Short-term commercial paper (CP) rates have hit the highest levels since mid-2014 owing to a shortage of liquidity in the system and redemption pressures faced by mutual funds — the main investors in the CP market — towards the end of the quarter.

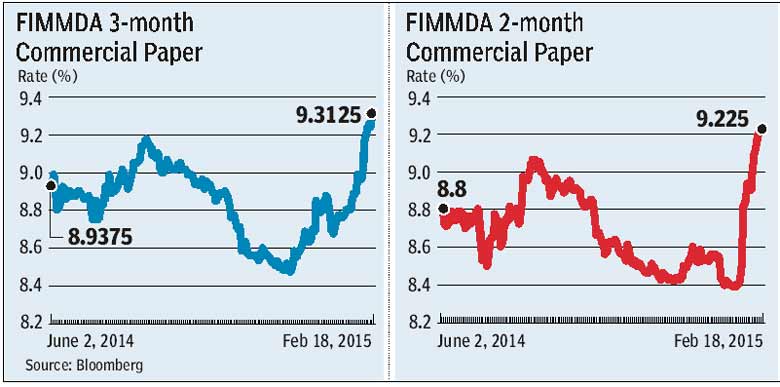

According to the Fixed Income Money Market and Derivatives Association of India (FIMMDA) data, which are indicative of the secondary market rates, the two-month CP rate hit the highest since May 2014 at 9.23% on Wednesday. Rates on the three-month CPs also tested the levels of 9.31%, which are again the highest since May 2014.

CPs are short-term instruments used by companies to borrow funds, mainly for working capital needs. One of the reasons that has led to the higher rates is the shortage of funds seen in the market due to a host of factors, including the coal block and spectrum auctions.

“Because of the advance tax outflows, spectrum and coal block auctions, there is a liquidity crunch in the market that is keeping the yields on a higher side,” said Lakshmi Iyer, chief investment officer-debt, Kotak AMC.

Market experts say the current rates for top-notch short-term commercial papers in the primary market stand between 9.25% to 9.50%, while high-yielding papers offer rates in the range of 9.75% to 10% in the primary market.

One of the reasons for the surge in short-term commercial paper rates is the higher rates sought by mutual fund houses, which are the main investors in the CP market.

“The major investors in commercial papers are mutual funds and they generally tend to take a higher pricing because of the redemption pressures towards the end of the financial year. This is one of the reasons that is pushing the rates higher,” said NS Venkatesh, executive director-treasury, IDBI Bank.

Between June 2014 and January 2015, companies issued commercial papers worth R55,910 crore with the outstanding amount as on January 31, 2015, at R2.37 lakh crore, according to Reserve Bank of India data.