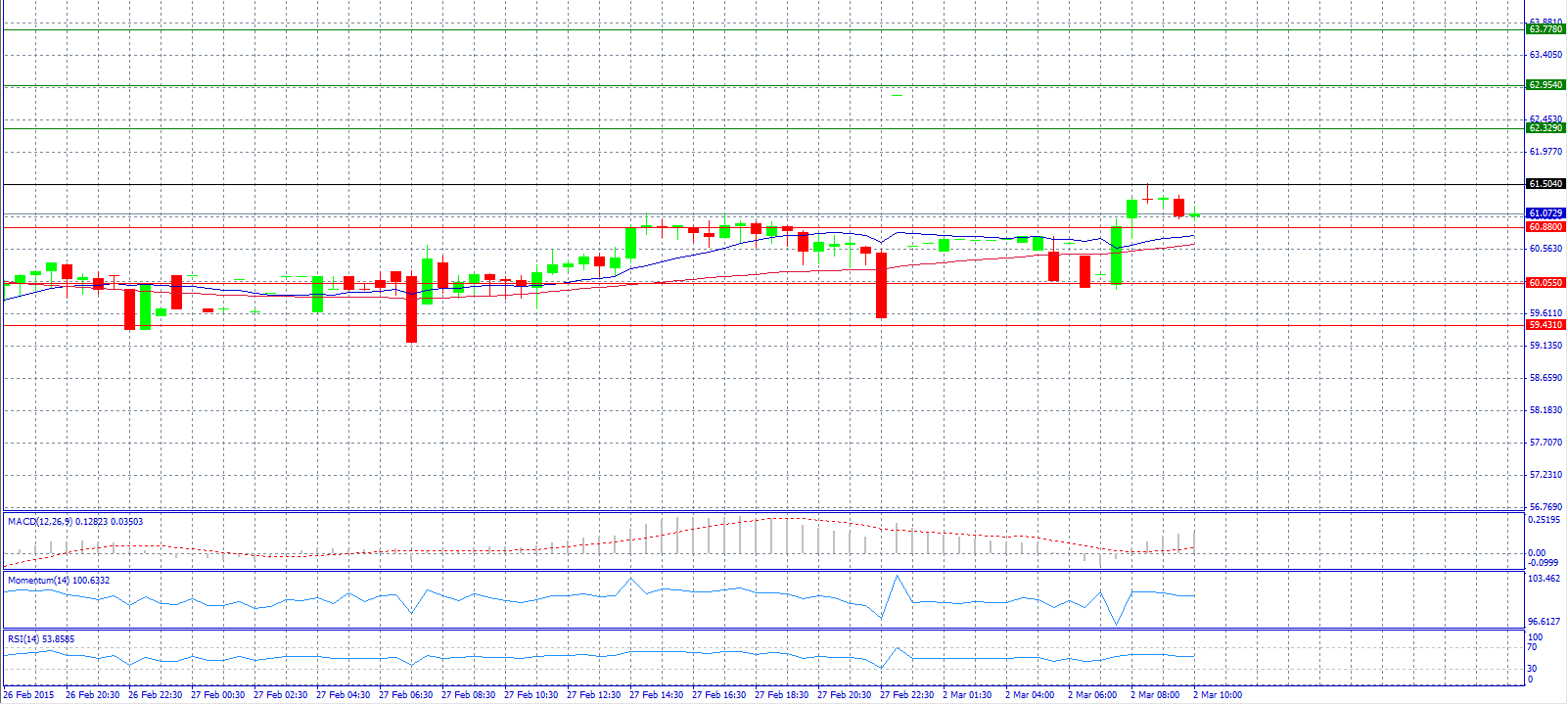

Market Scenario 1: Long positions above 61.504 with target @ 62.329.

Market Scenario 2: Short positions below 61.504 with target @ 60.055.

Comment: The ruble weakens on lower oil prices and Nemtsov murder.

Supports and Resistances:

R3 63.778

R2 62.954

R1 62.329

PP 61.504

S1 60.880

S2 60.055

S3 59.431

DISCLAIMER: Forexcorporate Marketing Research Department

1. Information on this page / e-mail / letter is not a recommendation to buy or sell and of course, can not guarantee a profit, it should be considered only as information that may assist you in making good decisions in your trading. Information and graphics presented above have been obtained from reliable sources, but their accuracy can not be fully guaranteed. Forexcorporate, its representatives, employees, and other authors will not be liable for any loss resulted from the use of this information.

2. The purpose of this risk disclaimer is to inform users of the potential financial risks involved in trading in foreign currencies. The transaction or operations in the Forex or OTC markets does involve a substantial degree of risk, and should not be undertaken until the user has carefully evaluate whether their financial situation is appropriate for such transactions. Trading may result in a substantial or complete loss of funds and therefore should only be undertaken with risk capital.