- India

- International

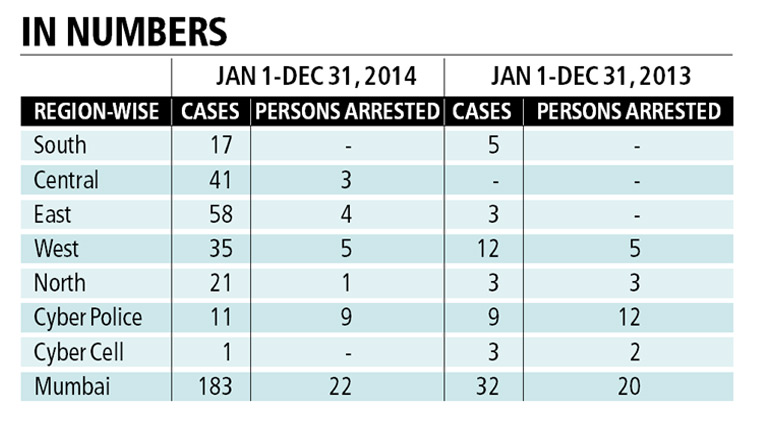

City saw a steep rise in credit card fraud cases in 2014, say police

183 cases were registered in 2014 as opposed to just 32 in 2013.

By: Rohit Alok

According to Mumbai police’s records, there has been a steep rise in credit card fraud cases registered across the city last year. The data shows that 183 cases were registered in 2014 as opposed to a mere 32 that were registered in 2013. The detection rate in 2014 was at a lowly 12 per cent with only 22 of 183 cases being solved. Incidentally detection rate in 2013 was 62.5 per cent.

The Mumbai Police have claimed that spurt in the credit card frauds in Mumbai is primarily due to the boom of e-commerce websites.

“This crime coincides with the increase of credit card usage online. Its a trend that we have observed and are probing. Currently there are numerous websites and some that are exceedingly popular. The dependency of the consumer has shifted from cash to pay by credit or debit cards, as that is the mode of payment for all purchases online,” said Dhananjay Kulkarni, deputy commissioner of police (detection)

A senior cyber official shared that not all transactions made online on these e-commerce websites are secure.

“When we type our password for Gmail, the main Goggle servers receives the password in a scrambled order that is their format to maintain the privacy of the user and hide their identity. However, that is not the case for every e-commerce website,” the officer stated. He further claimed that when credit card details and passwords are entered, even though they may seem to be unseen on an individuals electronic device there is a possibility that the password typed could reflect on the concerned websites main server.

“One must be cautious as there is no way to verify these website’s main servers. There is no such mandatory regulation to have one particular format to receive and correspondingly store the data these websites receive, “ said the officer.

Another cyber official shared that skimmers, which are used to copy the coded crypted digits on the magnet band of a credit or debit card, are still being regularly cloned by waiters at time of a transaction.

“The skimming terminal, that are used to gather the information off the card are available in different sizes. Waiters even fit them on their waists and clone the card before the card is actually swiped for payment. There is a demand for these coded digits, the market rate for such a credit card detail is as low as Rs. 100,” said the cyber official.

“These credit cases require a great study to investigate, we are not equipped at local police station levels to detect such crimes,” said a police official with a police station, where there are reportedly 13 undetected credit card related crimes.

The police also believes that in the credit cases where the victim receives a phone call from the accused, who impersonates a bank’s tele-caller, are made from outside the city limits.

Nishikant Patil, senior police inspector with the Dadar police had said that “most of such calls received by our complainants have been traced to states such as Punjab, Haryana, Uttar Pradesh and Bihar but no caller has been yet identified yet. We have been able to find out the owner of the cellphone numbers but they turn out to be persons completely unrelated to the crime.”

Investigators also believe that the personal information, including the date of birth of the victims, has been sought by the accused from various marketing companies, which conduct regular surveys across the city, exchange details of their contact list for a hefty fee.

Sadanand Date, joint commissioner of police (crime) had earlier said that more about 1,000 police personnel will be trained to be more tech savvy as the the police wants to expand its capacity to investigate cyber related crimes. “There are 608 cases that are registered as cyber crimes in the past year. We want to create a capacity where we will be in a position to up to solve upto 6,000 cases, which would come under the IT Act,” said Date.

Buzzing Now

May 04: Latest News

- 01

- 02

- 03

- 04

- 05