A strong U.S. dollar will not significantly change the's plan to hike interest rates sometime this summer, Pimco's Scott Mather told CNBC on Wednesday.

"Undoubtedly there will be winners and losers, but historically, the U.S. economy has not been derailed by a stronger dollar," Mather, Pimco's chief investment officer of U.S. core strategies, said in an interview with "Power Lunch."

"Since much of that dollar strength is coming because other central banks in the world are easing monetary policy, that is a good thing for global aggregate demand. It's a good thing in general for U.S. exporters. So that is going to offset much of the pain."

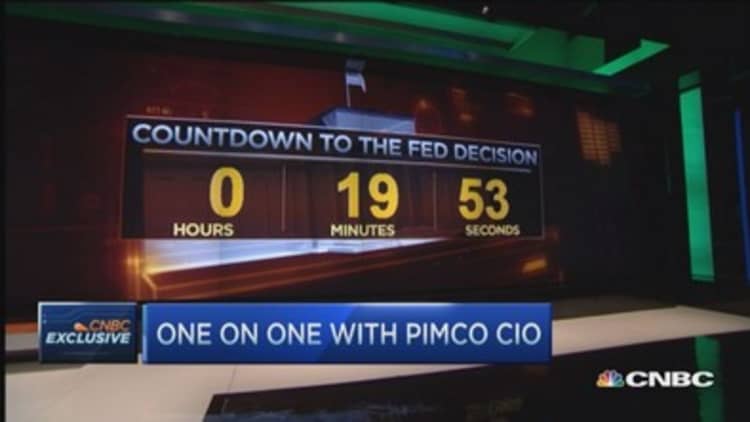

On Wednesday, the Fed released its statement and reiterated that it would be "patient" on raising interest rates. However, it dropped the phrase "considerable time" when referencing when it would increase its target funds rate.

European surprise?

While there is a concern about the European economy, Mather said this could turn out to be the year that Europe surprises to the upside in terms of growth.

"People have very low expectations, and yet we have a record new push by the ECB [European Central Bank] to ease monetary conditions," he said. "We think all of that can have a pretty powerful positive impact on economic growth in Europe. We shouldn't get too mired down in negative sentiment."

Mather also thinks that Greece and Europe will ultimately find a middle ground. Greece's new prime minister, Alexis Tsipras, wants to pare back the cuts imposed on the country as part of its bailout package.

Read More The scary thing about Europe's QE plan: Insana

Pimco's Total Return Fund, the world's largest bond fund, invests across Europe but noted that its holdings in Greece are very small, "almost not worth mentioning," Mather noted.

He thinks there are big opportunities in Italy and Spain where the ECB will have a "powerful impact."